Key Takeaways

- Difficulty transitioning to commercial-scale production, reliance on a few partners, and persistent losses threaten Solid Power's revenue growth and financial stability.

- Macroeconomic risks, supply chain pressures, and high R&D costs hinder margin expansion and may necessitate further shareholder dilution.

- Strategic OEM partnerships, manufacturing scale-up, broadened customer engagement, and disciplined financial management could drive growth, margin expansion, and reduced earnings volatility over time.

Catalysts

About Solid Power- Develops solid-state battery technologies for the electric vehicles (EV) and other markets in the United States.

- Persistent challenges in scaling solid-state battery technology from laboratory phases to mass production, combined with the company's ongoing operating losses of nearly $50 million year-to-date and high capital expenditure requirements, threaten to delay meaningful commercial revenues and could significantly worsen earnings in the foreseeable future.

- Despite anticipated expansions in pilot line capacity and continued development milestones, the risk of slower-than-expected global electric vehicle adoption-driven by macroeconomic headwinds and volatility in energy prices-could sharply limit the growth of Solid Power's top-line revenue as addressable market demand fails to materialize at expected rates.

- Geopolitical tensions and increasing competition for critical battery raw materials create substantial supply chain risk and potential cost inflation for Solid Power, making future margin expansion highly uncertain and possibly resulting in further operating loss deterioration.

- The company's narrow customer concentration, highlighted by the reliance on a small group of automotive partners for both validation and potential scale-up, exposes future cash flows to volatility if any partnership stalls or dissolves, which could negatively affect both revenue stability and forward earnings visibility.

- Escalating research and development expenditures-already exceeding $33 million in the quarter-without clear near-term monetization underscores the threat of further operating losses and the likelihood of needing additional dilutive capital raises, directly impacting future earnings per share and shareholder value.

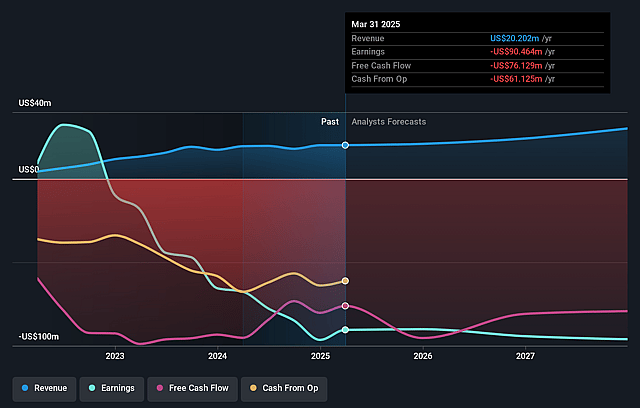

Solid Power Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more pessimistic perspective on Solid Power compared to the consensus, based on a Fair Value that aligns with the bearish cohort of analysts.

- The bearish analysts are assuming Solid Power's revenue will grow by 17.1% annually over the next 3 years.

- The bearish analysts are not forecasting that Solid Power will become profitable in next 3 years. To represent the Analyst Price Target as a Future PE Valuation we will estimate Solid Power's profit margin will increase from -412.6% to the average US Auto Components industry of 4.8% in 3 years.

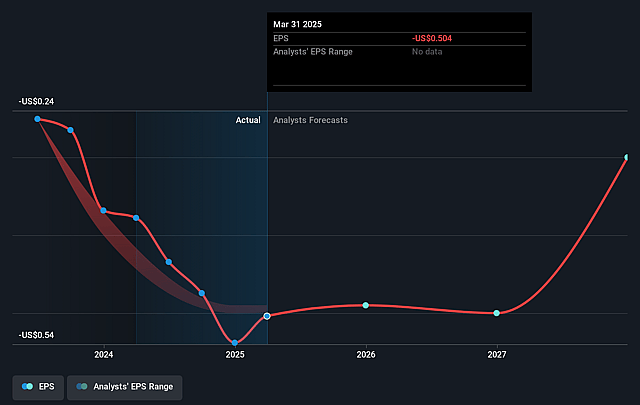

- If Solid Power's profit margin were to converge on the industry average, you could expect earnings to reach $1.7 million (and earnings per share of $0.01) by about September 2028, up from $-93.5 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bearish analyst cohort, the company would need to trade at a PE ratio of 132.1x on those 2028 earnings, up from -7.6x today. This future PE is greater than the current PE for the US Auto Components industry at 17.3x.

- Analysts expect the number of shares outstanding to grow by 0.5% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 7.73%, as per the Simply Wall St company report.

Solid Power Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Solid Power's ongoing partnerships with major automotive OEMs such as BMW, demonstrated by the introduction of a BMW i7 test vehicle powered by its solid-state batteries, suggest that if these relationships convert into multi-year supply agreements, long-term revenue growth could accelerate as EV adoption increases.

- The successful ramp-up and commissioning of the continuous electrolyte production pilot line, supported by both customer engagement and Department of Energy funding, could improve manufacturing scale and cost efficiencies, ultimately supporting higher gross margins and earnings power over time.

- The active engagement in electrolyte sampling with both existing and new customers indicates broadening market interest and potential for diversification of the customer base, which may drive recurring revenue streams and reduce earnings volatility.

- The strong liquidity position with nearly $280 million in total liquidity and continued investment in strategic infrastructure development, coupled with disciplined financial management, provides significant runway to achieve commercialization milestones, which could lead to margin expansion and improved net income in the medium-to-long term.

- The ability to repurchase shares, as evidenced by $3.6 million in buybacks during the quarter, signals management's confidence in future prospects and supports shareholder value, which could help provide downside support for the share price and benefit earnings per share in the future.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bearish price target for Solid Power is $1.0, which represents the lowest price target estimate amongst analysts. This valuation is based on what can be assumed as the expectations of Solid Power's future earnings growth, profit margins and other risk factors from analysts on the more bearish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $4.0, and the most bearish reporting a price target of just $1.0.

- In order for you to agree with the bearish analysts, you'd need to believe that by 2028, revenues will be $36.4 million, earnings will come to $1.7 million, and it would be trading on a PE ratio of 132.1x, assuming you use a discount rate of 7.7%.

- Given the current share price of $3.93, the bearish analyst price target of $1.0 is 293.0% lower. Despite analysts expecting the underlying buisness to improve, they seem to believe the market's expectations are too high.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

Have other thoughts on Solid Power?

Create your own narrative on this stock, and estimate its Fair Value using our Valuator tool.

Create NarrativeHow well do narratives help inform your perspective?

Disclaimer

AnalystLowTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystLowTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystLowTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.