- United States

- /

- Auto

- /

- NYSE:HOG

Did Proposed Federal Funding Cuts Just Shift Harley-Davidson's (HOG) Technology Investment Narrative?

Reviewed by Sasha Jovanovic

- In recent days, the U.S. Department of Energy announced proposed federal funding cuts that could impact major automakers, including Harley-Davidson, potentially affecting grants previously awarded for technology and electric vehicle initiatives.

- This development has raised concerns about future government support for Harley-Davidson's innovation efforts and investments in emerging segments like electric motorcycles.

- We'll now explore how the threat of reduced federal support for technology investments could influence Harley-Davidson's investment outlook.

AI is about to change healthcare. These 32 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

Harley-Davidson Investment Narrative Recap

To be a Harley-Davidson shareholder today, you need to believe the company can reinvigorate its brand, overcome weak consumer demand, and transition successfully into new segments like electric motorcycles, all while facing macroeconomic uncertainty and elevated rates. The recent announcement of possible federal funding cuts for electric vehicle initiatives adds another layer of uncertainty to Harley-Davidson’s innovation push but is not likely to materially shift the main short-term catalyst, brand and product revitalization, nor the key risk of declining motorcycle unit sales.

Of the latest company news, the launch of the "Get Lost" apparel collection with Realtree stands out. While not directly related to electric vehicle funding, this collaboration highlights Harley-Davidson's push to broaden its appeal and reach new customers, a critical catalyst as shifting consumer demand remains front and center for the near future.

But, while expanding lifestyle offerings can help, investors should be aware that persistent weakness in global motorcycle sales remains a challenge and...

Read the full narrative on Harley-Davidson (it's free!)

Harley-Davidson's outlook anticipates $3.9 billion in revenue and $390.5 million in earnings by 2028. This relies on a 4.4% annual revenue decline and a $147.7 million earnings increase from the current earnings of $242.8 million.

Uncover how Harley-Davidson's forecasts yield a $29.33 fair value, a 9% upside to its current price.

Exploring Other Perspectives

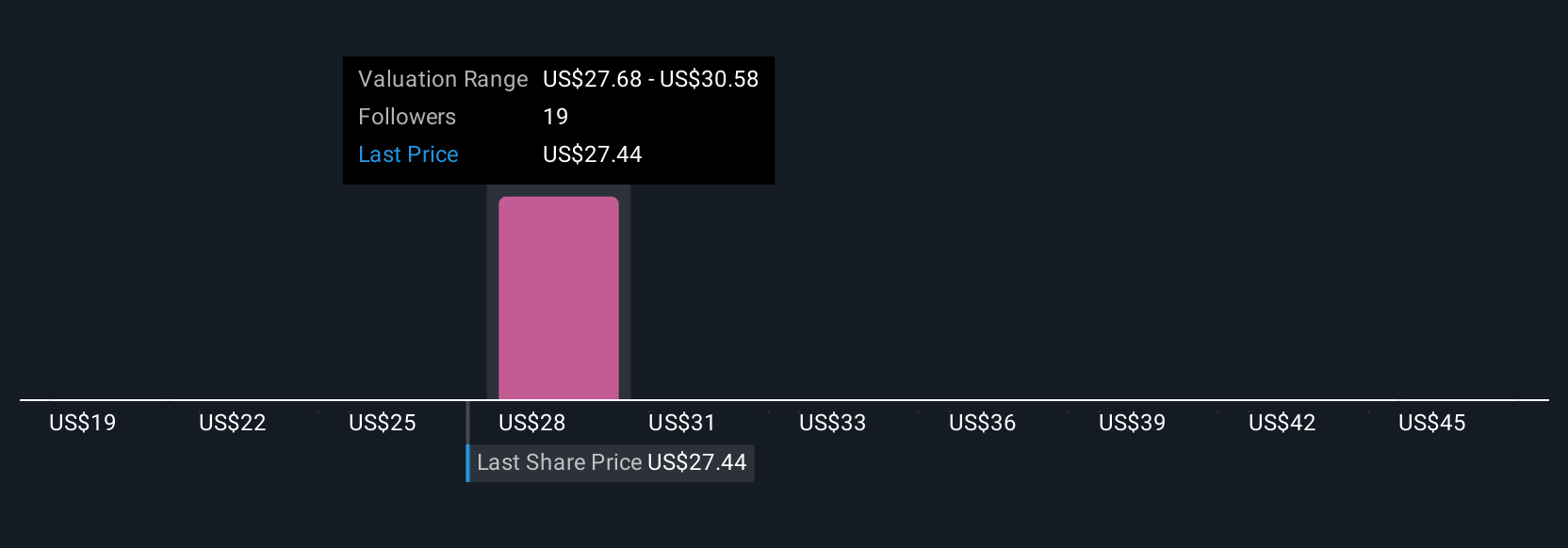

Simply Wall St Community members have placed fair value estimates for Harley-Davidson between US$19 and US$47.94, based on four diverse forecasts. With such wide-ranging views and unit sales still under pressure, your own expectations for future growth and risk are more important than ever.

Explore 4 other fair value estimates on Harley-Davidson - why the stock might be worth as much as 78% more than the current price!

Build Your Own Harley-Davidson Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Harley-Davidson research is our analysis highlighting 1 key reward and 3 important warning signs that could impact your investment decision.

- Our free Harley-Davidson research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Harley-Davidson's overall financial health at a glance.

Ready To Venture Into Other Investment Styles?

Our daily scans reveal stocks with breakout potential. Don't miss this chance:

- The end of cancer? These 28 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

- Outshine the giants: these 25 early-stage AI stocks could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Harley-Davidson might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:HOG

Harley-Davidson

Manufactures and sells motorcycles in the United States and internationally.

Adequate balance sheet and fair value.

Market Insights

Community Narratives