- United States

- /

- Real Estate

- /

- NYSE:FPH

3 Undiscovered US Gems To Enhance Your Portfolio

Reviewed by Simply Wall St

As the U.S. stock market continues its upward trajectory, with major indices like the Nasdaq hitting record highs amid optimism for potential rate cuts, investors are increasingly seeking opportunities in smaller, less-known companies that could offer unique growth potential. In this dynamic environment, identifying stocks that combine strong fundamentals with promising market positions can be a strategic move to enhance and diversify one's portfolio.

Top 10 Undiscovered Gems With Strong Fundamentals In The United States

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Southern Michigan Bancorp | 117.38% | 8.87% | 4.89% | ★★★★★★ |

| Sound Financial Bancorp | 34.70% | 2.11% | -11.08% | ★★★★★★ |

| ASA Gold and Precious Metals | NA | 12.79% | -0.59% | ★★★★★★ |

| Affinity Bancshares | 43.51% | 4.54% | 8.05% | ★★★★★★ |

| SUI Group Holdings | NA | 16.40% | -30.66% | ★★★★★★ |

| Metalpha Technology Holding | NA | 75.66% | 28.60% | ★★★★★★ |

| FRMO | 0.10% | 42.87% | 47.51% | ★★★★★☆ |

| Linkhome Holdings | 7.03% | 215.05% | 239.56% | ★★★★★☆ |

| Rich Sparkle Holdings | 26.73% | -6.13% | 1.75% | ★★★★★☆ |

| Solesence | 91.26% | 23.30% | 4.70% | ★★★★☆☆ |

Let's dive into some prime choices out of from the screener.

XPEL (XPEL)

Simply Wall St Value Rating: ★★★★★★

Overview: XPEL, Inc. is involved in the manufacturing, installation, sale, and distribution of protective films and coatings with a market capitalization of approximately $987.36 million.

Operations: XPEL generates revenue primarily from its Auto Parts & Accessories segment, which contributed $448.90 million.

XPEL's recent launch of the COLOR Paint Protection Film (PPF) line, featuring a palette of 16 colors, marks an innovative step in vehicle personalization. This offering combines aesthetic appeal with robust protection, backed by a 10-year warranty. Financially, XPEL reported strong earnings for Q2 2025 with revenue at US$124.71 million and net income rising to US$16.29 million from the previous year. The company's debt-to-equity ratio has impressively decreased from 18.7 to just 0.08 over five years, highlighting its financial prudence and stability amidst industry challenges and competitive pressures.

Ituran Location and Control (ITRN)

Simply Wall St Value Rating: ★★★★★★

Overview: Ituran Location and Control Ltd. offers location-based telematics services and machine-to-machine telematics products across Israel, Brazil, and other international markets, with a market cap of $671.81 million.

Operations: The company generates revenue primarily from telematics services, contributing $247.08 million, and telematics products, adding $92.54 million.

With a solid track record, Ituran Location and Control shines as a debt-free entity, having eliminated its 53.1% debt-to-equity ratio from five years ago. The company boasts high-quality earnings, with profits growing at an impressive 28% annually over the past five years. Recent earnings reports show net income of US$13.45 million for Q2 2025, slightly up from US$13.13 million the previous year, while revenue rose to US$86.79 million from US$84.87 million in the same period last year. Their strategic alliance with BMW Motorrad Brazil enhances their market presence by providing advanced telematics services to customers in Brazil.

- Navigate through the intricacies of Ituran Location and Control with our comprehensive health report here.

Gain insights into Ituran Location and Control's past trends and performance with our Past report.

Five Point Holdings (FPH)

Simply Wall St Value Rating: ★★★★★★

Overview: Five Point Holdings, LLC designs, owns, and develops mixed-use planned communities in Orange County, Los Angeles County, and San Francisco County with a market cap of approximately $847 million.

Operations: Five Point Holdings generates revenue primarily from its Valencia and Great Park segments, with $139.83 million and $795.07 million, respectively. The company's net profit margin is impacted by adjustments such as the removal of the Great Park Venture amounting to -$738.37 million.

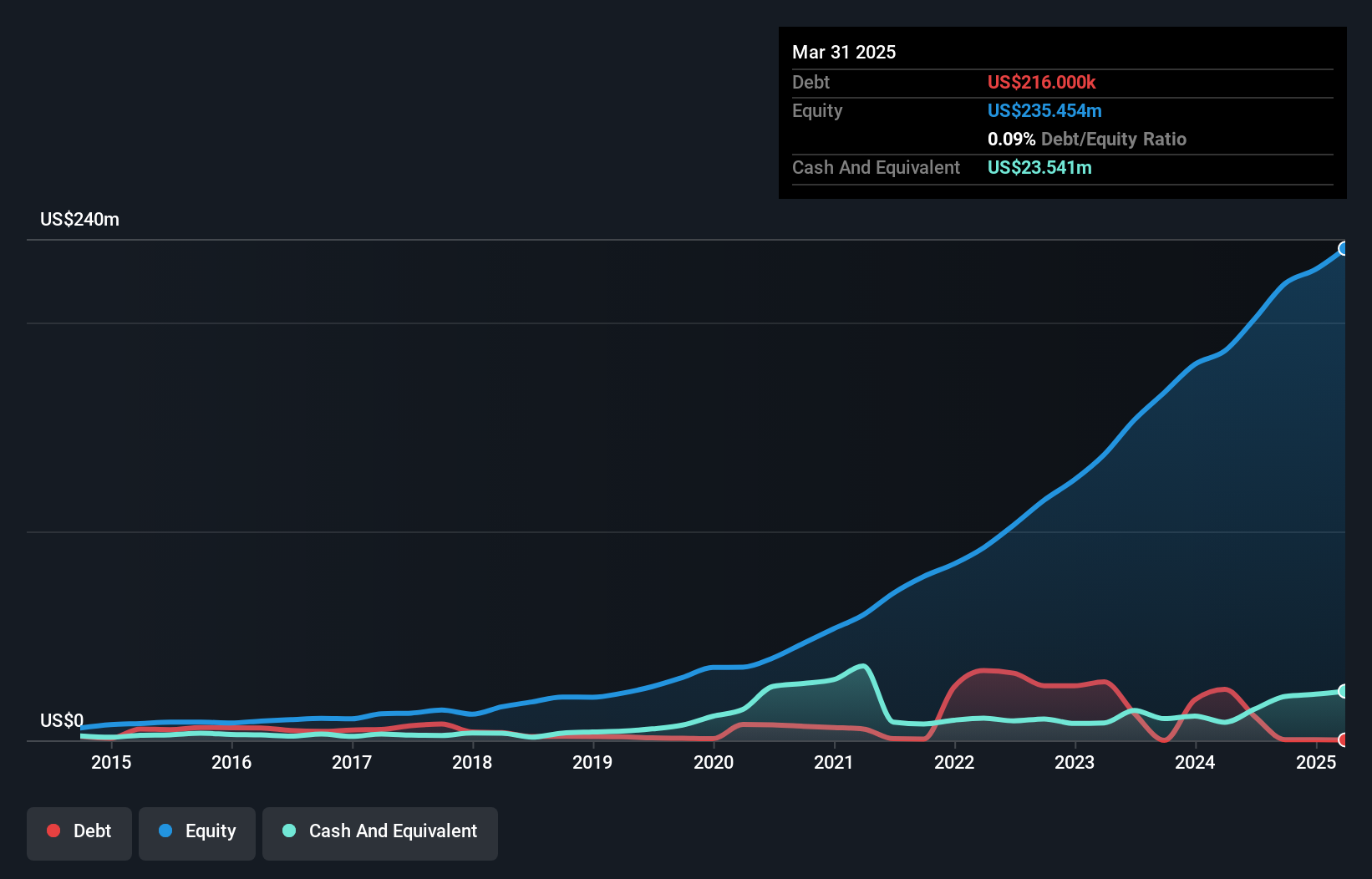

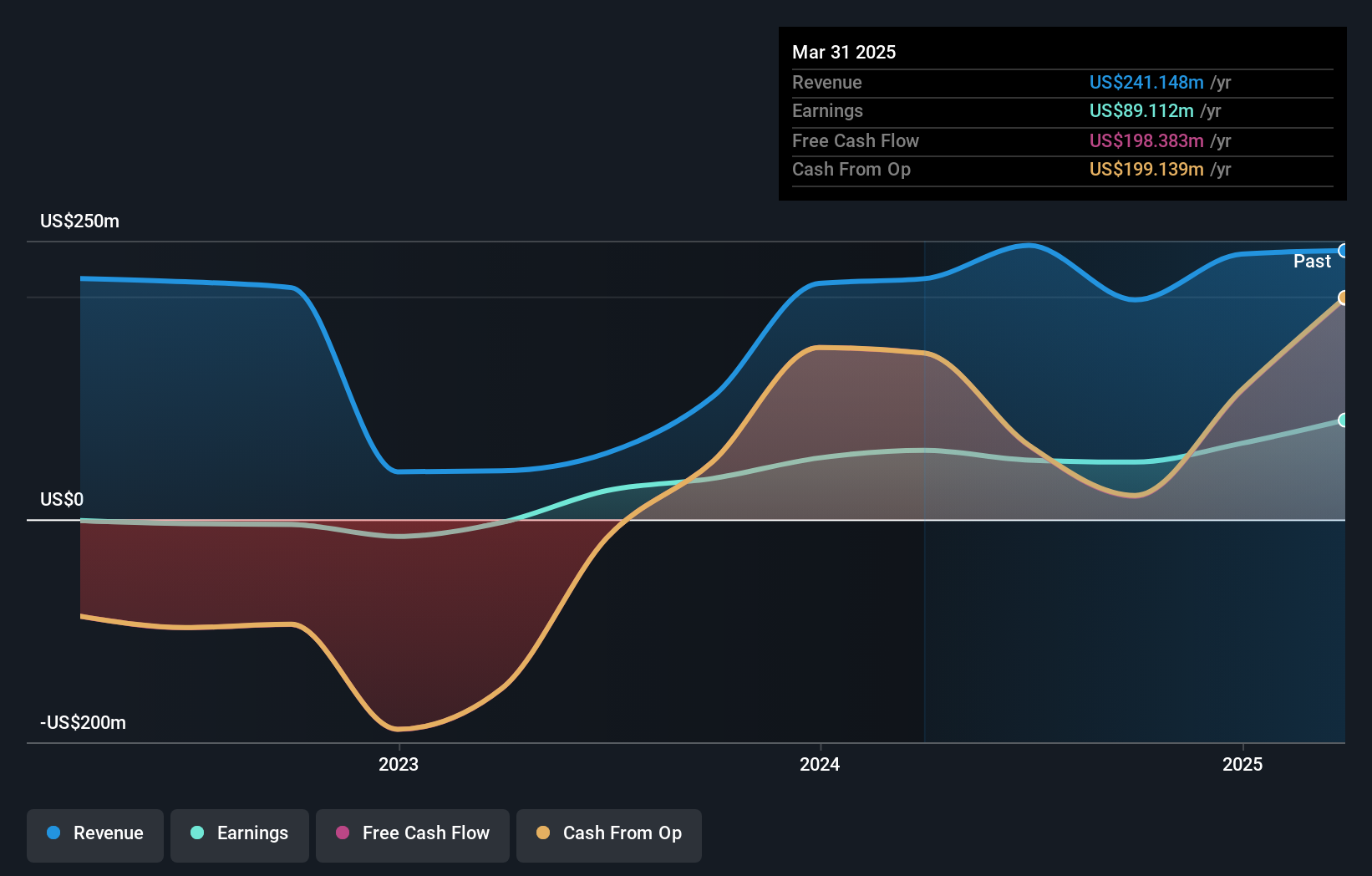

Five Point Holdings is making waves in the real estate sector with a notable earnings growth of 46.2% over the past year, outpacing the industry's 13.8%. Despite a dip in quarterly revenue to US$7.47 million from last year's US$51.19 million, net income for the first half of 2025 surged to US$26.6 million compared to US$17.05 million previously, showcasing strong profitability and high-quality earnings. The debt-to-equity ratio improved significantly from 38.2% to 26.3% over five years, and its net debt-to-equity stands at a satisfactory 6%, indicating sound financial health amidst trading at an attractive valuation below fair value estimates.

- Take a closer look at Five Point Holdings' potential here in our health report.

Evaluate Five Point Holdings' historical performance by accessing our past performance report.

Taking Advantage

- Get an in-depth perspective on all 285 US Undiscovered Gems With Strong Fundamentals by using our screener here.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:FPH

Five Point Holdings

Designs, owns, and develops mixed-use planned communities in Orange County, Los Angeles County, and San Francisco County.

Flawless balance sheet and good value.

Similar Companies

Market Insights

Community Narratives