- United States

- /

- Auto Components

- /

- NYSE:BWA

Evaluating BorgWarner (BWA): Is the Stock Still Undervalued After Recent Gains?

Reviewed by Kshitija Bhandaru

BorgWarner (BWA) stock has recently caught some attention as investors review its latest performance data and financial returns. With some meaningful moves over the past month, there is growing interest in what might be next for this automotive technology company.

See our latest analysis for BorgWarner.

BorgWarner has rallied impressively through the year, clocking a 31.6% gain in its share price year-to-date and a 19.3% total shareholder return over the last twelve months. This signals strong momentum following a run of positive developments. Recent short-term dips have not derailed the bigger picture. The company’s long-term trend also remains solid with a 47% total shareholder return over three years.

If BorgWarner’s momentum piques your interest, now could be the perfect moment to discover See the full list for free.

With recent gains and positive financial growth, the key question for investors is whether BorgWarner’s current share price still offers upside or if the market has already factored in all future prospects. Is now truly a buying opportunity, or has the market fully priced in BorgWarner’s continued growth?

Most Popular Narrative: 7.8% Undervalued

BorgWarner’s most popular narrative points to a fair value that sits above the latest closing price, reflecting optimism for future growth but recognizing risks. This perspective is driven by expectations for electrification and global automotive demand to propel the company’s fundamentals over time.

Strong new business awards and accelerating RFQ (request for quotation) activity in both hybrid and electric vehicle (EV) product lines demonstrate robust demand for BorgWarner's electrified propulsion systems. This positions the company to capitalize on the industry-wide transition to hybrid and electric vehicles, and supports sustained top-line revenue growth as electrification continues to outpace ICE declines.

Want to know which future projections set this price target apart? The narrative’s fair value hinges on bold assumptions about margin recovery and surging demand. Which forecasts turn today’s price into a buying opportunity? Uncover the surprising growth blueprint that’s driving this valuation.

Result: Fair Value of $44.71 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent dependence on combustion products and ongoing headwinds in the battery segment could threaten BorgWarner’s long-term revenue visibility and profit margins.

Find out about the key risks to this BorgWarner narrative.

Another View: Challenging the Bullish Narrative

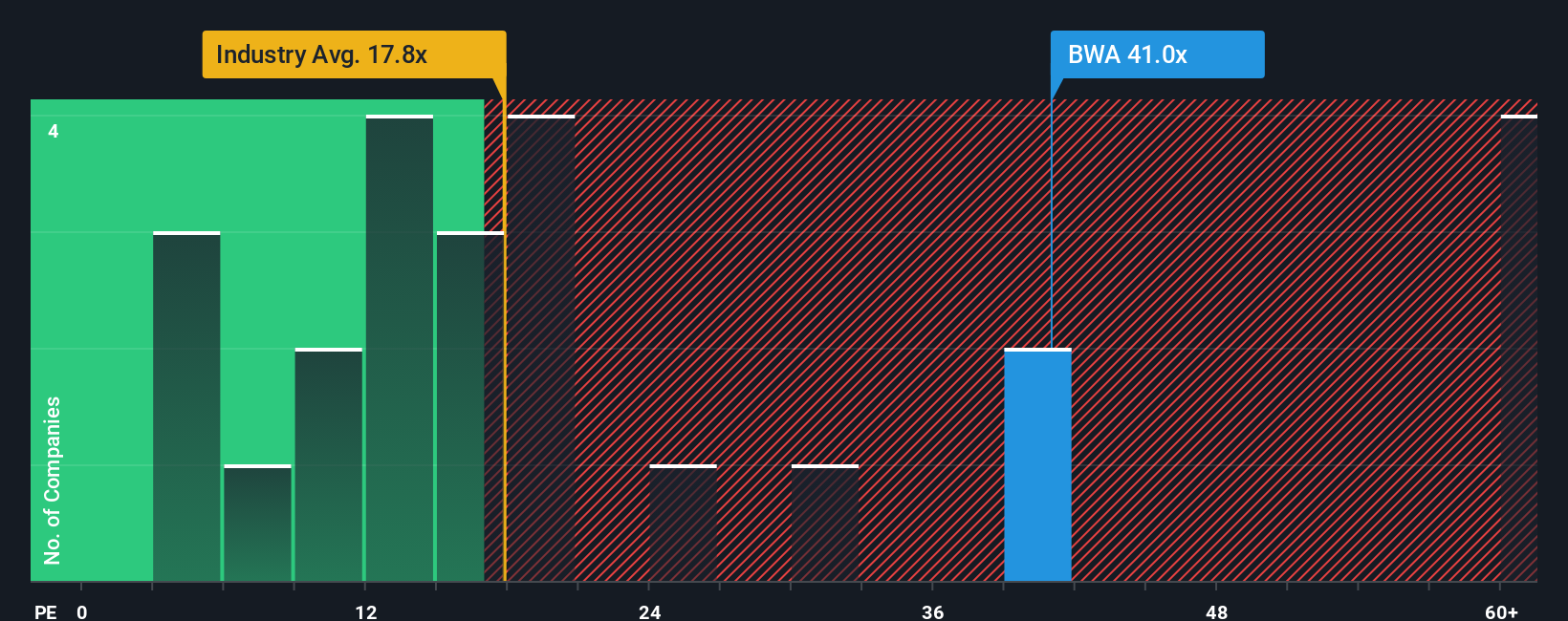

While the fair value estimate suggests BorgWarner is undervalued, a closer look at its price-to-earnings ratio tells a different story. At 40.5x earnings, the company trades well above both the Auto Components industry average of 17.3x and its own fair ratio of 16.3x. This steep premium could mean investors are expecting a lot from future performance. Will the fundamentals justify such high hopes?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own BorgWarner Narrative

If you see things differently or want to dig into the numbers on your own, there’s nothing stopping you from putting together your own take in just a few minutes, Do it your way

A great starting point for your BorgWarner research is our analysis highlighting 2 key rewards and 4 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Don’t let a great opportunity slip away. Start your next smart move by taking a look at forward-thinking stocks curated for real-world results, only a click away.

- Tap into tomorrow’s tech with these 24 AI penny stocks and see which companies are making artificial intelligence a reality in everyday life.

- Catch growing income streams when you explore these 19 dividend stocks with yields > 3% and find potential winners with healthy yields exceeding 3%.

- Expand your portfolio into future finance by checking out these 79 cryptocurrency and blockchain stocks, which highlights advancements in digital assets and blockchain innovation.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if BorgWarner might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:BWA

BorgWarner

Provides solutions for combustion, hybrid, and electric vehicles worldwide.

Excellent balance sheet average dividend payer.

Similar Companies

Market Insights

Community Narratives