- United States

- /

- Auto

- /

- NasdaqGM:PSNY

Polestar (NasdaqGM:PSNY) Valuation in Focus After Strong Sales Growth Spurs Positive Investor Sentiment

Reviewed by Kshitija Bhandaru

Polestar Automotive Holding UK (NasdaqGM:PSNY) just announced retail sales figures for the third quarter and first nine months of 2025, showing a 13% rise over last year’s quarter and 36% growth year to date.

See our latest analysis for Polestar Automotive Holding UK.

After Polestar revealed robust sales growth this quarter, investors sent the stock up 1.05% over the past day. However, the one-year total shareholder return still sits at -33.98%. There is momentum in the latest numbers, but long-term performance remains challenged as the company works to turn the corner.

If Polestar’s sales boost has you thinking about what else is out there, now is a perfect time to discover See the full list for free.

With sales surging but shares still down sharply over the past year, investors are left to wonder if Polestar is trading at a bargain or if the market has already factored in all the good news.

Most Popular Narrative: 11.5% Undervalued

With Polestar’s fair value estimate set at $1.00, shares are currently trading below this benchmark at $0.88. The stage is set for potential upside if narrative projections play out.

The anticipated continuation of high tariffs, mounting pricing pressure, and ongoing regulatory changes in major markets, notably the US, combined with a shift towards lower-priced EV segments in Europe, threaten to compress Polestar's average selling prices and gross margins, reducing future profitability.

Want a glimpse of the forecasts justifying this price target? The story hinges on breakneck sales expansion, ambitious profit margin improvements, and an earnings surge few would predict. The narrative’s math is anything but ordinary. See what’s driving this bold valuation call.

Result: Fair Value of $1.00 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent cash burn and mounting competition could quickly undermine Polestar’s turnaround, particularly if profitability remains elusive or if market share erodes further.

Find out about the key risks to this Polestar Automotive Holding UK narrative.

Another View: What Do Sales Ratios Suggest?

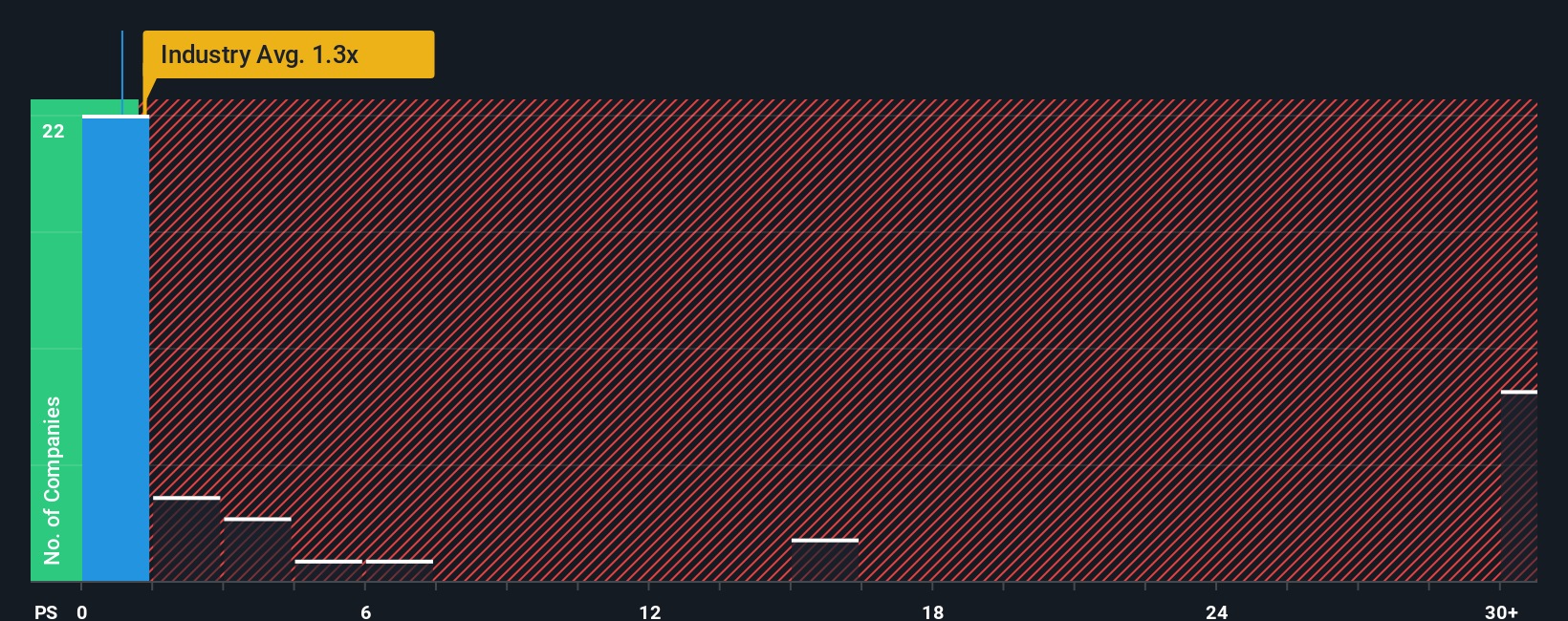

Looking at Polestar’s current price-to-sales ratio of 0.8x, it is sharply lower than the US Auto industry average of 1.3x and its peer group at 2.4x. However, it remains double its own fair ratio of 0.4x. While that sounds relatively inexpensive, it highlights real valuation risk if revenue growth does not accelerate as anticipated. Is the market being cautious, or underestimating what is next?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Polestar Automotive Holding UK Narrative

You can dive into the numbers and shape your own view of Polestar’s story in just a few minutes. Create your own take on the data Do it your way

A great starting point for your Polestar Automotive Holding UK research is our analysis highlighting 1 key reward and 3 important warning signs that could impact your investment decision.

Looking for More Smart Investment Ideas?

Step up your investing game and catch unique opportunities the market is revealing. Don’t let the next big winner slip away. Set your sights on what’s trending now.

- Tap into tomorrow’s financial leaders by checking out these 3575 penny stocks with strong financials, where resilient companies with strong fundamentals are making waves despite their smaller size.

- Capitalize on the rapid rise of artificial intelligence. Browse these 25 AI penny stocks and be among the first to spot game-changers transforming entire industries.

- Fuel your income strategy by seeking out these 18 dividend stocks with yields > 3%, ideal for investors wanting reliable yields above 3% to strengthen their portfolios.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGM:PSNY

Polestar Automotive Holding UK

Engages in the research and development, marketing, commercialization, and sale of battery electric vehicles and related technology solutions.

Low risk and slightly overvalued.

Similar Companies

Market Insights

Community Narratives