- United States

- /

- Auto

- /

- NasdaqGS:RIVN

Rivian (RIVN): Assessing Valuation After Recent Share Price Pullback and Growth Outlook

Reviewed by Kshitija Bhandaru

Rivian Automotive (RIVN) stock has seen some ups and downs lately, prompting investors to reassess its outlook. Over the past month, shares dipped about 2%, even as annual revenue continues to grow.

See our latest analysis for Rivian Automotive.

After surging earlier in the year, Rivian’s share price has cooled a little, yet longer-term investors have still seen a positive 1-year total shareholder return of 26%. Recent headlines around production targets and evolving EV demand have kept sentiment shifting, and the current mood suggests investors are weighing growth hopes against industry risks.

If you’re interested in what’s happening with other electric vehicle makers, now is a perfect time to explore the full lineup of major players across the sector. See the full list for free.

Given Rivian's mixed performance and modest discount to analyst price targets, the key question investors face now is whether the recent dip represents a genuine buying opportunity or if the future growth story is already fully reflected in the current price.

Most Popular Narrative: 3.7% Undervalued

Rivian's most widely followed narrative points to a fair value just above the latest close, suggesting the market is nearly in line with those expectations. However, forecasts of aggressive revenue growth and future profitability are at the heart of how this valuation is justified.

The launch of the R2 platform represents a step-change improvement in Rivian's cost structure. Management has secured supplier contracts and component sourcing that reduce bill of materials by nearly 50% compared to R1, significantly lowering per-unit costs. This operational overhaul is expected to improve gross margins and the path to profitability as scale is achieved.

Curious what fuels the bulls? There is a bold expectation of rapid revenue gains, major cost cuts, and a future profit equation that rivals established industry giants. Uncover the projections and ambitious numbers that drive this high-stakes fair value.

Result: Fair Value of $14.04 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, potential setbacks such as regulatory changes to EV incentives or sustained high cash burn could quickly shift analyst sentiment and affect Rivian’s outlook.

Find out about the key risks to this Rivian Automotive narrative.

Another View: Valuation by Sales Multiples

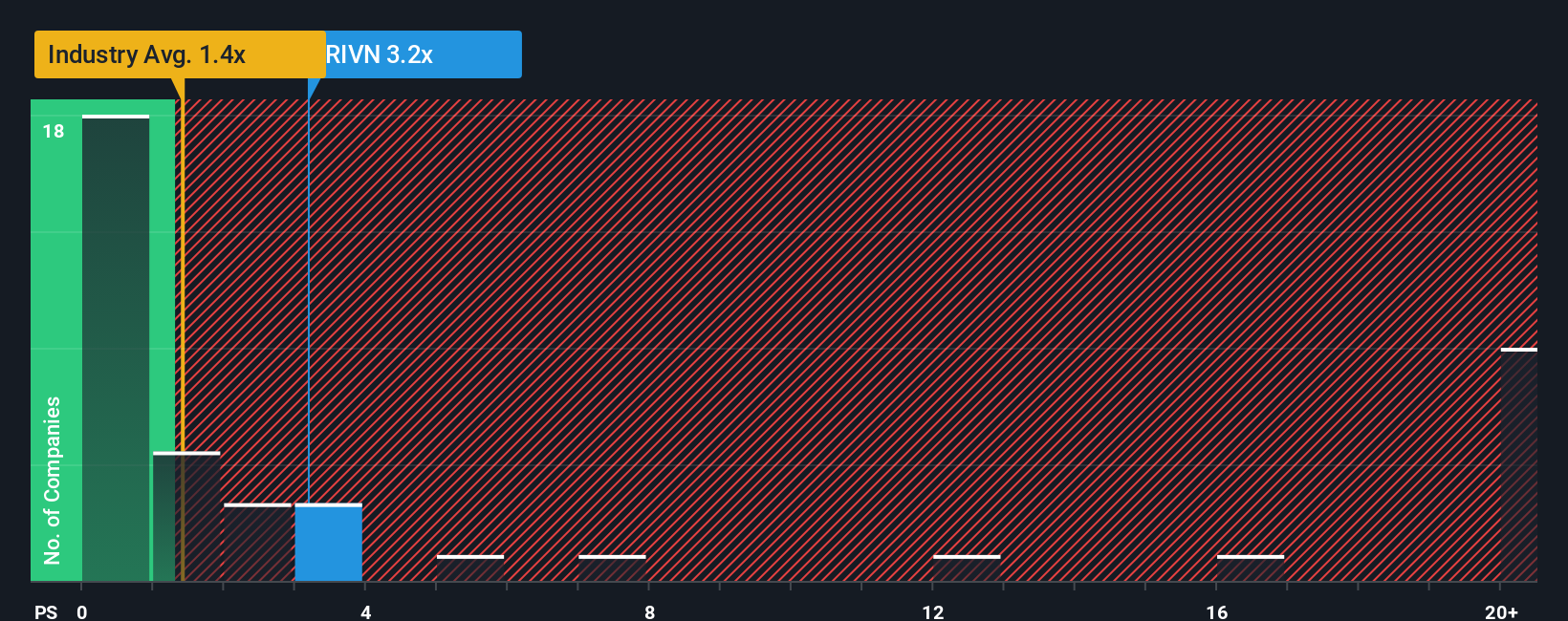

Looking from a different angle, Rivian trades at a price-to-sales ratio of 3.2x, which is noticeably higher than both the US auto industry average (1.4x) and the peer average (1.7x). This steeper ratio signals the market expects a lot of future growth, but it also exposes investors to risk if results do not materialize. Could this premium be justified, or is the stock priced on hope?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Rivian Automotive Narrative

If you see it differently or want to dig into the numbers yourself, you can easily develop a personal take on Rivian’s outlook in just minutes. Do it your way

A great starting point for your Rivian Automotive research is our analysis highlighting 1 key reward and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

If you want to move ahead of the crowd, Simply Wall Street’s tools make it easy to pinpoint tomorrow’s opportunities, tailored to your curiosity and goals.

- Uncover income opportunities and get ahead of market trends by targeting these 19 dividend stocks with yields > 3% that offer excellent yields and consistent returns in today’s uncertain climate.

- Tap into disruptive tech by searching for these 23 AI penny stocks at the forefront of artificial intelligence breakthroughs and industry-changing innovation.

- Capitalize on market mispricings by spotting these 916 undervalued stocks based on cash flows before they are recognized by everyone else, giving you an edge on value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:RIVN

Rivian Automotive

Designs, develops, manufactures, and sells electric vehicles and accessories.

Excellent balance sheet with limited growth.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Constellation Energy Dividends and Growth

CoreWeave's Revenue Expected to Rocket 77.88% in 5-Year Forecast

Bisalloy Steel Group will shine with a projected profit margin increase of 12.8%

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026