- United States

- /

- Auto

- /

- NasdaqGS:LI

Will Li Auto's (LI) Swift Li i8 Overhaul Shift Its Competitive Narrative in China's EV Market?

Reviewed by Simply Wall St

- Li Auto made rapid changes to its newly launched Li i8 electric SUV in early August 2025, consolidating trims and lowering prices following muted initial demand and heightened public scrutiny, including online criticism and a controversial crash test video.

- This swift product adjustment highlights both the fierce competition in China's electric vehicle sector and Li Auto's efforts to respond quickly to consumer feedback and reputational challenges.

- We will explore how Li Auto’s prompt reconfiguration of the Li i8 lineup could affect the company’s broader investment outlook and growth trajectory.

The latest GPUs need a type of rare earth metal called Dysprosium and there are only 26 companies in the world exploring or producing it. Find the list for free.

Li Auto Investment Narrative Recap

To feel comfortable as a Li Auto shareholder, you need to believe the company can leverage its strength in technology and its growing vehicle lineup to win market share in China’s fiercely competitive electric vehicle market. The recent rapid consolidation and price cuts for the new Li i8 SUV draw attention to both intense near-term competition and the risk of pressure on vehicle pricing, but these actions do not appear to fundamentally alter the company’s most important near-term catalyst: successful launches of new battery electric vehicles. The biggest immediate risk remains erosion of profit margins if price reductions persist or intensify.

The official launch and subsequent adjustment to the Li i8 family SUV, featuring advanced in-house drive systems and supercharging batteries, is central to Li Auto’s goal of expanding its presence in the fast-growing BEV segment. How well the i8 performs in attracting buyers, especially with price-sensitive competition from models like Nio’s Onvo L90, will relate directly to ongoing revenue growth targets this year.

Yet, in contrast to the optimism around new product innovation, investors should also be aware of how pricing challenges could ...

Read the full narrative on Li Auto (it's free!)

Li Auto's outlook forecasts CN¥253.6 billion in revenue and CN¥17.4 billion in earnings by 2028. This implies an annual revenue growth rate of 20.6% and a CN¥9.3 billion increase in earnings from the current CN¥8.1 billion.

Uncover how Li Auto's forecasts yield a $34.11 fair value, a 38% upside to its current price.

Exploring Other Perspectives

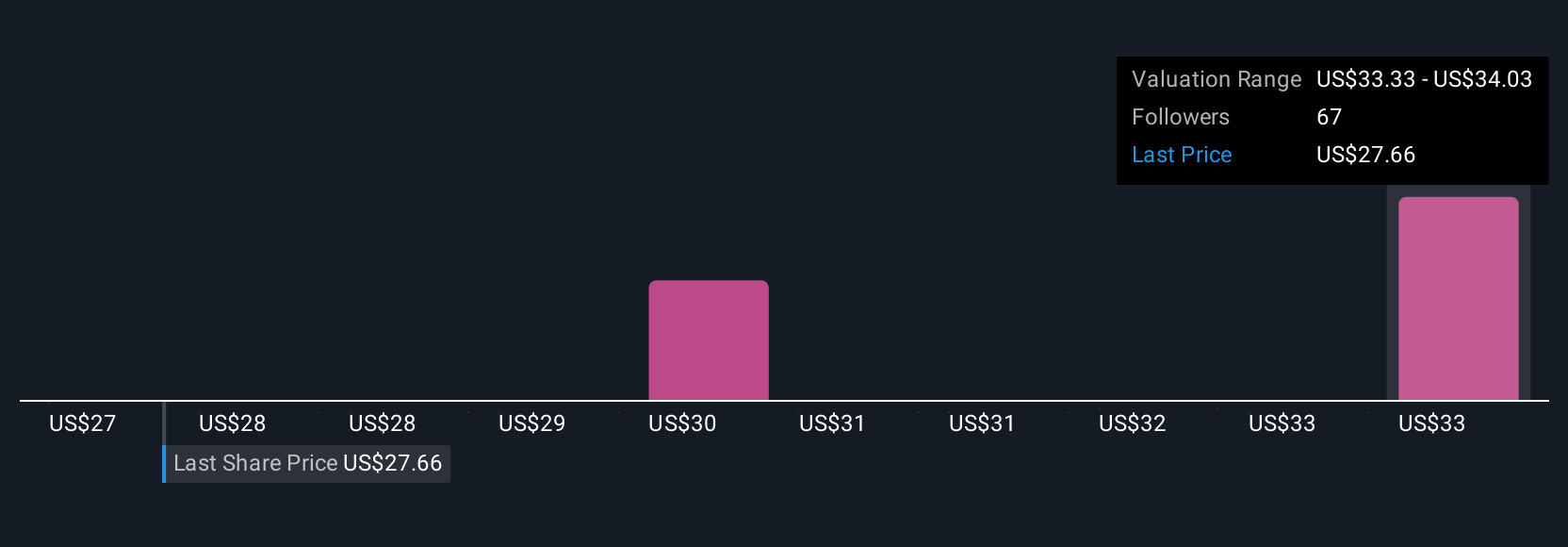

Five fair value estimates from the Simply Wall St Community range between US$26.99 and US$34.11, reflecting a broad spectrum of retail perspectives. With recent vehicle price adjustments pressuring margins, the way Li Auto manages profitability could shape sentiment among these participants, readers can see how opinion varies widely and compare it with new developments themselves.

Explore 5 other fair value estimates on Li Auto - why the stock might be worth just $27.00!

Build Your Own Li Auto Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Li Auto research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Li Auto research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Li Auto's overall financial health at a glance.

Interested In Other Possibilities?

Opportunities like this don't last. These are today's most promising picks. Check them out now:

- We've found 20 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- AI is about to change healthcare. These 24 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- Explore 26 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:LI

Li Auto

Operates in the energy vehicle market in the People’s Republic of China.

Reasonable growth potential with adequate balance sheet.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

SLI is share to watch next 5 years

The "Molecular Pencil": Why Beam's Technology is Built to Win

PRME remains a long shot but publication in the New England Journal of Medicine helps.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026