- United States

- /

- Auto

- /

- NasdaqGS:LOT

Does Lotus’s Q3 2025 Revenue Drop But Narrower Loss Reshape The Bull Case For LOT?

Reviewed by Sasha Jovanovic

- In November 2025, Lotus Technology Inc. reported third-quarter 2025 results showing revenue of US$137.43 million and a net loss of US$65.42 million, alongside 4,612 vehicle deliveries over the first nine months of the year amid tariffs, destocking, and phased upgraded model launches.

- While revenue fell sharply year on year, the smaller loss per share suggests cost controls are starting to take effect even as delivery volumes remain pressured by external and operational headwinds.

- With revenue down but losses narrowing and deliveries constrained by tariffs and destocking, we’ll now examine how this reshapes Lotus Technology’s investment narrative.

The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

Lotus Technology Investment Narrative Recap

To own Lotus Technology, you need to believe its premium EV strategy and technology roadmap can eventually scale into profitable volume, despite today’s shrinking revenue base and persistent losses. The latest results do not materially change the near term picture: the key catalyst remains executing upcoming model rollouts, while the biggest immediate risk is that ongoing tariffs and weak deliveries keep straining a business that already has limited cash runway and negative equity.

The most relevant update here is the third quarter 2025 earnings release, which shows revenue almost halving year on year but net loss and loss per share narrowing. For me, that combination underlines the tension between Lotus tightening its cost structure and the continued drag from lower volumes, and it puts even more weight on whether new models and the ONE LOTUS integration can translate into healthier revenue without reigniting heavy cash burn.

Yet behind the improving loss per share, there is still a critical funding and profitability risk that investors should be aware of...

Read the full narrative on Lotus Technology (it's free!)

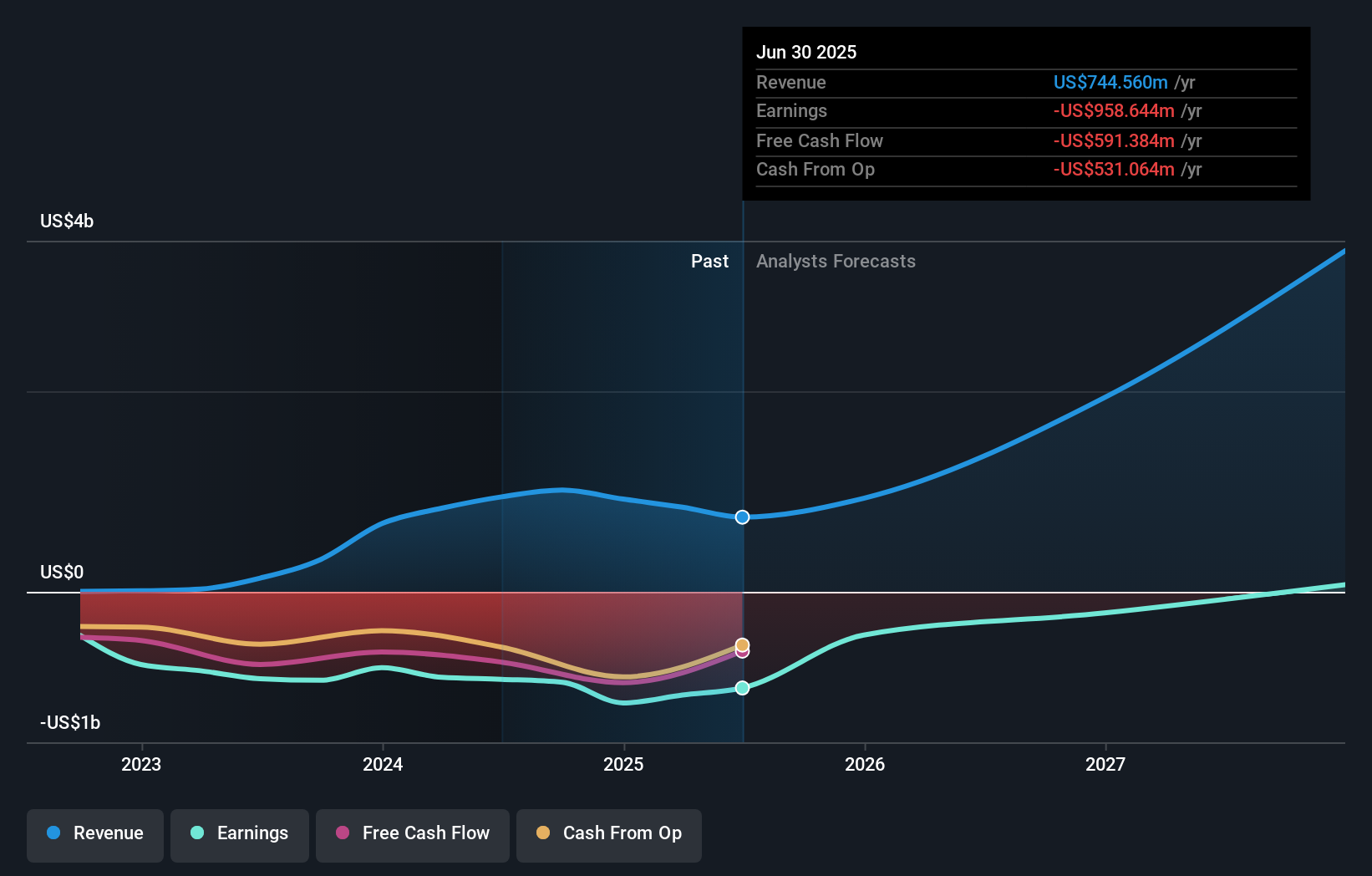

Lotus Technology's narrative projects $4.0 billion revenue and $56.5 million earnings by 2028. This implies an earnings increase from current earnings to reach $56.5 million by that year.

Uncover how Lotus Technology's forecasts yield a $3.00 fair value, a 127% upside to its current price.

Exploring Other Perspectives

One member of the Simply Wall St Community currently pegs Lotus Technology’s fair value at US$3.00 per share. You can set that beside the recent revenue decline and ongoing losses to weigh how execution and funding risks might influence your own expectations for the business.

Explore another fair value estimate on Lotus Technology - why the stock might be worth just $3.00!

Build Your Own Lotus Technology Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Lotus Technology research is our analysis highlighting 1 key reward and 2 important warning signs that could impact your investment decision.

- Our free Lotus Technology research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Lotus Technology's overall financial health at a glance.

Seeking Other Investments?

Markets shift fast. These stocks won't stay hidden for long. Get the list while it matters:

- These 12 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- Outshine the giants: these 25 early-stage AI stocks could fund your retirement.

- This technology could replace computers: discover 27 stocks that are working to make quantum computing a reality.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:LOT

Lotus Technology

Engages in the design, development, and sale of battery electric lifestyle vehicles worldwide.

High growth potential with very low risk.

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

TXT will see revenue grow 26% with a profit margin boost of almost 40%

Significantly undervalued gold explorer in Timmins, finally getting traction

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026