- United States

- /

- Auto

- /

- NYSE:F

Is Ford’s 28.8% 2024 Rally Supported by Recent Electric Vehicle Momentum?

Reviewed by Bailey Pemberton

If you have been following Ford Motor’s stock, you are probably wondering: is now the right moment to buy, hold, or sell? Over the past year, Ford has surprised many with a 21.0% rise, and if you bought five years ago, you have seen a remarkable gain of 110.3%. Even in the last week, the stock climbed 5.7%, keeping in step with stronger momentum that has defined much of 2024. Year to date, Ford is up 28.8%.

What is fueling this run? Recently, Ford has attracted attention for its aggressive push into electric vehicles and partnerships with leading battery technology firms. Headlines about improved supply chain conditions and new product launches have also helped shape a more positive perception of Ford’s growth potential in a tough market. Investors are starting to notice that some of the risk factors weighing on the stock over the past couple of years, like chip shortages and production delays, are easing.

Of course, price moves are just one side of the story. If you are valuation minded, you will be interested to know that Ford currently scores a 3 out of 6 on our value check, meaning it is undervalued according to half of the metrics we track. But what does that really mean for your investment decision?

Let's dig into the most common ways analysts judge whether Ford is undervalued or overvalued, and after that, I will share a smarter approach that goes beyond basic numbers alone.

Why Ford Motor is lagging behind its peers

Approach 1: Ford Motor Discounted Cash Flow (DCF) Analysis

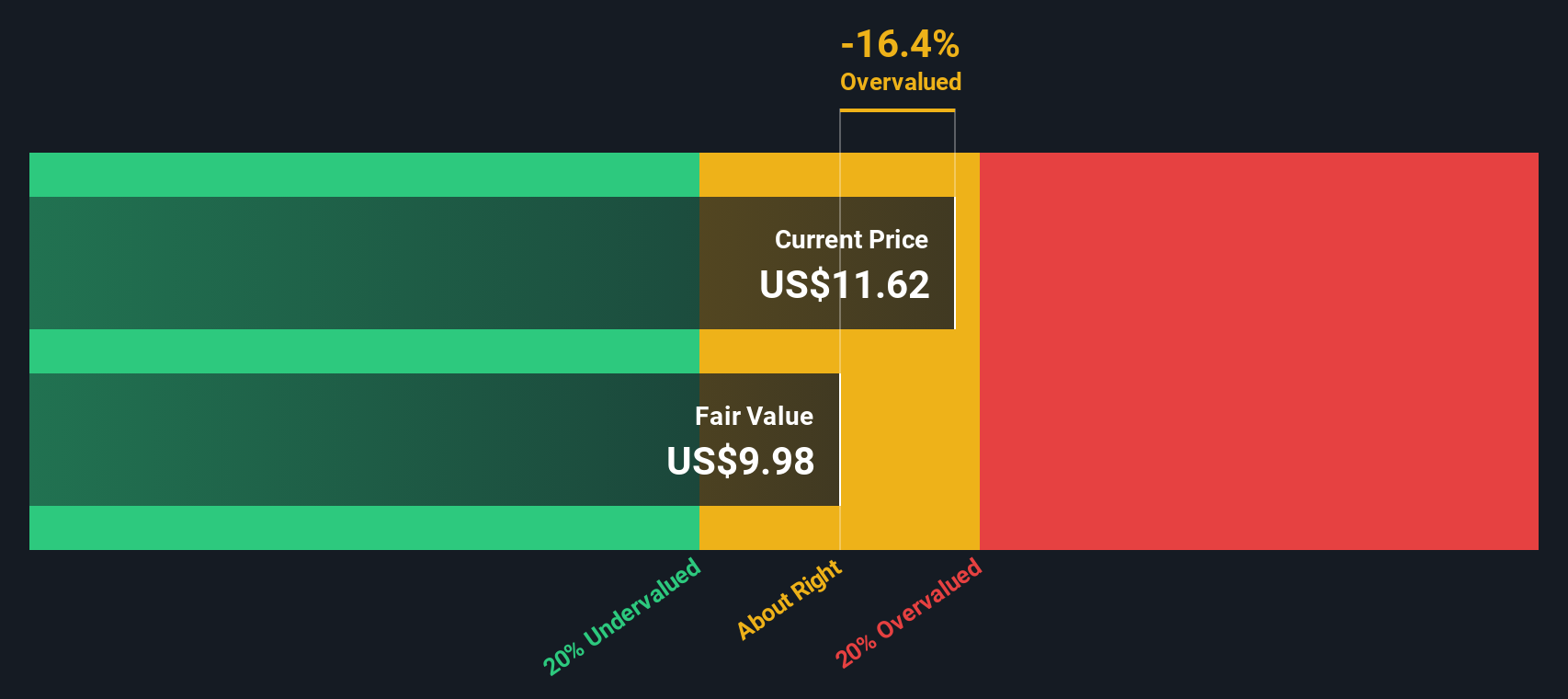

A Discounted Cash Flow (DCF) model estimates a company’s intrinsic value by projecting its future cash flows and then discounting them back to today’s dollars. This process gives investors a sense of what the business is actually worth now based on those future expectations.

For Ford Motor, the DCF analysis uses its current annual Free Cash Flow, which stands at $10.0 billion. Analysts provide explicit cash flow growth forecasts for the next five years. After that period, additional projections are extrapolated by Simply Wall St. For example, projections show Ford’s Free Cash Flow decreasing to $5.1 billion in 2026 and further to $3.8 billion by 2031, suggesting expectations of some contraction over time.

Overall, this DCF model estimates Ford’s intrinsic value at $9.59 per share. Compared to the company’s recent share price, this implies the stock is trading about 29.6% above what the projection suggests it is worth. In simple terms, the DCF view is that Ford is currently overvalued by the market.

Result: OVERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Ford Motor may be overvalued by 29.6%. Find undervalued stocks or create your own screener to find better value opportunities.

Approach 2: Ford Motor Price vs Earnings (PE Ratio)

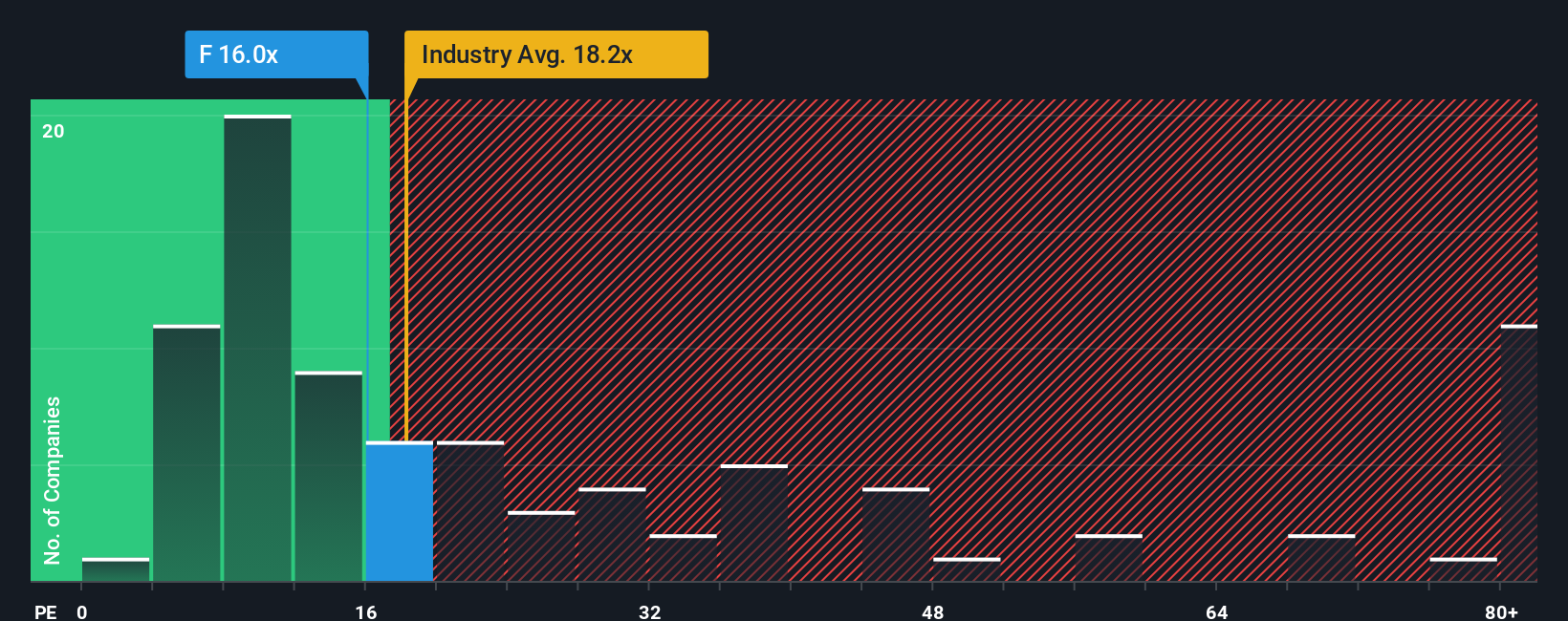

For consistently profitable companies like Ford Motor, the Price-to-Earnings (PE) ratio is a widely used and straightforward way to assess value. The PE ratio helps investors understand how much they are paying for one dollar of the company's earnings, making it a sensible yardstick for companies generating healthy profits.

A "normal" or "fair" PE ratio depends on several factors beyond just profit. Companies with higher growth expectations or lower risk typically deserve a higher multiple, while slower-growing or riskier businesses might be assigned a lower one. Therefore, comparing PE ratios always requires context.

Ford currently trades at a PE ratio of 15.7x. This figure is a bit lower than the auto industry average of 18.3x and also below the average of its listed peers at 18.3x. At first glance, this might imply that Ford is undervalued relative to its sector. However, to get a clearer picture, Simply Wall St calculates a "Fair Ratio" for each company, which incorporates the business’s specific growth outlook, profit margins, size, and unique risks.

In Ford’s case, the Fair Ratio is 20.6x, suggesting the shares deserve a somewhat higher valuation than the market is currently applying. Because this Fair Ratio takes into account Ford’s individual strengths and risks, rather than just broad industry averages, it provides a more tailored and insightful benchmark.

Comparing the Fair Ratio of 20.6x with Ford’s actual PE of 15.7x, the stock currently looks undervalued on this measure.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Ford Motor Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let’s introduce you to Narratives. A Narrative is your story for a company's future. It is where you turn your view on Ford’s strategy, sales, and profits into concrete assumptions about future earnings and a fair value estimate. This approach links what’s actually happening at Ford to your forecasts, creating a clear connection between the company’s story, financial projections, and what you believe the shares are worth.

Narratives are easy to build and compare on Simply Wall St’s Community page, where millions of investors share their own outlooks and update them as the facts change. By clearly seeing a Narrative’s fair value next to the current share price, you can confidently identify your best Buy or Sell moments. Because Narratives update with new news and earnings, they help you stay on top of what matters. For example, one investor may believe Ford’s earnings could reach $9.8 billion by 2028 for a fair value of $16.00 per share, while another, more bearish, sees weaker profit growth and values Ford at $8.00. This shows just how powerful and dynamic Narratives can be for guiding your investment decisions.

Do you think there's more to the story for Ford Motor? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:F

Ford Motor

Develops, delivers, and services Ford trucks, sport utility vehicles, commercial vans and cars, and Lincoln luxury vehicles worldwide.

Established dividend payer and fair value.

Similar Companies

Market Insights

Community Narratives