- United States

- /

- Auto

- /

- NYSE:GM

Debt can be a Significant Obstacle for General Motors's (NYSE:GM) Future Growth

A company's debt can be a hindrance to implementing new innovations and investing in growth. That is why we will evaluate the debt standing and to which extent it can slow development. General Motors Company (NYSE:GM) is currently engaged in developing their cloud system which will deliver uptades-over-the-air, and their new dedication to EVs will require quite a bit of funds.

When Is Debt Dangerous?

Debt becomes a fixed obligation that helps a company in good times - high profit - and hinders in bad times - when profit and growth are lacking.

Currently, GM has US$130b in trailing 12 month revenue, and US$10.9b in profit. However, the company has been free cash flow negative for some time and is currently at US$-12.7b FCF.

This significantly hinders their ability to pay down debt obligations, and expansion will be difficult to finance. The ratings' agency, Fitch, has also affirmed GM's -BBB Long-Term Issuer Default Ratings with a stable outlook that is not expected to change until the macroeconomic situation stabilizes. This is quite low on the ratings scale, which puts the company at significant risk.

Considering revenue growth, even though the company plans to double revenues in the next decade, seeing that their revenues have been declining and stable with a top at US$156b going back to 2015, we can acknowledge that their vision is easier said than done, and execution will be key.

Check out our latest analysis for General Motors

How Much Debt Does General Motors Carry?

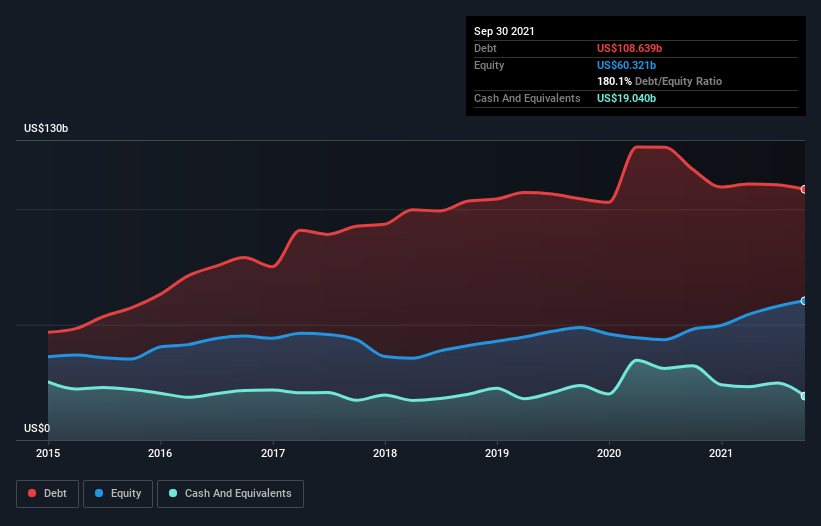

You can click the graphic below for the historical numbers, but it shows that General Motors had US$108.6b of debt in September 2021, down from US$117.2b, one year before.

However, it does have US$19.0b in cash offsetting this, leading to net debt of about US$89.6b.

In order to size up a company's debt relative to its earnings, we calculate its net debt divided by its earnings before interest, tax, depreciation, and amortization (EBITDA) and its earnings before interest and tax (EBIT) divided by its interest expense (its interest cover). This way, we consider both the absolute quantum of the debt, as well as the interest rates paid on it.

As it happens General Motors has a fairly concerning net debt to EBITDA ratio of 5.0 but very strong interest coverage of 14.7.

Finally, while the tax-man may adore accounting profits, lenders only accept cold hard cash. So we always check how much of that EBIT is translated into free cash flow. As mentioned, over the last three years, General Motors saw substantial negative free cash flow, in total. While that may be a result of expenditure for growth, it does make the debt far more risky.

Conclusion

GM is envisioning a bold future, and that must be somehow funded. Currently, it may be harder for the company to take on more debt to fund new projects such as EV production.

With this, we see that investors need a healthy bit of caution when evaluating the company's bold growth plans, as the large weight of debt can come between what GM wants to become and what may end up happening.

At the end of the day, it's often better to focus on companies that are free from net debt. You can access our special list of such companies (all with a track record of profit growth). It's free.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Simply Wall St analyst Goran Damchevski and Simply Wall St have no position in any of the companies mentioned. This article is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Goran Damchevski

Goran is an Equity Analyst and Writer at Simply Wall St with over 5 years of experience in financial analysis and company research. Goran previously worked in a seed-stage startup as a capital markets research analyst and product lead and developed a financial data platform for equity investors.

About NYSE:GM

General Motors

Designs, builds, and sells trucks, crossovers, cars, and automobile parts worldwide.

Undervalued with slight risk.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

PSIX The timing of insider sales is a serious question mark

The Great Strategy Swap – Selling "Old Auto" to Buy "Future Light"

Not a Bubble, But the "Industrial Revolution 4.0" Engine

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026