Key Takeaways

- Partnerships with major automakers and rapid technology progress position Solid Power for accelerated, large-scale supply agreements and outsized revenue growth.

- Strong manufacturing capacity and first-mover advantage enable robust demand capture across automotive and non-automotive markets, supporting margin expansion and diversified high-value revenue.

- Persistent operating losses, high dependency on key automotive partners, commercialization risks, and uncertain technology advantages threaten revenue growth and hinder progress toward profitability.

Catalysts

About Solid Power- Develops solid-state battery technologies for the electric vehicles (EV) and other markets in the United States.

- Analyst consensus views the partnership with BMW and SK On as driving incremental revenue, but the rapid demonstration of a functioning i7 with Solid Power cells signals an imminent inflection point that could accelerate full-scale, multi-year supply agreements with leading automakers, offering potential for step-change revenue growth well beyond current expectations.

- While analyst consensus sees the continuous electrolyte manufacturing pilot line as enhancing production and margins, Solid Power's capacity to deliver 75 metric tons annually could position it as one of the few U.S.-based suppliers able to meet automaker and renewable energy OEM demand at scale, supporting not just margin expansion but also outsized revenue capture from first-mover advantage.

- Tightening global emissions standards and regulatory momentum for domestic battery supply are likely to pull forward demand for Solid Power's advanced battery components, creating the conditions for exponential order growth and a premium pricing environment, thereby driving sustained margin improvement and robust earnings growth.

- Solid Power's strong cash position and demonstrated capital discipline, combined with buybacks at distressed valuation levels, may result in significant earnings per share accretion once operating leverage turns positive, positioning the company for outsized returns as commercialization ramps.

- The accelerating demand for solid-state battery solutions in non-automotive markets, such as grid modernization, commercial fleets, and emerging electric aviation, provides Solid Power a multi-billion-dollar expansion opportunity beyond light vehicles, laying the foundation for diversified, long-term high-margin revenue streams.

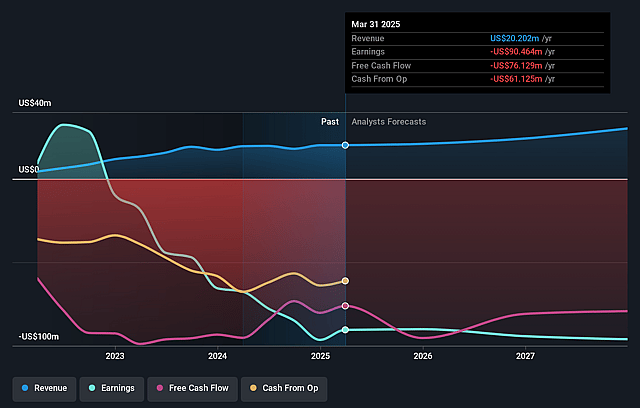

Solid Power Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more optimistic perspective on Solid Power compared to the consensus, based on a Fair Value that aligns with the bullish cohort of analysts.

- The bullish analysts are assuming Solid Power's revenue will grow by 17.4% annually over the next 3 years.

- Even the bullish analysts are not forecasting that Solid Power will become profitable in next 3 years. To represent the Analyst Price Target as a Future PE Valuation we will estimate Solid Power's profit margin will increase from -412.6% to the average US Auto Components industry of 4.8% in 3 years.

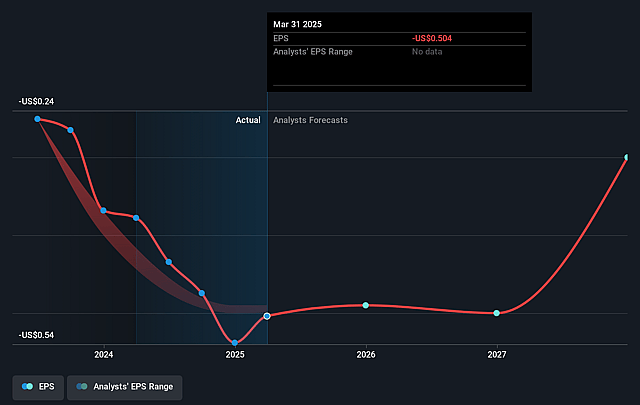

- If Solid Power's profit margin were to converge on the industry average, you could expect earnings to reach $1.8 million (and earnings per share of $0.01) by about September 2028, up from $-93.5 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bullish analyst cohort, the company would need to trade at a PE ratio of 525.3x on those 2028 earnings, up from -7.3x today. This future PE is greater than the current PE for the US Auto Components industry at 17.7x.

- Analysts expect the number of shares outstanding to grow by 0.5% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 7.76%, as per the Simply Wall St company report.

Solid Power Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Solid Power's operating expenses continue to significantly outpace its revenues, with a year-to-date operating loss of nearly fifty million dollars while generating only thirteen point five million dollars in revenue, putting persistent downward pressure on earnings per share and raising the risk of further dilution or capital raises if losses persist.

- The company's commercial progress heavily relies on milestone achievements with a small set of automotive partners, such as BMW and SK On, which exposes future revenues to substantial risk should these relationships weaken or if contract milestones face unforeseen delays.

- Solid Power remains at an early stage of product commercialization, as evidenced by its focus on pilot production capacity and customer sampling, making it vulnerable to both slower-than-expected electric vehicle adoption and intense competition from other battery technology firms, which may prevent significant top-line revenue growth.

- Ongoing heavy investments in capital expenditures and high research and development spending may further erode net margins, particularly if technical challenges in scaling up sulfide electrolyte production or integrating with customer manufacturing lines delay the company's path to profitability.

- There is ongoing uncertainty regarding the ability of Solid Power's proprietary technology to outperform traditional lithium-ion solutions or competing solid-state battery technologies, which, if not resolved, could limit customer uptake and result in lower-than-anticipated future revenues and market share.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bullish price target for Solid Power is $4.0, which is the highest price target estimate amongst analysts. This valuation is based on what can be assumed as the expectations of Solid Power's future earnings growth, profit margins and other risk factors from analysts on the bullish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $4.0, and the most bearish reporting a price target of just $1.0.

- In order for you to agree with the bullish analysts, you'd need to believe that by 2028, revenues will be $36.7 million, earnings will come to $1.8 million, and it would be trading on a PE ratio of 525.3x, assuming you use a discount rate of 7.8%.

- Given the current share price of $3.78, the bullish analyst price target of $4.0 is 5.5% higher. The relatively low difference between the current share price and the analyst consensus price target indicates that they believe on average, the company is fairly priced.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystHighTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystHighTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystHighTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.