- United States

- /

- Auto Components

- /

- NYSE:ALV

Is It Smart To Buy Autoliv, Inc. (NYSE:ALV) Before It Goes Ex-Dividend?

Autoliv, Inc. (NYSE:ALV) stock is about to trade ex-dividend in four days. Typically, the ex-dividend date is one business day before the record date, which is the date on which a company determines the shareholders eligible to receive a dividend. The ex-dividend date is an important date to be aware of as any purchase of the stock made on or after this date might mean a late settlement that doesn't show on the record date. Therefore, if you purchase Autoliv's shares on or after the 21st of May, you won't be eligible to receive the dividend, when it is paid on the 10th of June.

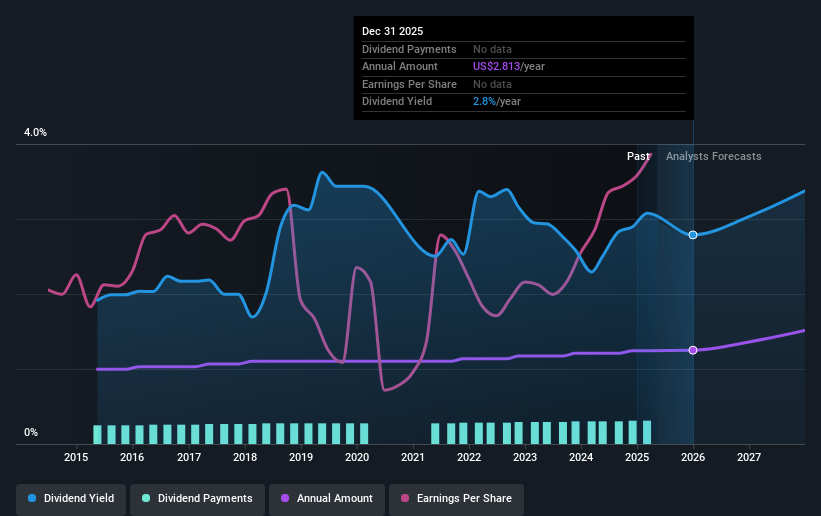

The company's next dividend payment will be US$0.70 per share. Last year, in total, the company distributed US$2.80 to shareholders. Looking at the last 12 months of distributions, Autoliv has a trailing yield of approximately 2.8% on its current stock price of US$100.92. Dividends are a major contributor to investment returns for long term holders, but only if the dividend continues to be paid. As a result, readers should always check whether Autoliv has been able to grow its dividends, or if the dividend might be cut.

We've discovered 2 warning signs about Autoliv. View them for free.Dividends are usually paid out of company profits, so if a company pays out more than it earned then its dividend is usually at greater risk of being cut. That's why it's good to see Autoliv paying out a modest 32% of its earnings. Yet cash flows are even more important than profits for assessing a dividend, so we need to see if the company generated enough cash to pay its distribution. Thankfully its dividend payments took up just 46% of the free cash flow it generated, which is a comfortable payout ratio.

It's positive to see that Autoliv's dividend is covered by both profits and cash flow, since this is generally a sign that the dividend is sustainable, and a lower payout ratio usually suggests a greater margin of safety before the dividend gets cut.

See our latest analysis for Autoliv

Click here to see the company's payout ratio, plus analyst estimates of its future dividends.

Have Earnings And Dividends Been Growing?

Stocks in companies that generate sustainable earnings growth often make the best dividend prospects, as it is easier to lift the dividend when earnings are rising. If earnings decline and the company is forced to cut its dividend, investors could watch the value of their investment go up in smoke. For this reason, we're glad to see Autoliv's earnings per share have risen 11% per annum over the last five years. Earnings per share are growing rapidly and the company is keeping more than half of its earnings within the business; an attractive combination which could suggest the company is focused on reinvesting to grow earnings further. This will make it easier to fund future growth efforts and we think this is an attractive combination - plus the dividend can always be increased later.

Another key way to measure a company's dividend prospects is by measuring its historical rate of dividend growth. Since the start of our data, 10 years ago, Autoliv has lifted its dividend by approximately 2.6% a year on average. Earnings per share have been growing much quicker than dividends, potentially because Autoliv is keeping back more of its profits to grow the business.

To Sum It Up

Has Autoliv got what it takes to maintain its dividend payments? Autoliv has grown its earnings per share while simultaneously reinvesting in the business. Unfortunately it's cut the dividend at least once in the past 10 years, but the conservative payout ratio makes the current dividend look sustainable. It's a promising combination that should mark this company worthy of closer attention.

On that note, you'll want to research what risks Autoliv is facing. To help with this, we've discovered 2 warning signs for Autoliv that you should be aware of before investing in their shares.

If you're in the market for strong dividend payers, we recommend checking our selection of top dividend stocks.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NYSE:ALV

Autoliv

Through its subsidiaries, develops, manufactures, and supplies passive safety systems to the automotive industry in Europe, the Americas, China, Japan, and rest of Asia.

Undervalued with solid track record and pays a dividend.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Stride Stock: Online Education Finds Its Second Act

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)