- United States

- /

- Auto Components

- /

- NasdaqGS:SLDP

Solid Power (SLDP) Valuation Revisited After Director Share Sale and Severance Plan Changes

Reviewed by Simply Wall St

Solid Power (SLDP) is back in focus after director Erik Anderson sold 30,000 shares and the company adjusted its Executive Change in Control and Severance Plan, raising fresh questions about leadership incentives and governance.

See our latest analysis for Solid Power.

Those governance tweaks are landing after a sharp run, with the share price at 5.12 and a year to date share price return of 147.34 percent. However, the recent 30 day share price return of negative 27.89 percent suggests momentum is cooling, even as the 1 year total shareholder return of 357.14 percent keeps longer term holders comfortably in the green.

If this mix of high potential and volatility has your attention, it could be a good moment to look beyond SLDP and explore auto manufacturers as other electric vehicle related ideas.

With revenue still small, losses heavy, and the share price well below analyst targets after a huge run, is Solid Power now trading at a discount to its solid state potential, or is the market already pricing in tomorrow’s growth?

Most Popular Narrative: 26.9% Undervalued

With the narrative fair value sitting at 7.0 against a last close of 5.12, the story leans toward meaningful upside if its assumptions land.

The analysts are assuming Solid Power's revenue will grow by 13.5% annually over the next 3 years.

Analysts are not forecasting that Solid Power will become profitable in next 3 years. To represent the Analyst Price Target as a Future PE Valuation we will estimate Solid Power's profit margin will increase from -412.6% to the average US Auto Components industry of 4.8% in 3 years.

Curious how a loss making battery developer can still command a premium valuation narrative, driven by aggressive growth, margin recovery, and a towering future earnings multiple?

Result: Fair Value of $7 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, major OEM partnerships, scalable electrolyte production, and strong liquidity could accelerate adoption and margins more quickly than expected, challenging this undervaluation narrative.

Find out about the key risks to this Solid Power narrative.

Another View: Rich Multiples Challenge the Undervaluation Story

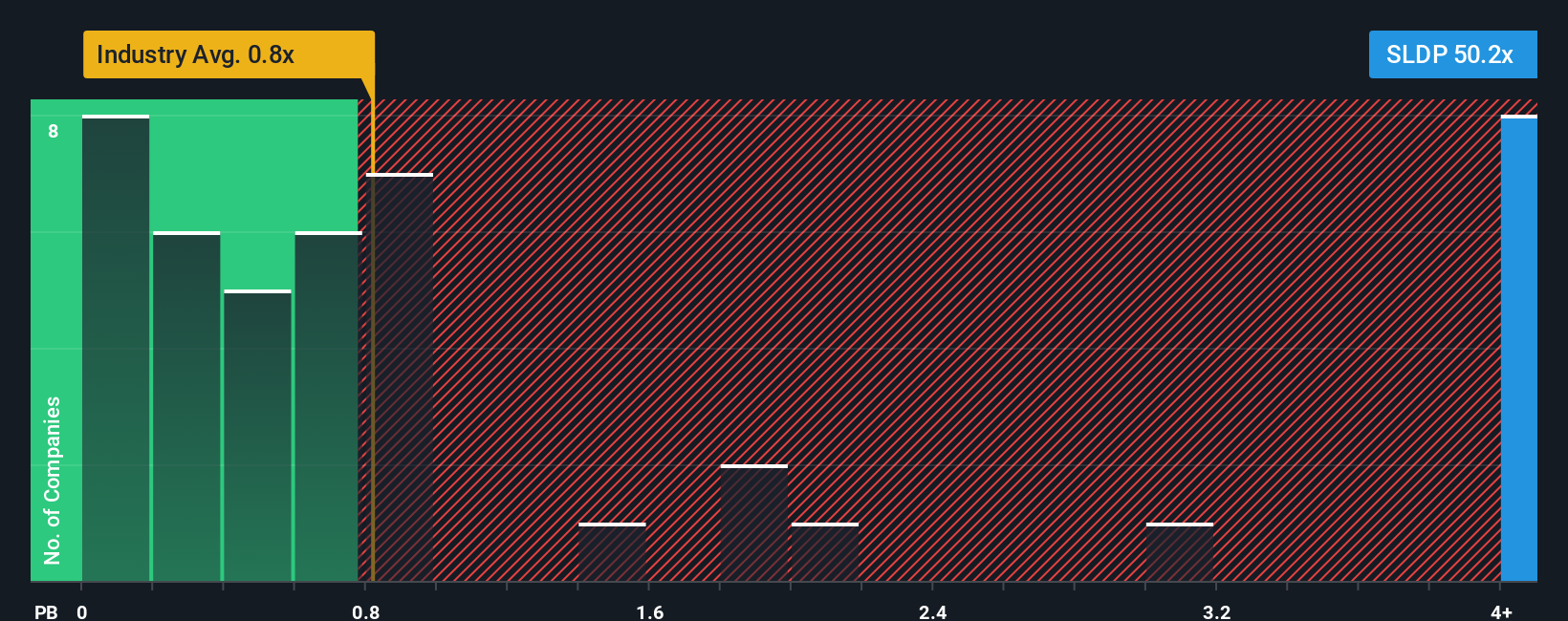

While the narrative fair value points to upside, the market is already paying a steep price for Solid Power’s sales, with a price to sales ratio of 49.4 times versus about 0.8 times for the US Auto Components industry and 1.3 times for peers, far above a fair ratio of 1.9 times that the market could move toward. That gap suggests meaningful downside risk if enthusiasm cools, even if the long term story plays out.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Solid Power Narrative

If these perspectives do not quite match your own view, take a closer look at the numbers yourself and craft a personalized narrative in just minutes, Do it your way.

A great starting point for your Solid Power research is our analysis highlighting 1 key reward and 2 important warning signs that could impact your investment decision.

Ready for your next investing edge?

Do not stop at one compelling story. Use the Simply Wall Street Screener to uncover fresh stock ideas that match your strategy before other investors catch on.

- Capture potential upside by targeting companies trading below their estimated cash flow value through these 907 undervalued stocks based on cash flows before sentiment fully shifts.

- Position yourself where innovation meets growth by following advances in automation, machine learning, and data infrastructure with these 26 AI penny stocks.

- Seek reliable income streams while markets swing by scanning for stable payers using these 12 dividend stocks with yields > 3% that offer yields above 3 percent.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:SLDP

Solid Power

Develops solid-state battery technologies for the electric vehicles (EV) and other markets in the United States.

Flawless balance sheet with limited growth.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Unicycive Therapeutics (Nasdaq: UNCY) – Preparing for a Second Shot at Bringing a New Kidney Treatment to Market (TEST)

Rocket Lab USA Will Ignite a 30% Revenue Growth Journey

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Trending Discussion