- United States

- /

- Auto

- /

- NYSE:F

Ford Motor (F) Valuation: Weighing the Stock’s Outlook After Recent Share Price Gains

Reviewed by Simply Wall St

See our latest analysis for Ford Motor.

Ford’s 24% share price return year-to-date reflects growing optimism, as recent gains have come alongside industry tailwinds and improving sentiment following ongoing cost-cutting and product strategy shifts. Over the past year, total shareholder return reached 16%, suggesting that momentum is building for long-term holders.

Looking for more opportunities in this space? Check out other auto manufacturers with strong growth trends using our dedicated screener: See the full list for free.

But with the stock rallying and Ford trading close to analyst targets, the key question is whether shares remain undervalued based on fundamentals or if the market is already pricing in the company’s future growth prospects.

Most Popular Narrative: 4.7% Overvalued

Ford’s most-followed valuation narrative places its fair value at $11.45, just under the last closing price of $11.99. This indicates only a modest premium. This small gap spotlights why Ford’s current price is generating so much debate among investors and analysts right now.

Ford's ongoing transformation of its Ford Pro commercial platform, emphasizing high-margin, recurring revenues from software, telematics, and aftermarket services, continues to outperform, with paid software subscriptions up 24% year-over-year and aftermarket approaching 20% of Pro EBIT. This shift toward recurring digital revenues supports structurally higher net margins and enhances earnings durability.

Curious what’s driving this tight valuation? The calculations weigh a unique blend of next-gen auto services, bold margin targets, and evolving earnings forecasts. The narrative’s key assumptions might challenge your ideas about Ford’s transformation playbook. Don’t miss the breakdown behind these numbers. See the story for yourself.

Result: Fair Value of $11.45 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, ongoing trade policy uncertainty and Ford's heavy reliance on large trucks and SUVs may still challenge the company's growth story in the future.

Find out about the key risks to this Ford Motor narrative.

Another View: How Do the Numbers Stack Up?

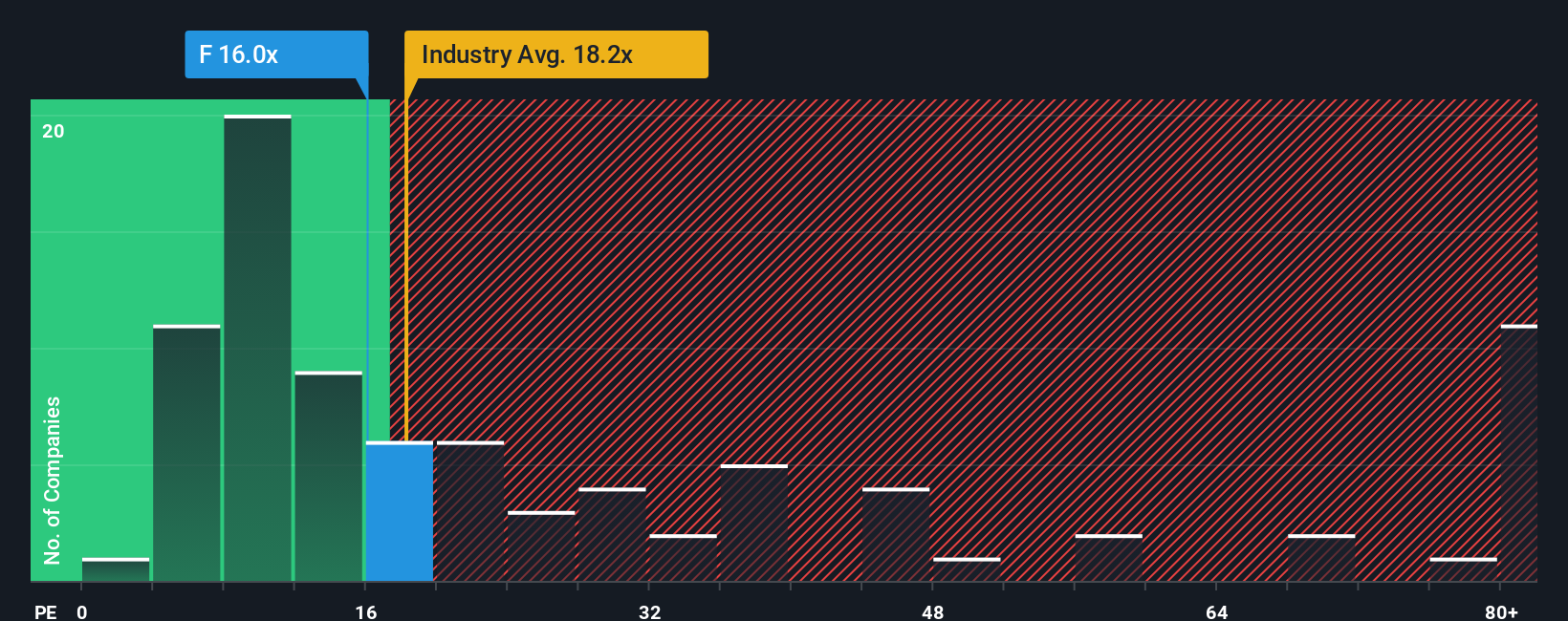

Looking at Ford from a price-to-earnings perspective, the company trades at 15.1 times earnings. This is cheaper than both the global auto industry average (18.4x) and its peer group (16.9x). The fair ratio suggests the market could move toward 20.4x, implying possible room for upside if sentiment changes. But does this gap represent a genuine value opportunity or simply reflect long-standing risks?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Ford Motor Narrative

If you have your own perspective or want a fresh look at the numbers, building your personal view from the data takes just a few minutes. So why not Do it your way?

A great starting point for your Ford Motor research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Push your portfolio further by tracking investment trends other smart investors are seizing on right now. The opportunities below can give your research an instant edge.

- Capture potential high-yield returns by tapping into these 17 dividend stocks with yields > 3% that consistently offer attractive income above 3%.

- Stay ahead of the curve by targeting next-generation tech opportunities with these 24 AI penny stocks shaping the future of automation and intelligence.

- Strengthen your watchlist using these 875 undervalued stocks based on cash flows selected for their outstanding cash flow potential and overlooked market pricing.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:F

Ford Motor

Develops, delivers, and services Ford trucks, sport utility vehicles, commercial vans and cars, and Lincoln luxury vehicles worldwide.

Established dividend payer and fair value.

Similar Companies

Market Insights

Community Narratives