- United States

- /

- Auto Components

- /

- NasdaqGS:SLDP

What Solid Power (SLDP)'s $150 Million Equity Offering Means For Shareholders

Reviewed by Simply Wall St

- On September 5, 2025, Solid Power, Inc. filed a shelf registration and announced a $150 million at-the-market follow-on equity offering for its common stock.

- This move signals that Solid Power is seeking to raise significant capital, potentially supporting its production scaling and technology development plans in the competitive solid-state battery market.

- We'll examine how Solid Power's capital raise may influence its ability to fund growth and withstand ongoing industry headwinds.

AI is about to change healthcare. These 31 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

Solid Power Investment Narrative Recap

To back Solid Power as a shareholder, you need confidence in its ability to scale solid-state battery technology for meaningful commercialization, forging industry partnerships, and converting R&D progress into revenue. The recent $150 million at-the-market equity offering addresses near-term funding needs and supports production scaling, which is critical to driving the main catalyst of commercial delivery, though it does introduce short-term dilution risk for current shareholders, likely the most material immediate concern while efforts to cut cash burn remain ongoing.

A relevant recent announcement tying into this funding move is the expanded partnership with SK On, which includes electrolyte supply and R&D agreements expected to generate at least US$50 million in revenue. This brings greater visibility to future cash inflows, potentially supporting Solid Power’s rapid scale-up efforts, yet the ability to move from R&D revenue to recurring, large-scale production remains a key catalyst for the investment case.

On the flip side, investors should be aware that if cash needs escalate faster than expected…

Read the full narrative on Solid Power (it's free!)

Solid Power's outlook anticipates $33.2 million in revenue and $1.6 million in earnings by 2028. This assumes a 13.5% annual revenue growth rate and a $95.1 million increase in earnings from the current level of -$93.5 million.

Uncover how Solid Power's forecasts yield a $2.50 fair value, a 34% downside to its current price.

Exploring Other Perspectives

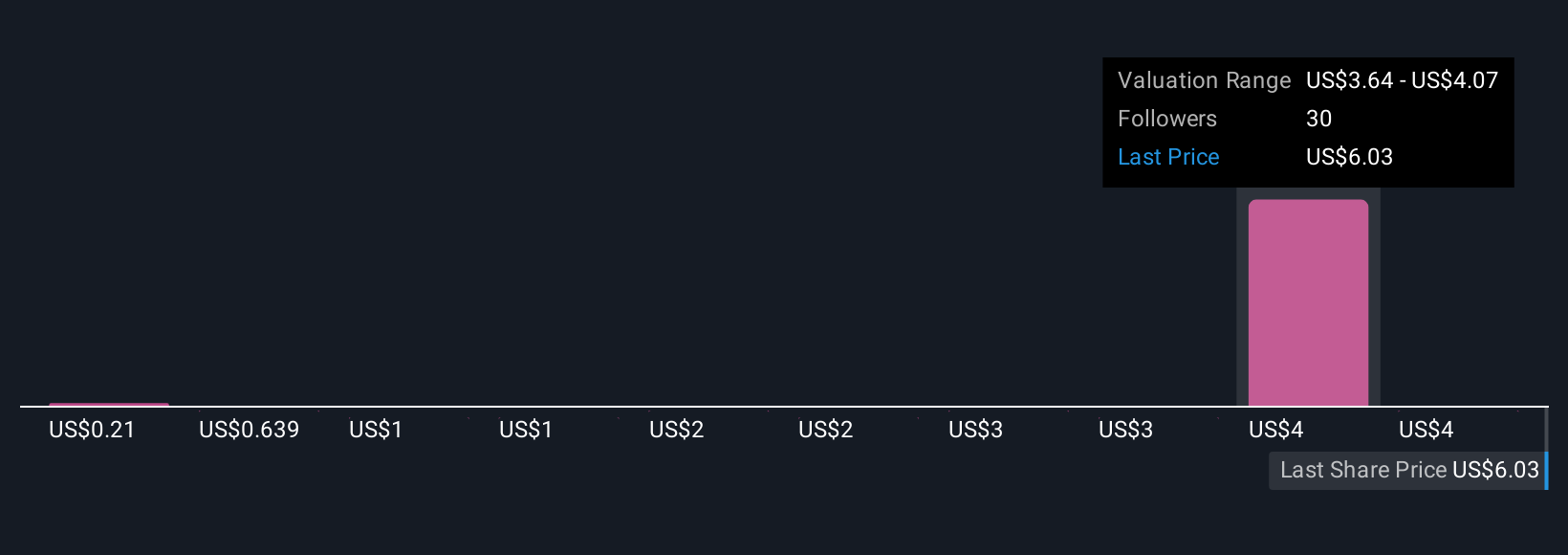

Six different members of the Simply Wall St Community estimate Solid Power’s fair value between US$0.21 and US$4.50 per share. While recent fundraising increases financial flexibility, market participants remain mindful of the ongoing dilution and execution risks facing Solid Power at this stage.

Explore 6 other fair value estimates on Solid Power - why the stock might be worth less than half the current price!

Build Your Own Solid Power Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Solid Power research is our analysis highlighting 1 key reward and 2 important warning signs that could impact your investment decision.

- Our free Solid Power research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Solid Power's overall financial health at a glance.

Looking For Alternative Opportunities?

These stocks are moving-our analysis flagged them today. Act fast before the price catches up:

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

- We've found 18 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- These 8 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:SLDP

Solid Power

Develops solid-state battery technologies for the electric vehicles (EV) and other markets in the United States.

Flawless balance sheet with limited growth.

Similar Companies

Market Insights

Community Narratives