- United States

- /

- Auto

- /

- NYSE:GM

Sterling Anderson Joins General Motors (NYSE:GM) As Executive VP And Chief Product Officer

Reviewed by Simply Wall St

General Motors (NYSE:GM) recently appointed Sterling Anderson as Executive Vice President, Global Product, and Chief Product Officer, underscoring its commitment to enhancing its product strategy amidst the evolving electric vehicle market. The company's stock experienced a 16% increase over the past month, aligning well with broader market trends, which saw a 4% rise over the last week. Despite decreased earnings guidance and a slight decline in quarterly net income, the dividend increase and strategic leadership appointments lend support to investor confidence, balancing the broader market influence on GM's overall performance during this period.

General Motors has 3 possible red flags (and 2 which are concerning) we think you should know about.

The recent appointment of Sterling Anderson at General Motors is poised to have a significant effect on the company's strategic direction, particularly its electric vehicle (EV) and autonomous vehicle (AV) focus. This leadership change aligns with GM's efforts to refine its EV strategy and pursue operational efficiencies. Long-term shareholders have seen a total return of 110.19% over the past five years, highlighting robust historical performance despite recent earnings guidance adjustments. This growth trajectory signifies substantial investor confidence fueled by enhanced product strategies and broader market participation.

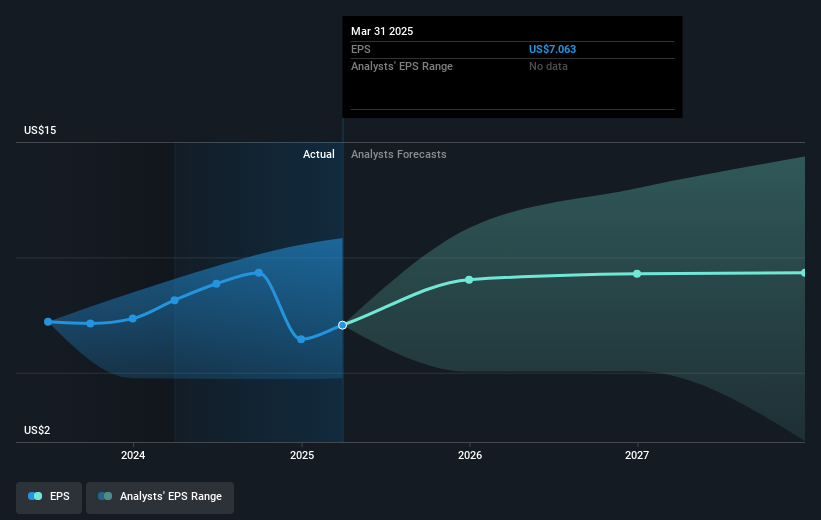

Over the past year, GM underperformed compared to the US Auto industry, which saw returns of 61.8%, emphasizing challenges amid heightened EV competition and global supply chain issues. However, the company's aggressive cost-cutting measures and strategic investments in AV technology partnerships, such as with NVIDIA, could contribute positively to revenue and earnings forecasts. Despite a current share price of $45.46, the stock is trading at an approximate 16% discount to the analyst consensus price target of $54.39. This price gap suggests potential for appreciation if GM successfully implements its planned efficiencies and capital allocation strategies, offsetting tariff impacts and enhancing its market position in the rapidly evolving automotive landscape.

Click to explore a detailed breakdown of our findings in General Motors' financial health report.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:GM

General Motors

Designs, builds, and sells trucks, crossovers, cars, and automobile parts worldwide.

Undervalued with mediocre balance sheet.

Similar Companies

Market Insights

Community Narratives