- United States

- /

- Auto

- /

- NYSE:F

A Century after Model T, Ford Motor (NYSE:F) Is Pushing All-In on EV Success

When it comes to automotive history, few cars have influenced it more than Ford Model T. The first affordable automobile was revolutionary – changing the way we think about cars and their production. Over 100 years later, Ford Motor Company(NYSE: F)is still striving to do the same – just with a different energy source.

In this article, we'll examine the latest updates on the company and look at the state of their balance sheet.

See our latest analysis for Ford Motor.

Forming New Partnerships, Creating New Jobs, Hiring New Executives

Ford announced a new partnership with a South Korean battery supplier SK Innovation. In an investment worth US$11.4b, Ford will contribute with US$7b to build 2 battery plants in Kentucky and one in Tennessee (along with the assembly plant for F-Series pickup trucks). Ford is not planning to take on any new debt to finance this project that should create 11,000 jobs and a capacity to produce batteries for 1 million vehicles annually.

In an interesting turn of events, Ford poached Apple's top car executive. Doug Field, the head of Apple's smart car project, will be Ford's chief advanced technology and embedded systems officer. Before Apple, Mr.Field was Tesla's chief vehicle engineer.

Meanwhile, Ford has started the pre-production of F-150 Lightning. The demand for the truck has now surpassed 150,000 reservations, prompting the company to invest an additional US$250m and add 450 jobs to the production.

Yet, Rivian R1T is already here. As first trucks are rolling out from the facility in Normal, Illinois – the initial reviews are positive. While the company filed the paperwork with the Securities and Exchange Commission, the IPO date has still not been revealed. However, it will be one of the biggest recent IPO's with a target of US$80b.

Ford's Debt Outlook

Generally speaking, debt only becomes a real problem when a company can't easily pay it off, either by raising capital or with its cash flow.

However, a more usual (but still expensive) situation is where a company must dilute shareholders at a cheap share price to get debt under control. By replacing dilution, though, debt can be an excellent tool for businesses that need capital to invest in growth at high rates of return. When we think about a company's use of debt, we first look at cash and debt together.

How Much Debt Does Ford Motor Carry?

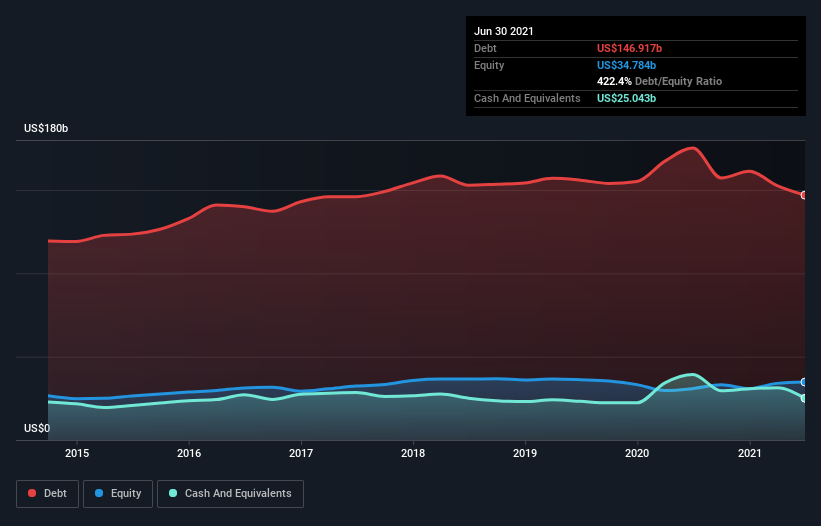

The image below, which you can click on for greater detail, shows that Ford Motor had a debt of US$146.9b at the end of June 2021, a reduction from US$175.2b over a year.

However, it does have US$25.0b in cash, offsetting this, leading to net debt of about US$121.9b.

How Strong Is Ford Motor's Balance Sheet?

Zooming in on the latest balance sheet data, we can see that Ford Motor had liabilities of US$83.5b due within 12 months and liabilities of US$130.3b due beyond that.

Offsetting these obligations, it had cash of US$25.0b as well as receivables valued at US$4.03b due within 12 months. So its liabilities total US$184.7b more than the combination of its cash and short-term receivables. The deficiency here weighs heavily at the US$56.6b.

To size up a company's debt relative to its earnings, we calculate its net debt divided by its earnings before interest, tax, depreciation, and amortization (EBITDA) and its earnings before interest and tax (EBIT) divided by its interest expense (its interest cover).

The advantage of this approach is that we consider both the absolute quantum of debt (with net debt to EBITDA) and the actual interest expenses associated with that debt (with its interest cover ratio).

Ford Motor has a relatively high debt to EBITDA ratio of 11.5, suggesting a meaningful debt load. But the good news is that it boasts a reasonably comforting interest cover of 2.7 times, suggesting it can responsibly service its obligations.

One redeeming factor for Ford Motor is that it turned last year's EBIT loss into a gain of US$4.5b during the previous twelve months. When analyzing debt levels, the balance sheet is the obvious place to start. But it is future earnings, more than anything will determine Ford Motor's ability to maintain a healthy balance sheet from now on.

So if you want to see what the professionals think, you might find this free report on analyst profit forecasts to be interesting.

But our final consideration is also important because a company cannot pay debt with paper profits; it needs cold hard cash. So it's worth checking how much of the earnings before interest and tax (EBIT) is backed by free cash flow. Happily for many shareholders, Ford Motor produced more free cash flow than EBIT over the last year. That sort of solid cash generation paints a more optimistic picture.

Our Evaluation

Ford Motor's net debt to EBITDA left us tentative about the stock, as well as its level of total liabilities.

But on the bright side, its conversion of EBIT to free cash flow is a good sign and makes us more optimistic. Furthermore, the company has been slowly reducing its debt over the last 5 years. It remains confident about financing the latest ventures without taking on any debt - this is a good sign.

Although the risks are there, the management seems to be doing the right moves - committing to the new technologies, providing new jobs for the Americans, poaching top talent from the competitors, and diversifying into promising ventures like Rivian.

The balance sheet is the area to focus on when you are analyzing debt. However, not all investment risk resides within the balance sheet - far from it. For example - Ford Motor has 1 warning sign we think you should be aware of.

If you are interested in a list of net debt-free companies, you can access our unique list of such companies (all with a track record of profit growth).

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Simply Wall St analyst Stjepan Kalinic and Simply Wall St have no position in any of the companies mentioned. This article is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Stjepan Kalinic

Stjepan is a writer and an analyst covering equity markets. As a former multi-asset analyst, he prefers to look beyond the surface and uncover ideas that might not be on retail investors' radar. You can find his research all over the internet, including Simply Wall St News, Yahoo Finance, Benzinga, Vincent, and Barron's.

About NYSE:F

Ford Motor

Develops, delivers, and services Ford trucks, sport utility vehicles, commercial vans and cars, and Lincoln luxury vehicles worldwide.

Solid track record established dividend payer.

Similar Companies

Market Insights

Community Narratives