Last Update17 Oct 25

Narrative Update: Solid Power Analyst Price Target Adjustment

Analysts have slightly raised their fair value estimate for Solid Power to $4.00 per share, citing modest improvements in the discount rate and profit margin assumptions.

What's in the News

- Solid Power, Inc. filed a follow-on equity offering totaling $150 million through an at-the-market offering of common stock (Key Developments).

- From April 1, 2025 to June 30, 2025, the company repurchased 3,361,396 shares, representing 1.84% of shares for $3.53 million. The company has now completed the repurchase of 9,065,797 shares, totaling 5.03% of outstanding shares for $12.59 million under the ongoing buyback program announced on January 23, 2024 (Key Developments).

Valuation Changes

- The Fair Value Estimate has risen slightly, from $4.00 to $4.00 per share.

- The Discount Rate has decreased marginally, moving from 7.79% to 7.77%.

- Revenue Growth remains unchanged at approximately 13.54%.

- The Net Profit Margin has improved very slightly, rising from 4.78% to 4.78%.

- The Future P/E Ratio has fallen marginally, from 581.08x to 580.79x.

Key Takeaways

- Investor optimism about early market dominance may be misplaced due to risks around slow commercial adoption, ongoing losses, and concentration in key partnerships.

- Supply chain challenges, high capital needs, and unproven long-term licensing pose threats to profitability and stable revenue growth.

- Strategic OEM partnerships, scalable manufacturing, robust customer interest, strong financial footing, and technological advancement position Solid Power for long-term growth and market leadership in solid-state batteries.

Catalysts

About Solid Power- Develops solid-state battery technologies for the electric vehicles (EV) and other markets in the United States.

- The rapid pace of investment and milestones achieved, such as partnerships with BMW and SK On, appear to be leading investors to assume accelerated revenue growth and early market dominance, despite the risk that large-scale commercial adoption and customer diversification may not materialize as quickly as expected, potentially leading to future revenue shortfalls.

- Significant ongoing operating losses and high capital expenditures required for pilot manufacturing lines and technology development could sustain elevated cash burn, with investors possibly underestimating the time and cost needed to achieve profitable scale-posing risks to future net margins and eventual earnings growth.

- Current optimism around increasing global EV adoption and government incentives may be inflating expectations for robust, sustained demand for solid-state batteries, but lingering supply chain volatility or delays in regulatory clarity could result in cost overruns or production setbacks, impacting future profitability.

- The company's focus on expanding electrolyte sampling and customer engagement, while promising, highlights ongoing product validation needs and competitive risk; investors may be overestimating Solid Power's ability to secure exclusive or long-term licensing deals, putting future gross margins and stable revenue at risk.

- Heavy dependence on a limited number of key partnerships, notably BMW and SK On, exposes Solid Power to concentration risk-if these partners delay or scale back commitments in response to industry shifts, the anticipated revenue and margin improvements driven by broader electrification trends may not materialize as projected.

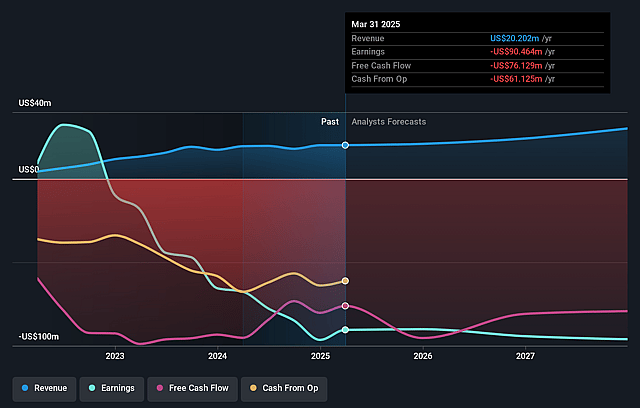

Solid Power Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Solid Power's revenue will grow by 13.5% annually over the next 3 years.

- Analysts are not forecasting that Solid Power will become profitable in next 3 years. To represent the Analyst Price Target as a Future PE Valuation we will estimate Solid Power's profit margin will increase from -412.6% to the average US Auto Components industry of 4.8% in 3 years.

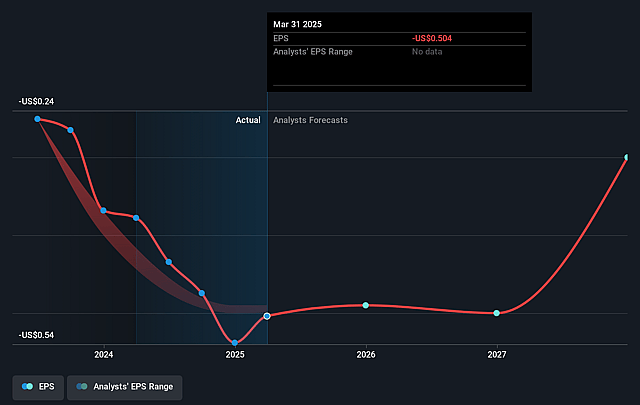

- If Solid Power's profit margin were to converge on the industry average, you could expect earnings to reach $1.6 million (and earnings per share of $0.01) by about September 2028, up from $-93.5 million today.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 362.6x on those 2028 earnings, up from -7.6x today. This future PE is greater than the current PE for the US Auto Components industry at 17.3x.

- Analysts expect the number of shares outstanding to grow by 0.5% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 7.73%, as per the Simply Wall St company report.

Solid Power Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Strategic partnerships and validation with major OEMs like BMW-as seen in the i7 test vehicle powered by Solid Power's cells-signal potential for licensing deals and mass adoption, which could accelerate top-line revenue growth and attract further industry partnerships.

- Progress in scaling up proprietary electrolyte manufacturing, supported by Department of Energy funding and a new pilot line expected to reach 75 metric tons capacity, demonstrates increasing production capability, reducing supply chain risk, and potentially improving gross margins through economies of scale.

- Continued customer demand for multiple generations of Solid Power's electrolytes, as evidenced by ongoing sampling to both existing and new strategic customers, indicates broadening market acceptance, increasing the likelihood of recurring revenues and long-term contract wins.

- Solid Power's strong balance sheet with $279.8 million in liquidity, low current liabilities, and the ability to undertake share repurchases, positions it to weather high R&D and scaling expenses without near-term dilution or solvency risks, supporting potential earnings and shareholder value over time.

- Advancements in solid-state battery technology and infrastructure investment (such as pilot lines and automatic process improvements) enhance the company's barriers to entry and position Solid Power to capture value from the secular shift to EVs and electrified commercial fleets, which could boost EBITDA and net margins in the long term.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $2.5 for Solid Power based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $4.0, and the most bearish reporting a price target of just $1.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be $33.2 million, earnings will come to $1.6 million, and it would be trading on a PE ratio of 362.6x, assuming you use a discount rate of 7.7%.

- Given the current share price of $3.93, the analyst price target of $2.5 is 57.2% lower. Despite analysts expecting the underlying buisness to improve, they seem to believe the market's expectations are too high.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.