- United States

- /

- Auto

- /

- NasdaqGS:TSLA

Tesla (TSLA) Is Down 5.9% After Weak China Sales and Rising Global EV Competition – Has The Bull Case Changed?

Reviewed by Sasha Jovanovic

- In recent days, Tesla has reported its weakest vehicle sales in China in three years, with October deliveries dropping to just 26,006 units and market share falling to 3.2%, coupled with declining sales across key European markets and increased competition from both domestic and international EV makers like Xiaomi and Alphabet’s Waymo.

- This comes amid ongoing product recalls, major shareholder votes on executive pay and governance, and Tesla’s efforts to satisfy consumer demands such as integrating Apple's CarPlay into its vehicles.

- We’ll look at how these sales declines and intensifying competition in core markets may impact Tesla’s outlook for high-margin, recurring software revenue growth.

The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

Tesla Investment Narrative Recap

To be a Tesla shareholder today, you need strong conviction in the company’s ability to transition from hardware-driven car sales to a software-centric, autonomous mobility and energy business. Recent reports of sharply lower EV sales in China and difficulty maintaining share in key European markets challenge Tesla's short-term delivery trajectory but haven’t yet fundamentally altered the importance of scaling robotaxi services for recurring high-margin software revenue, the most important near-term catalyst. The greatest current risk remains execution delays or setbacks in advancing robotaxi and FSD revenue outside the U.S., given stiff regulatory and competitive headwinds. One of the latest relevant developments is Faraday Future’s announcement of NACS compatibility, unlocking access to Tesla’s Supercharger network for new rival EVs starting in 2026. This move underscores how Tesla’s infrastructure, while supporting ecosystem revenue, may also empower competitors, highlighting the twin pressures of monetizing autonomy and defending market share in core markets. Yet, against this progress, investors should be aware that regulatory speedbumps in Europe and China could significantly...

Read the full narrative on Tesla (it's free!)

Tesla's outlook envisions $148.1 billion in revenue and $15.4 billion in earnings by 2028. This assumes a 16.9% annual revenue growth rate and an increase in earnings of $9.5 billion from the current $5.9 billion level.

Uncover how Tesla's forecasts yield a $391.32 fair value, a 3% downside to its current price.

Exploring Other Perspectives

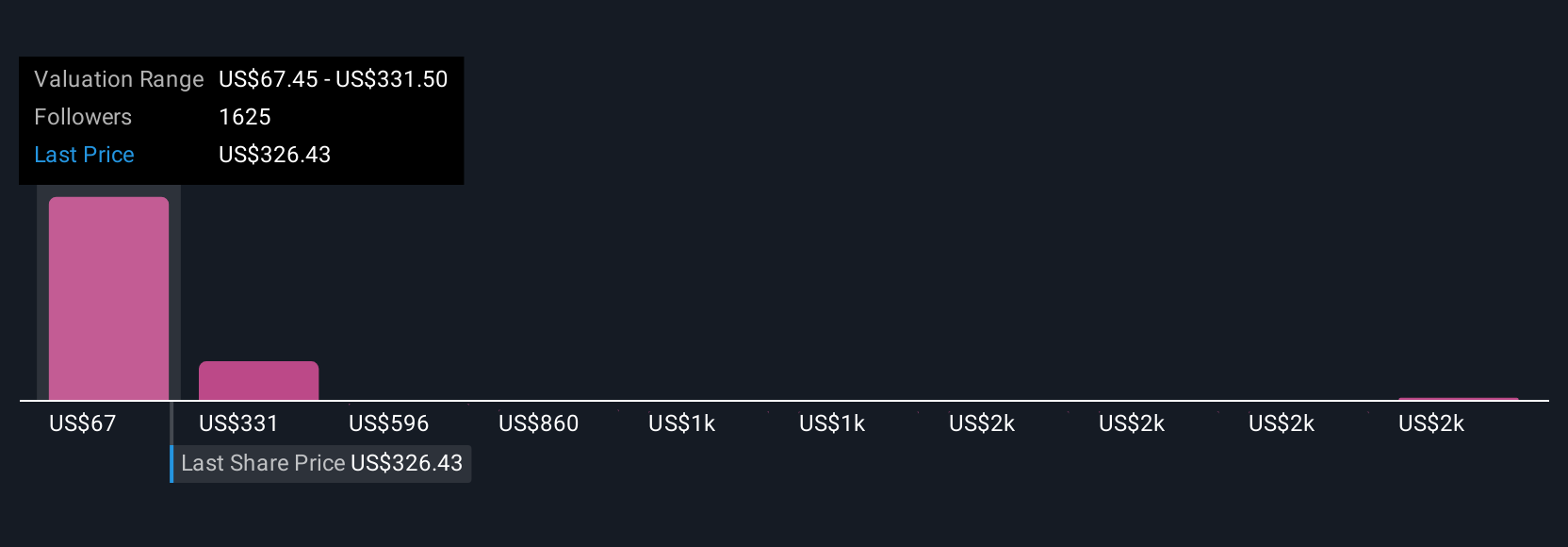

Private members of the Simply Wall St Community produced 222 fair value estimates for Tesla, from as low as US$67.45 to as high as US$2,707.91. As regulatory approvals remain a key hurdle, consider how differing views on global robotaxi expansion could shape your outlook on Tesla’s earnings potential.

Explore 222 other fair value estimates on Tesla - why the stock might be worth over 6x more than the current price!

Build Your Own Tesla Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Tesla research is our analysis highlighting 1 key reward and 1 important warning sign that could impact your investment decision.

- Our free Tesla research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Tesla's overall financial health at a glance.

Searching For A Fresh Perspective?

Our top stock finds are flying under the radar-for now. Get in early:

- Explore 26 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

- Rare earth metals are the new gold rush. Find out which 36 stocks are leading the charge.

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Tesla might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:TSLA

Tesla

Designs, develops, manufactures, leases, and sells electric vehicles, and energy generation and storage systems in the United States, China, and internationally.

Flawless balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives