Ford Motor Company ( NYSE: F ) roared back to life in 2021, reaching levels not seen in 5-years. Since then, the stock has pulled back around the key level of US$13.

With new models like F150 Lightning behind the corner and strategic investments like Rivian that are about to IPO, this situation mandates re-examination of the company's prospects.

Latest Developments

The company is sticking with the plan to shift the business model to order-and-deliver from the traditional dealership concept. The goal is to allow for higher customization while reducing inventory costs and maintaining leaner production. While this has been a standard way of operation in Europe, Americans still prefer the instant gratification of shopping at dealerships.

Meanwhile, the ongoing semiconductor chip shortage is causing prolonged production shutdowns across the automotive sector. Ford reported that the Kansas City plant responsible for manufacturing the F-150 will continue its shutdown , while the other one in Dearborn will operate in only one shift.

However, the F-150 Lightning production target is now doubled to 80,000 , based on the strong demand ahead of the launch.

Finally, Rivian is reportedly filled an IPO with a launch target around Thanksgiving, pending SEC approval. The electric vehicle startup is looking at a staggering valuation of around US$80b – a massive jump over a valuation of US$27.6b, at which it raised funds earlier this year. Ford was an early investor in Rivian, with US$500m invested back in 2019.

See our latest analysis for Ford Motor

What's the opportunity in Ford Motor?

The share price seems sensible at the moment according to price multiple models, where we compare the company's price-to-earnings ratio to the industry average.

We look at the price-to-earnings ratio in this instance because there's not enough visibility to forecast its cash flows. The stock's ratio of 15.02x is currently trading in line with its industry peers' ratio, which means if you buy Ford Motor today, you'd be paying a relatively reasonable price for it.

Although, there may be an opportunity to buy in the future. This is because Ford Motor's beta (a measure of share price volatility) is high, meaning its price movements will be exaggerated relative to the rest of the market. If the market is bearish, the company's shares will likely fall by more than the rest of the market, providing a prime buying opportunity.

What does the future of Ford Motor look like?

Future outlook is an important aspect when you're buying a stock, especially if you are an investor looking for growth in your portfolio. Buying a great company with a robust outlook at a cheap price is always a good investment, so let's also look at the company's future expectations.

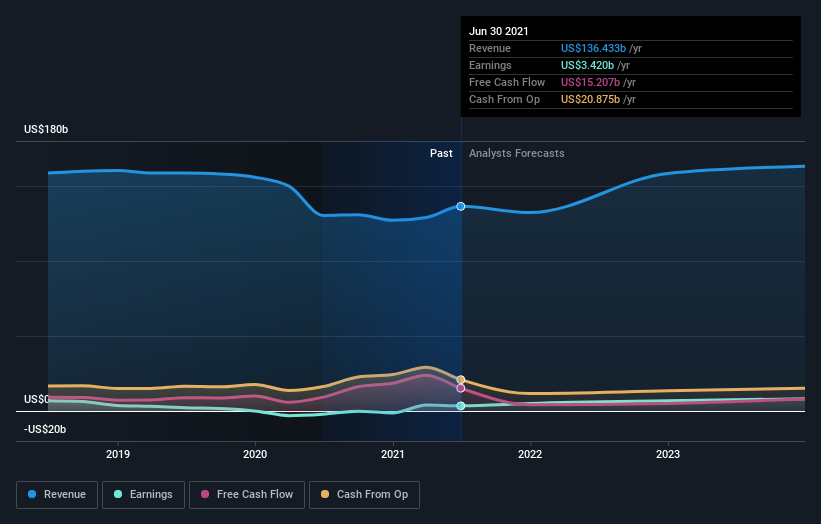

Ford Motor's earnings over the next few years are expected to double, indicating a very optimistic future ahead. This should lead to stronger cash flows, feeding into a higher share value.

What this means for you:

Are you a shareholder?F's optimistic future growth appears to have been factored into the current share price, with shares trading around industry price multiples. However, there are also other important factors that we haven't considered today, such as the company's financial strength. Have these factors changed since the last time you looked at F? Should the price drop below the industry PE ratio, will you have enough confidence to invest in the company?

Are you a potential investor? If you've been keeping an eye on F, now may not be the most advantageous time to buy, given it is trading around industry price multiples. However, the positive outlook is encouraging for F, which means it's worth diving deeper into other factors such as the strength of its balance sheet to take advantage of the next price drop.

In light of this, if you'd like to do more analysis on the company, it's vital to be informed of the risks involved. Every company has risks, and we've spotted 1 warning sign for Ford Motor you should know about.

If you are no longer interested in Ford Motor, you can use our free platform to see our list of over 50 other stocks with high growth potential.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Simply Wall St analyst Stjepan Kalinic and Simply Wall St have no position in any of the companies mentioned. This article is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Stjepan Kalinic

Stjepan is a writer and an analyst covering equity markets. As a former multi-asset analyst, he prefers to look beyond the surface and uncover ideas that might not be on retail investors' radar. You can find his research all over the internet, including Simply Wall St News, Yahoo Finance, Benzinga, Vincent, and Barron's.

About NYSE:F

Ford Motor

Develops, delivers, and services Ford trucks, sport utility vehicles, commercial vans and cars, and Lincoln luxury vehicles worldwide.

Solid track record established dividend payer.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

TAV Havalimanlari Holding will fly high with 25.68% revenue growth

Fiducian: Compliance Clouds or Value Opportunity?

Q3 Outlook modestly optimistic

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.