- United States

- /

- Auto

- /

- NasdaqGS:RIVN

Rivian Automotive (RIVN) Is Up 5.1% After Announcing Atlanta HQ and Quebec Service Center Expansion

Reviewed by Simply Wall St

- Rivian Automotive recently unveiled plans for a new East Coast headquarters in Atlanta set to open in late 2025, while also beginning construction on a permanent service center in Quebec to expand its North American footprint and support the upcoming launch of its R2 model.

- These initiatives illustrate Rivian's emphasis on regional growth, strengthened operational capabilities, and technological innovation, particularly with the rollout of a Google-powered navigation system and progress toward advanced EV features.

- We'll examine how Rivian's expansion into Atlanta and Quebec could influence its investment outlook and operational trajectory.

Rivian Automotive Investment Narrative Recap

To own Rivian, you need conviction in the company’s ability to scale production profitably and capture a larger share of the electric vehicle market, especially as it approaches the anticipated R2 launch. The Atlanta headquarters and Quebec service center reflect important execution steps, but do not fundamentally change the near-term catalyst of R2’s successful market launch or the persistent risk around battery tariffs and supply chain costs. Among the recent updates, the expansion of Rivian’s manufacturing and operational footprint, including the East Coast headquarters and new Quebec service center, affirms a commitment to operational growth supporting the R2 platform’s launch. For those watching closely, these milestones aim to address capacity and service needs, but the key variable remains how well Rivian adapts to evolving cost pressures and regulatory challenges. However, investors should also be alert to the additional uncertainty around battery tariffs, which could impact margins as...

Read the full narrative on Rivian Automotive (it's free!)

Rivian Automotive's outlook anticipates $12.0 billion in revenue and $645.2 million in earnings by 2028. Achieving these figures would require 34.2% annual revenue growth and an earnings increase of approximately $5.3 billion from current earnings of -$4.7 billion.

Exploring Other Perspectives

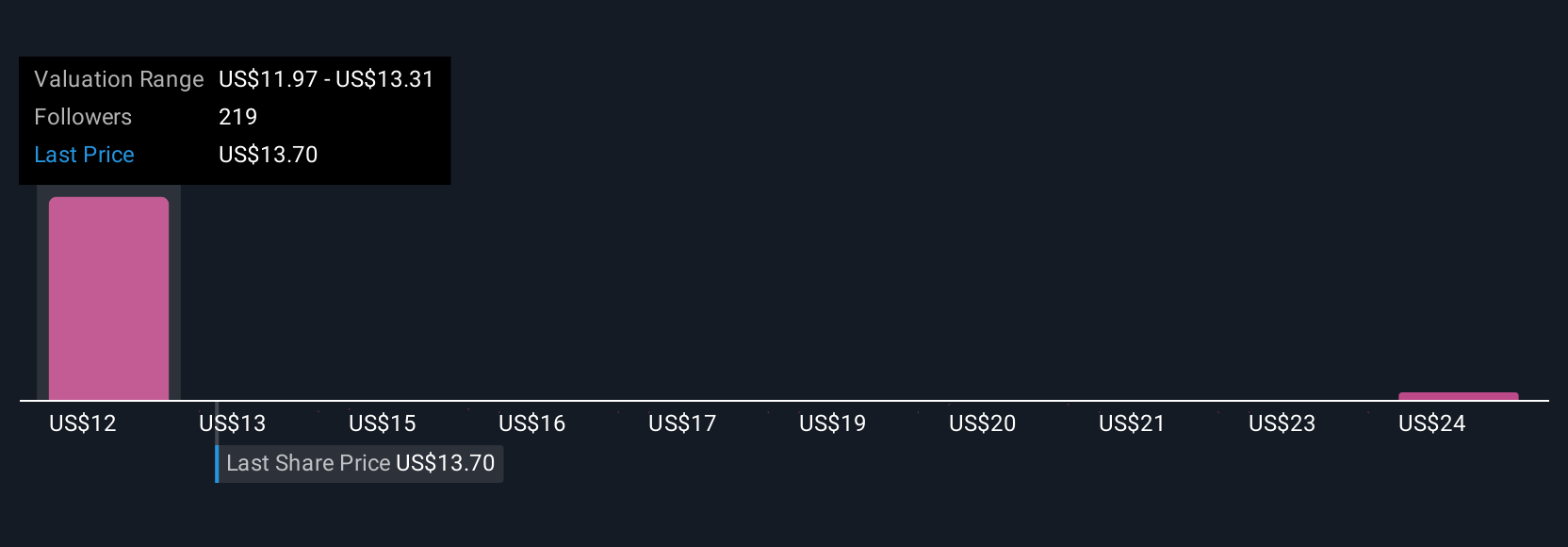

Simply Wall St Community members contributed 11 fair value estimates for Rivian, spanning a wide range from US$11.97 to US$25.41 per share. Despite such varied outlooks, ongoing tariff uncertainty remains a central concern that could shape the company’s costs and future earnings, reminding you to consider multiple viewpoints on Rivian’s outlook.

Build Your Own Rivian Automotive Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Rivian Automotive research is our analysis highlighting 1 key reward and 2 important warning signs that could impact your investment decision.

- Our free Rivian Automotive research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Rivian Automotive's overall financial health at a glance.

Want Some Alternatives?

Early movers are already taking notice. See the stocks they're targeting before they've flown the coop:

- We've found 17 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- AI is about to change healthcare. These 26 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:RIVN

Rivian Automotive

Designs, develops, manufactures, and sells electric vehicles and accessories.

Excellent balance sheet with limited growth.

Similar Companies

Market Insights

Community Narratives