- United States

- /

- Auto

- /

- NasdaqGS:RIVN

The Price Is Right For Rivian Automotive, Inc. (NASDAQ:RIVN) Even After Diving 26%

The Rivian Automotive, Inc. (NASDAQ:RIVN) share price has fared very poorly over the last month, falling by a substantial 26%. The recent drop completes a disastrous twelve months for shareholders, who are sitting on a 52% loss during that time.

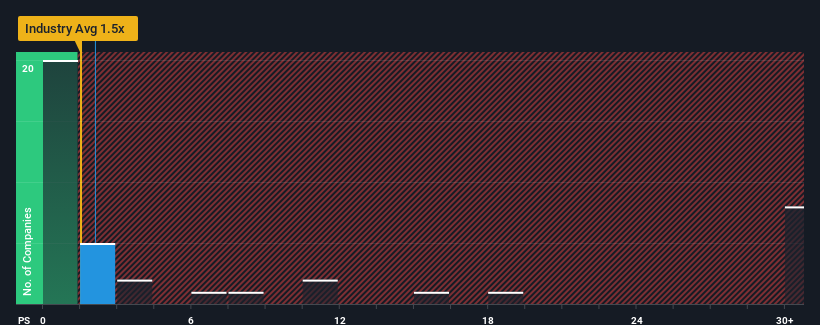

Although its price has dipped substantially, given close to half the companies operating in the United States' Auto industry have price-to-sales ratios (or "P/S") below 1.5x, you may still consider Rivian Automotive as a stock to potentially avoid with its 2.1x P/S ratio. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the elevated P/S.

Check out our latest analysis for Rivian Automotive

What Does Rivian Automotive's Recent Performance Look Like?

Rivian Automotive certainly has been doing a good job lately as it's been growing revenue more than most other companies. The P/S is probably high because investors think this strong revenue performance will continue. However, if this isn't the case, investors might get caught out paying too much for the stock.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Rivian Automotive.How Is Rivian Automotive's Revenue Growth Trending?

There's an inherent assumption that a company should outperform the industry for P/S ratios like Rivian Automotive's to be considered reasonable.

Taking a look back first, we see that the company grew revenue by an impressive 68% last year. Still, revenue has barely risen at all from three years ago in total, which is not ideal. So it appears to us that the company has had a mixed result in terms of growing revenue over that time.

Shifting to the future, estimates from the analysts covering the company suggest revenue should grow by 37% per year over the next three years. Meanwhile, the rest of the industry is forecast to only expand by 16% each year, which is noticeably less attractive.

With this information, we can see why Rivian Automotive is trading at such a high P/S compared to the industry. Apparently shareholders aren't keen to offload something that is potentially eyeing a more prosperous future.

The Bottom Line On Rivian Automotive's P/S

Rivian Automotive's P/S remain high even after its stock plunged. It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

Our look into Rivian Automotive shows that its P/S ratio remains high on the merit of its strong future revenues. It appears that shareholders are confident in the company's future revenues, which is propping up the P/S. Unless the analysts have really missed the mark, these strong revenue forecasts should keep the share price buoyant.

Before you settle on your opinion, we've discovered 2 warning signs for Rivian Automotive that you should be aware of.

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGS:RIVN

Rivian Automotive

Designs, develops, manufactures, and sells electric vehicles and accessories.

Excellent balance sheet with limited growth.

Similar Companies

Market Insights

Community Narratives