- United States

- /

- Auto

- /

- NasdaqGS:LOT

Lotus Technology Inc. (NASDAQ:LOT) Consensus Forecasts Have Become A Little Darker Since Its Latest Report

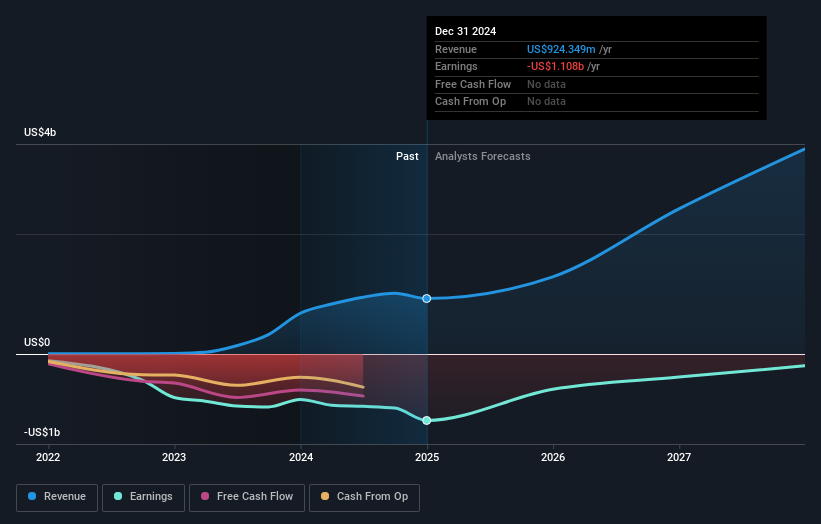

As you might know, Lotus Technology Inc. (NASDAQ:LOT) last week released its latest annual, and things did not turn out so great for shareholders. Revenues missed expectations somewhat, coming in at US$924m, but statutory earnings fell catastrophically short, with a loss of US$1.72 some 46% larger than what the analyst had predicted. The analyst typically update their forecasts at each earnings report, and we can judge from their estimates whether their view of the company has changed or if there are any new concerns to be aware of. With this in mind, we've gathered the latest statutory forecasts to see what the analyst is expecting for next year.

Our free stock report includes 3 warning signs investors should be aware of before investing in Lotus Technology. Read for free now.

Taking into account the latest results, the current consensus from Lotus Technology's one analyst is for revenues of US$1.29b in 2025. This would reflect a sizeable 39% increase on its revenue over the past 12 months. The loss per share is expected to greatly reduce in the near future, narrowing 47% to US$0.87. Before this earnings announcement, the analyst had been modelling revenues of US$1.57b and losses of US$0.62 per share in 2025. So there's been quite a change-up of views after the recent consensus updates, withthe analyst making a serious cut to their revenue outlook while also expecting losses per share to increase.

View our latest analysis for Lotus Technology

The average price target fell 25% to US$3.00, implicitly signalling that lower earnings per share are a leading indicator for Lotus Technology's valuation.

Of course, another way to look at these forecasts is to place them into context against the industry itself. It's pretty clear that there is an expectation that Lotus Technology's revenue growth will slow down substantially, with revenues to the end of 2025 expected to display 39% growth on an annualised basis. This is compared to a historical growth rate of 97% over the past three years. Juxtapose this against the other companies in the industry with analyst coverage, which are forecast to grow their revenues (in aggregate) 16% per year. Even after the forecast slowdown in growth, it seems obvious that Lotus Technology is also expected to grow faster than the wider industry.

The Bottom Line

The most important thing to note is the forecast of increased losses next year, suggesting all may not be well at Lotus Technology. Regrettably, they also downgraded their revenue estimates, but the latest forecasts still imply the business will grow faster than the wider industry. Furthermore, the analyst also cut their price targets, suggesting that the latest news has led to greater pessimism about the intrinsic value of the business.

With that said, the long-term trajectory of the company's earnings is a lot more important than next year. At least one analyst has provided forecasts out to 2027, which can be seen for free on our platform here.

Before you take the next step you should know about the 3 warning signs for Lotus Technology (2 don't sit too well with us!) that we have uncovered.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGS:LOT

Lotus Technology

Engages in the design, development, and sale of battery electric lifestyle vehicles worldwide.

High growth potential with very low risk.

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

The "Molecular Pencil": Why Beam's Technology is Built to Win

ADNOC Gas future shines with a 21.4% revenue surge

Watch Pulse Seismic Outperform with 13.6% Revenue Growth in the Coming Years

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026