- United States

- /

- Auto

- /

- NasdaqGS:TSLA

Tesla (TSLA): Assessing Valuation as New Model Launches and Regulatory Scrutiny Shape Market Sentiment

Reviewed by Kshitija Bhandaru

Tesla (TSLA) is in focus this week after launching new “Standard” trims for its Model Y and Model 3 vehicles. The move comes as the company grapples with shrinking sales, heated competition, and the expiration of federal EV tax credits.

See our latest analysis for Tesla.

Tesla’s share price has pulled back recently, falling more than 5% in the past day and about 4% over the past week as investors digest the mix of fresh model launches and high-profile regulatory scrutiny. Still, the momentum over the past three months remains strong with a 30% share price return. A stellar 1-year total shareholder return of nearly 90% demonstrates just how much faith remains in Tesla’s long-term vision, even amid volatile headlines and ongoing competitive pressure.

Interested in what else is gaining traction in autos? This is a great moment to check out See the full list for free.

With major new launches and mounting scrutiny, Tesla’s fundamentals and future prospects are under the microscope. Is the recent dip in share price a strategic buying opportunity, or are markets already factoring in tomorrow’s growth?

Most Popular Narrative: 2.8% Undervalued

According to BlackGoat, the fair value for Tesla stands at $425, slightly above its last close of $413.49. This narrative frames the current price environment as a potential window for forward-thinking investors, especially as Tesla transitions beyond its traditional auto business.

Tesla’s business model is shifting from one-time car sales to AI-powered software and service-based recurring revenue models. To estimate Tesla’s intrinsic value over the next 10 years, we model: • Automotive Growth: Continued expansion of Model Y sales and new models, with projected annual revenue growth of 15%.

Curious why Tesla's fair value projection is anchored in disruptive tech, data-driven expansion, and a bold pivot beyond cars? This narrative contains eye-opening assumptions that could spark conversation about Tesla’s true profit engine. Want to see the numbers behind this price target? Dive in and get the real details.

Result: Fair Value of $425 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, the biggest wildcards remain delays in full self-driving approval and aggressive competition from China. Both of these factors could reshape Tesla’s growth story.

Find out about the key risks to this Tesla narrative.

Another View: Price Ratios Raise Caution

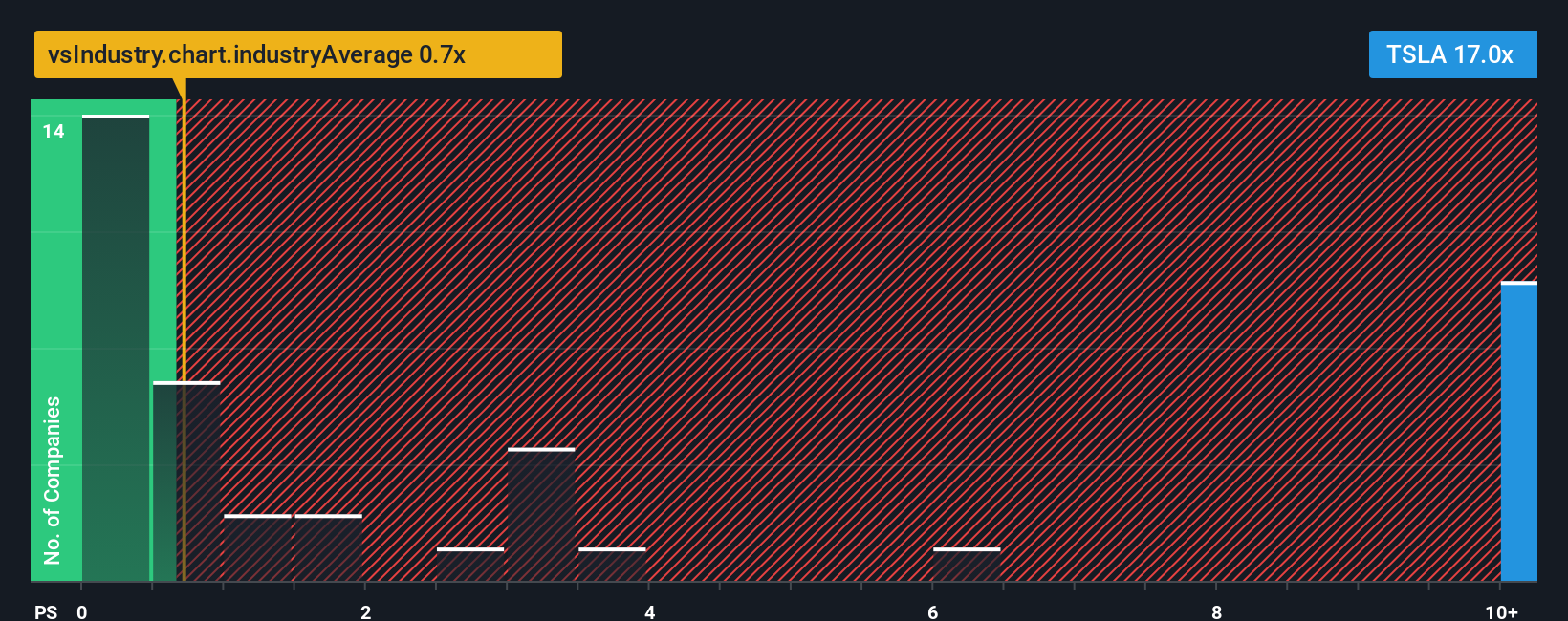

While some see Tesla as undervalued based on future growth, looking at its price-to-sales ratio gives a different impression. Tesla trades at 14.8x sales, much higher than both its peer average of 1.2x and the estimated fair ratio of 3.8x. This significant gap suggests current investors are paying a substantial premium over the industry, leaving little room for error in Tesla’s growth story. Does this premium signal confidence or possible over-exuberance?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Tesla Narrative

If you have your own view or want to dig deeper into the numbers, you can craft your personal take on Tesla in just minutes. Do it your way

A great starting point for your Tesla research is our analysis highlighting 1 key reward and 1 important warning sign that could impact your investment decision.

Looking for More Investment Ideas?

Don't let opportunity pass you by. Give your portfolio a fresh edge by acting on some of the market’s biggest trends, all in just a few clicks.

- Tap into fast-growing AI innovation by checking out these 24 AI penny stocks, which are shaping the smartest sectors in today's market.

- Catch companies trading below their potential and uncover your next value investment through these 892 undervalued stocks based on cash flows, with a focus on cash flow strength.

- Lock in steady income and resilience by reviewing these 19 dividend stocks with yields > 3%, offering yields above 3% for savvy investors.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Tesla might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:TSLA

Tesla

Designs, develops, manufactures, leases, and sells electric vehicles, and energy generation and storage systems in the United States, China, and internationally.

Flawless balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

TAV Havalimanlari Holding will fly high with 25.68% revenue growth

Fiducian: Compliance Clouds or Value Opportunity?

Q3 Outlook modestly optimistic

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.