- United States

- /

- Banks

- /

- NasdaqGS:NRIM

Top Dividend Stocks To Consider In August 2025

Reviewed by Simply Wall St

As the U.S. stock market rebounds from a recent sell-off, with major indices like the Dow Jones and S&P 500 showing gains, investors are closely watching economic indicators and earnings reports for further guidance. In this environment, dividend stocks can offer stability and income potential, making them an attractive option for those seeking to navigate market volatility while earning regular returns.

Top 10 Dividend Stocks In The United States

| Name | Dividend Yield | Dividend Rating |

| Valley National Bancorp (VLY) | 4.79% | ★★★★★☆ |

| Universal (UVV) | 6.08% | ★★★★★★ |

| Huntington Bancshares (HBAN) | 3.87% | ★★★★★☆ |

| First Interstate BancSystem (FIBK) | 6.62% | ★★★★★★ |

| Ennis (EBF) | 5.69% | ★★★★★★ |

| Douglas Dynamics (PLOW) | 4.23% | ★★★★★☆ |

| Dillard's (DDS) | 5.55% | ★★★★★★ |

| CompX International (CIX) | 5.39% | ★★★★★★ |

| Columbia Banking System (COLB) | 6.19% | ★★★★★★ |

| Citizens & Northern (CZNC) | 6.08% | ★★★★★☆ |

Click here to see the full list of 145 stocks from our Top US Dividend Stocks screener.

Let's explore several standout options from the results in the screener.

Northrim BanCorp (NRIM)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Northrim BanCorp, Inc. is the bank holding company for Northrim Bank, offering commercial banking products and services to businesses and professionals, with a market cap of $451.09 million.

Operations: Northrim BanCorp, Inc.'s revenue is primarily derived from Community Banking at $121.89 million, Home Mortgage Lending at $35.57 million, and Specialty Finance at $6.39 million.

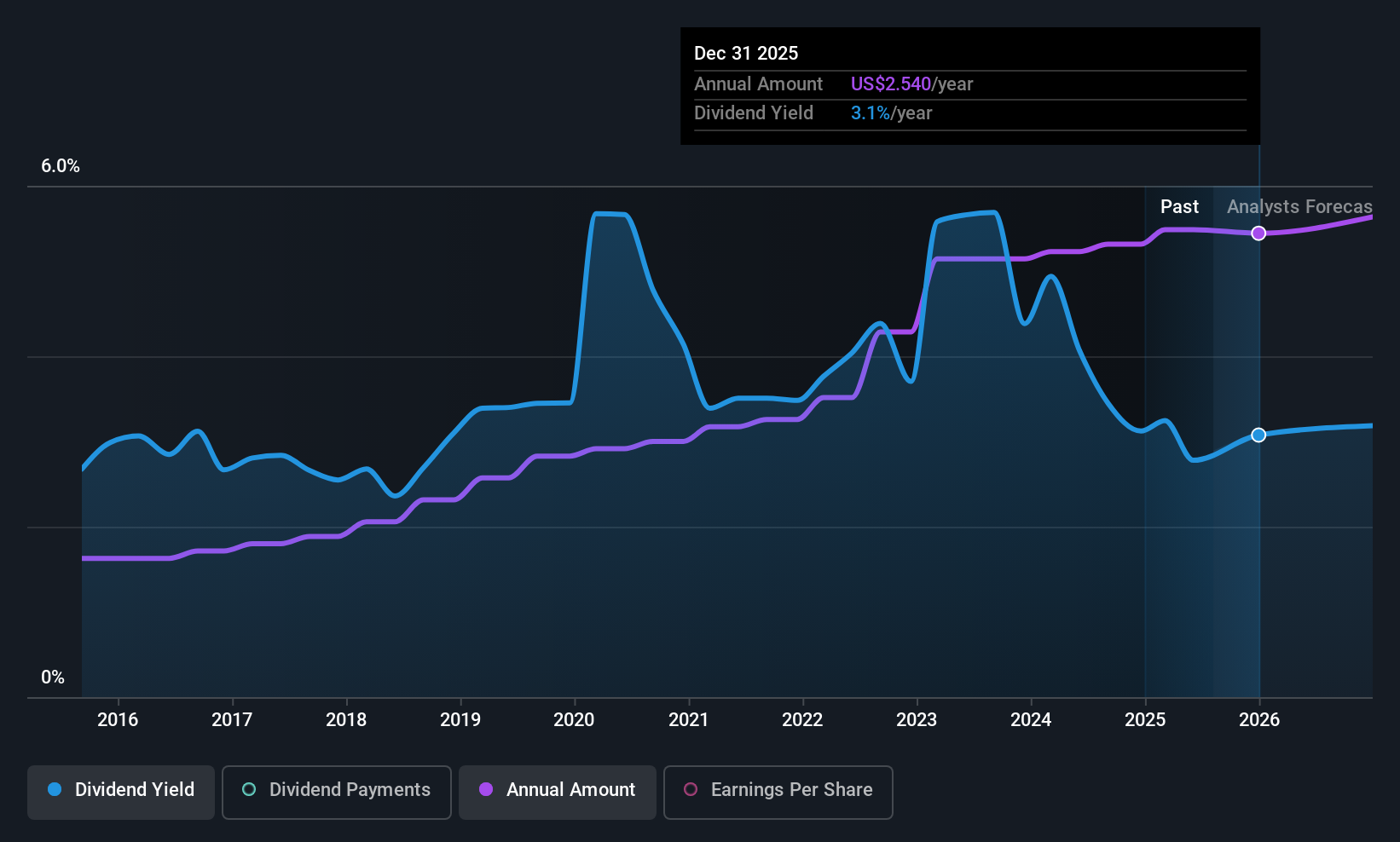

Dividend Yield: 3.1%

Northrim BanCorp has demonstrated stable and reliable dividend payments over the past decade, with a current yield of 3.13%, which is below the top quartile in the US market. The company's dividends are well covered by earnings, supported by a low payout ratio of 31.2%. Recent earnings reports show strong growth, with net income for Q2 2025 at US$11.78 million compared to US$9.02 million last year, indicating robust financial health that could sustain future dividends.

- Take a closer look at Northrim BanCorp's potential here in our dividend report.

- In light of our recent valuation report, it seems possible that Northrim BanCorp is trading behind its estimated value.

Autoliv (ALV)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Autoliv, Inc. develops, manufactures, and supplies passive safety systems for the automotive industry across Europe, the Americas, China, Japan, and the rest of Asia with a market cap of $8.47 billion.

Operations: Autoliv, Inc.'s revenue primarily comes from its Airbag and Seatbelt Products and Components segment, which generated $10.46 billion.

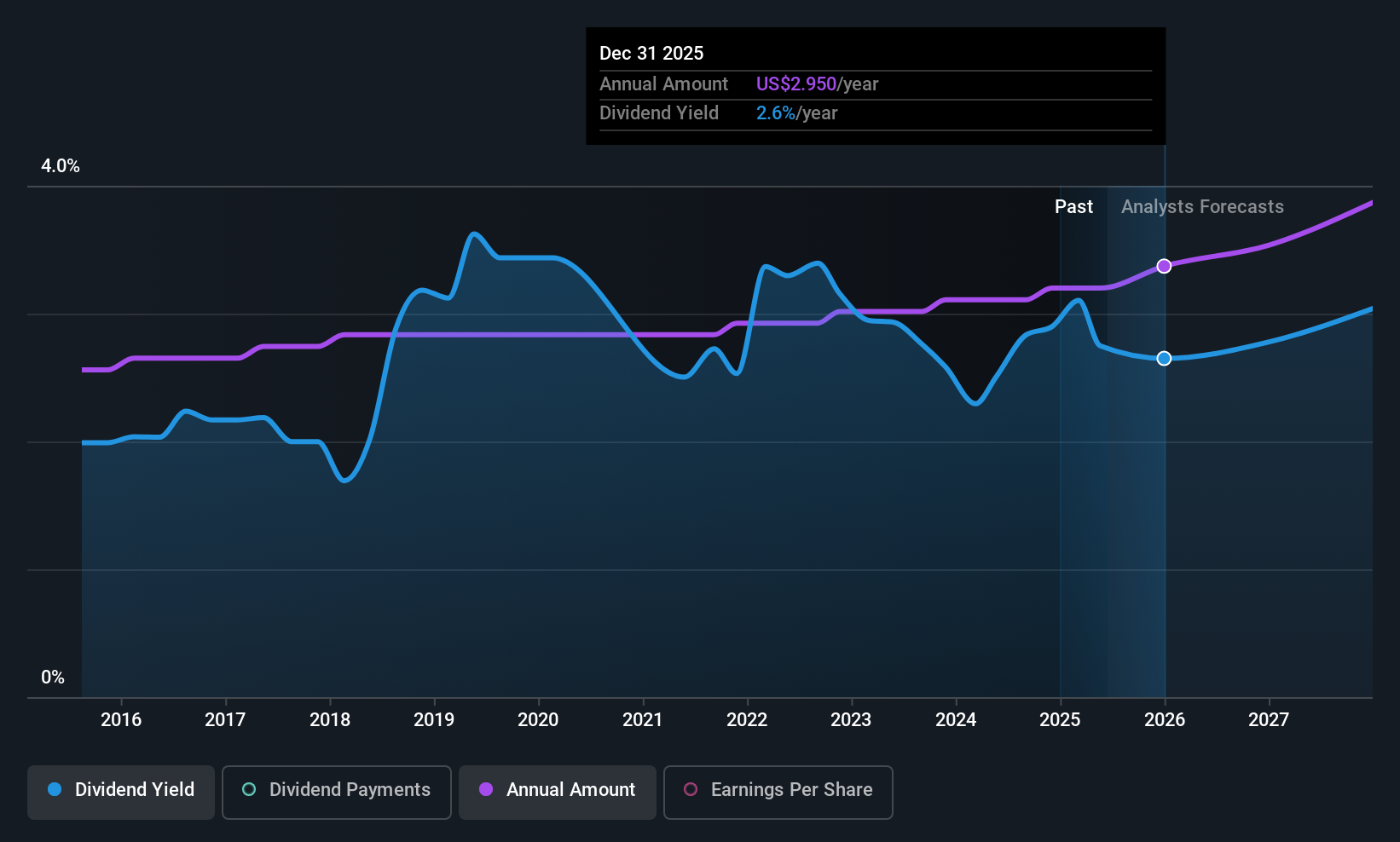

Dividend Yield: 3.1%

Autoliv's dividend payments are well covered by earnings with a payout ratio of 30.3% and supported by cash flows, though the yield of 3.08% is below the top quartile in the US market. Despite a volatile dividend history, recent increases reflect improved financial performance, as evidenced by Q2 2025 net income rising to US$167 million from US$138 million last year. The company maintains strong earnings growth and has announced a significant share buyback program up to US$2.5 billion through 2029.

- Click here and access our complete dividend analysis report to understand the dynamics of Autoliv.

- Our comprehensive valuation report raises the possibility that Autoliv is priced lower than what may be justified by its financials.

Synovus Financial (SNV)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Synovus Financial Corp. is a bank holding company for Synovus Bank, offering commercial and consumer banking products and services in the United States, with a market cap of approximately $6.46 billion.

Operations: In its revenue segments, Synovus Financial Corp. generates income primarily through commercial banking, consumer banking, and various financial services in the United States.

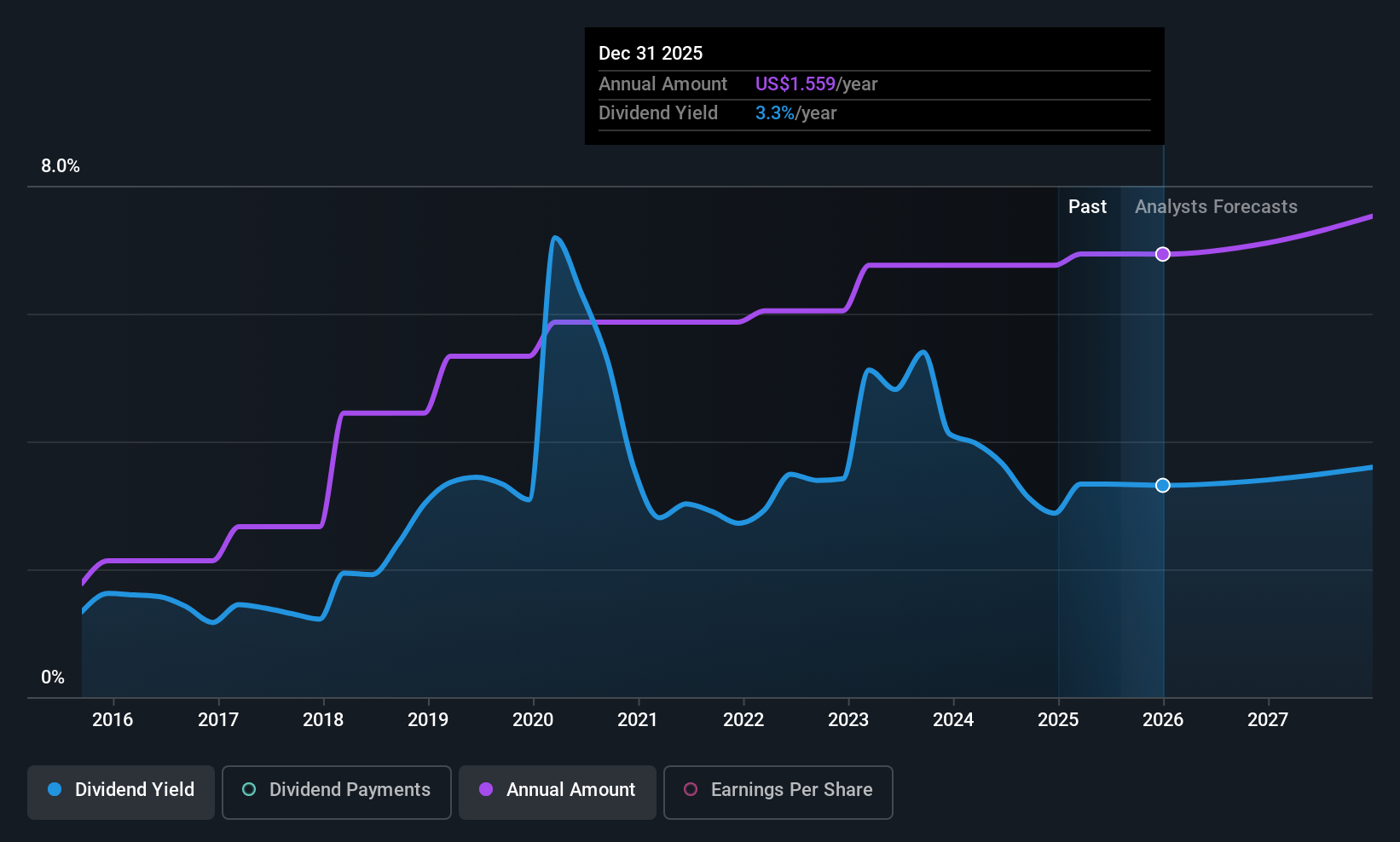

Dividend Yield: 3.4%

Synovus Financial's dividend yield of 3.35% is lower than the top quartile in the US market, yet it offers stable and growing dividends over the past decade with a sustainable payout ratio of 29.4%. Recent earnings growth and a merger agreement with Pinnacle Financial Partners for US$7.8 billion could enhance its financial position, though regulatory approvals are pending. The merger aims to create a stronger entity under Pinnacle's brand, potentially impacting future dividend policies.

- Navigate through the intricacies of Synovus Financial with our comprehensive dividend report here.

- The valuation report we've compiled suggests that Synovus Financial's current price could be quite moderate.

Taking Advantage

- Navigate through the entire inventory of 145 Top US Dividend Stocks here.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Northrim BanCorp might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:NRIM

Northrim BanCorp

Operates as the bank holding company for Northrim Bank that provides commercial banking products and services to businesses and professional individuals.

Flawless balance sheet with solid track record and pays a dividend.

Similar Companies

Market Insights

Community Narratives