- United States

- /

- Auto

- /

- NasdaqGS:RIVN

Rivian (RIVN): Assessing Valuation Following Volkswagen Partnership, Cost Cuts, and R2 SUV Expansion Plans

Reviewed by Simply Wall St

If you’ve been tracking Rivian Automotive (RIVN) lately, chances are your radar went off after a string of new developments. The company just made headlines for its deepening collaboration with Volkswagen, a renewed focus on lowering production costs, and the impending rollout of its more affordable R2 SUV. These decisions come at a moment when Rivian’s leadership is signaling a concerted push towards profitability and appealing to a wider base of EV buyers. This message is set to get even more attention as the team heads into a major industry conference this week.

Investors paying close attention will have noticed that sentiment around the stock has shifted in recent months. While Rivian’s share price climbed about 18% over the past month, it is still only up 5% over the past year and continues to face questions about long-term staying power, given last year’s volatility and an ongoing battle to achieve financial stability. Recent moves, such as expanding production capacity and cost controls, appear to be rebuilding momentum, especially as operational improvements and a broadened lineup take shape for 2026 and beyond.

With the pieces moving into place for Rivian’s next act, it is a fair time to ask whether this is a genuine buying opportunity or if the market is already accounting for all this future growth.

Most Popular Narrative: Fairly Valued

The most popular valuation narrative sees Rivian Automotive as essentially fairly valued, with the current share price closely matching the consensus price target.

Vertical integration in technology, especially in autonomy, battery, and software, combined with growing software and services revenue (including licensing via partnerships like with Volkswagen) is expected to open new high-margin revenue streams and diversify earnings. This may potentially strengthen EBITDA and net margins over time.

Want to know what could send Rivian’s valuation soaring or crashing? The analyst narrative teases huge revenue acceleration, industry-defying profit assumptions, and a future earnings multiple rarely seen for automakers. Uncover the foundational forecast that’s shaping how Wall Street measures this EV contender. One surprising mathematical leap stands behind everything you see in today’s price.

Result: Fair Value of $13.94 (ABOUT RIGHT)

Have a read of the narrative in full and understand what's behind the forecasts.However, sustained policy changes or a further loss of regulatory credits could quickly undermine Rivian’s path to profitability and alter the current valuation outlook.

Find out about the key risks to this Rivian Automotive narrative.Another View: Industry Metrics Raise Doubts

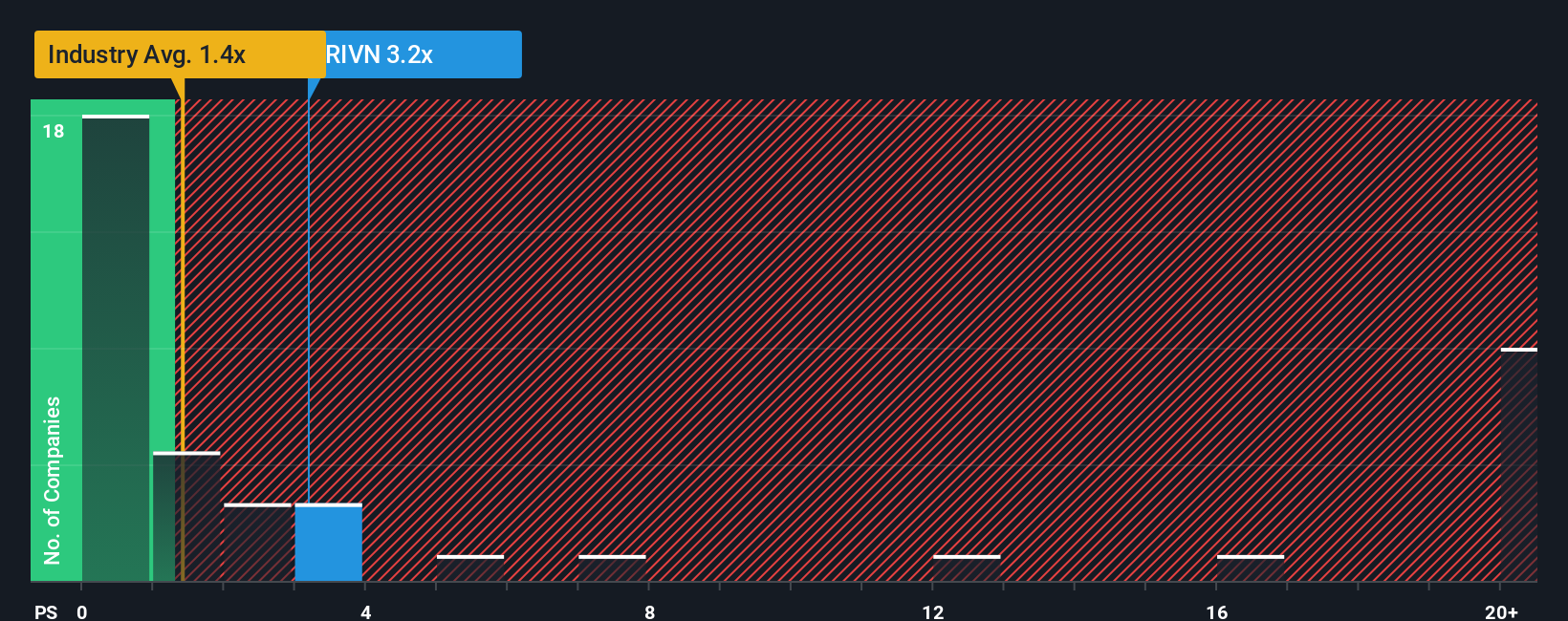

Our industry-based comparison paints a less optimistic picture, suggesting Rivian looks expensive relative to other automakers. That challenges the “fair value” verdict from the analyst consensus. Which method should investors trust?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Rivian Automotive Narrative

If you’re looking for more than analyst opinions or want to put the data to the test yourself, it only takes a few minutes to draft your own perspective. Do it your way.

A great starting point for your Rivian Automotive research is our analysis highlighting 1 key reward and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

You want an edge in today’s market, so don’t just stop here. Check out these smarter stock ideas that investors are already acting on.

- Access real growth potential by targeting companies with strong financials behind low-priced shares using our penny stocks with strong financials.

- Unlock opportunities in the fast-evolving world of artificial intelligence by scanning our collection of AI penny stocks leading the future of smart technology.

- Maximize value by focusing on shares the market may be overlooking with our handpicked selection of undervalued stocks based on cash flows.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:RIVN

Rivian Automotive

Designs, develops, manufactures, and sells electric vehicles and accessories.

Excellent balance sheet with limited growth.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Watch Pulse Seismic Outperform with 13.6% Revenue Growth in the Coming Years

Significantly undervalued gold explorer in Timmins, finally getting traction

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026