- United States

- /

- Auto

- /

- OTCPK:FSRN.Q

Despite Still Being Unprofitable, Fisker (NYSE:FSR) Remains in the EV Race

The car industry is undergoing arguably the most significant change since the invention of the automobile. In the face of global climate changes, regulations have been pushing for cleaner technologies, including electric vehicles (EVs).

Naturally, where there are big changes, there are significant opportunities. Companies like Fisker ( NYSE:FSR ) are trying to get ahead and pave their way in the new environment.

Yet, without much revenue, we're concerned about the cash burn. Today we'll take a look at the cash reserves, breakeven projections and assess the situation.

Q2 Earnings Report

- GAAP EPS : -US$0.16

- Cash & cash equivalents: US$ 962m

- No debt, announced US$625m in convertible bonds

Morgan Stanley recently issued a note claiming significant upside to the stock and setting an Overweight rating and a target of US$40. This pushed stock in the short term, but ultimately, it turned back below US$14.

The reason for the quick downside was raising US$625m in convertible bonds. The bonds will pay 2.5% per year, semi-annually beginning on March 15, 2022. The maturity date is set for September 15, 2026, unless earlier converted, redeemed, or repurchased.

Morgan Stanley praised the company for its ability to keep with the scheduled timelines. FY22 deliveries are planned at 4,000 units and FY23 for 45,000.

Meanwhile, Fisker has signed a manufacturing agreement with Magna International. Magna will be producing the all-electric Fisker Ocean SUV that is set to debut at Los Angeles Auto Show in November, later this year. The start of the full-scale production is set for November 2022.

Check out our latest analysis for Fisker

Cash Runaway and Breakeven Projection

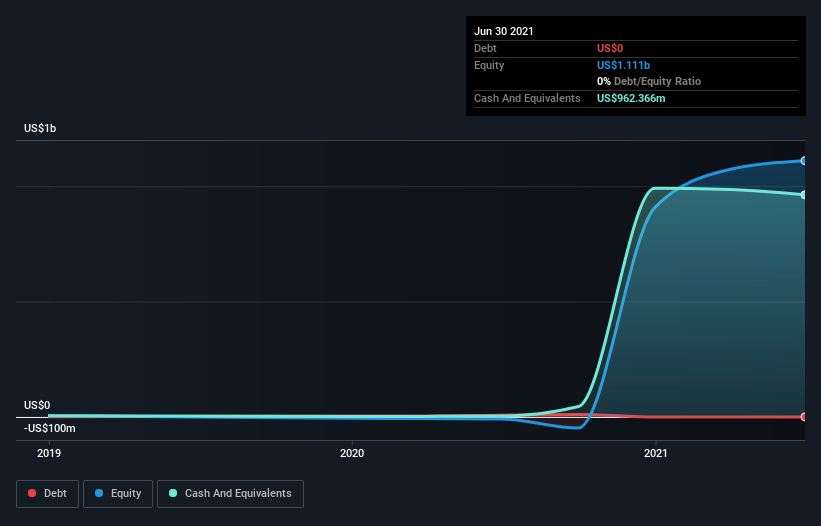

You can calculate a company's cash runway by dividing the amount of cash it has by the rate of spending that cash.When Fisker last reported its balance sheet in June 2021, it had zero debt and cash worth US$962m.In the last year, its cash burn was US$160m.That means it had a cash runway of about 6.0 years as of June 2021. However, they just raised an additional US$625m which buys them a full decade of cash burn at this pace.

Importantly, though, analysts think that Fisker will reach cash flow breakeven before then. Eight analysts covering the company expect it to turn a profit in 2023, roughly 2 years from now.

If that happens, then the length of its cash runway today, would become a moot point.Depicted below, you can see how its cash holdings have changed over time.

How Is Fisker's Cash Burn Changing Over Time?

In our view, Fisker doesn't yet produce significant amounts of operating revenue since it reported just US$49k in the last twelve months.Therefore, for this analysis, we'll focus on how the cash burn is tracking.Its cash burn positively exploded in the last year, up 2,656%.That kind of sharp increase in spending may pay off but is generally considered quite risky.

While the past is always worth studying, it is the future that matters most of all. For that reason, it makes a lot of sense to take a look at our analyst forecasts for the company .

How Easily Can Fisker Raise Cash?

Given its cash burn trajectory, Fisker shareholders may wish to consider how easily it could raise more cash, despite its solid cash runway.Generally speaking, a listed business can raise new cash through issuing shares or taking on debt.One of the main advantages of publicly listed companies is that they can sell shares to investors to raise cash and fund growth.By looking at a company's cash burn relative to its market capitalization, we gain insight into how much shareholders would be diluted if the company needed to raise enough cash to cover another year's cash burn.

Fisker's cash burn of US$160m is about 3.8% of its US$4.2b market capitalization.That's a low proportion, so it isn't surprising to see that the company just raised US$625m at 2.50% annual interest. However, a sharp sell-off reminds us that the market doesn't like the possibility of stock dilution.

So, Should We Worry About Fisker's Cash Burn?

As you can probably tell by now, we're not too worried about Fisker's cash burn. In particular, we think its cash runway stands out as evidence that the company is well on top of its spending.

While we must concede that its increasing cash burn is a bit worrying, the other factors mentioned in this article provide great comfort when it comes to the cash burn.One real positive is that analysts are forecasting that the company will reach breakeven.Looking at all the measures in this article, together, we're not worried about its rate of cash burn; the company seems well on top of its medium-term spending needs.

On another note, Fisker has 2 warning signs (and 1 which is significant) we think you should know about.

If you would prefer to check out another company with better fundamentals, then do not miss this free list of interesting companies that have HIGH return on equity and low debt or this list of stocks that are all forecast to grow .

*The article has been updated to amend the latest news about a convertible bond offering.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Simply Wall St analyst Stjepan Kalinic and Simply Wall St have no position in any of the companies mentioned. This article is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Stjepan Kalinic

Stjepan is a writer and an analyst covering equity markets. As a former multi-asset analyst, he prefers to look beyond the surface and uncover ideas that might not be on retail investors' radar. You can find his research all over the internet, including Simply Wall St News, Yahoo Finance, Benzinga, Vincent, and Barron's.

About OTCPK:FSRN.Q

Fisker

Develops, manufactures, markets, leases, or sells electric vehicles.

Moderate and slightly overvalued.

Similar Companies

Market Insights

Community Narratives