- United States

- /

- Auto

- /

- NasdaqGS:LI

Reassessing Li Auto (NasdaqGS:LI) Valuation After Weak November Deliveries and Execution Challenges

Reviewed by Simply Wall St

Li Auto (NasdaqGS:LI) just posted November deliveries of 33,181 vehicles, extending its year over year slump and highlighting how margin pressure, higher costs and production hiccups are weighing on sentiment around the stock.

See our latest analysis for Li Auto.

That softer November delivery print sits against a weak backdrop, with a roughly 11.6 percent 1 month share price return and about 24.7 percent year to date share price return both in negative territory. The 1 year total shareholder return of around negative 19.3 percent signals that enthusiasm has been fading as investors reassess execution risk and profitability.

If Li Auto’s recent volatility has you rethinking your exposure to EV makers, it could be worth comparing it with other auto manufacturers to see how they stack up on growth and resilience.

With the shares trading well below both recent highs and analyst targets, the key question now is whether Li Auto’s execution stumbles are already reflected in the price, or whether markets are still underestimating its future growth potential.

Most Popular Narrative: 35.6% Undervalued

With Li Auto closing at $18.10 against a narrative fair value of $28.09, the spread points to a sizable potential upside if forecasts materialise.

The company's ongoing transition from extended-range vehicles (EREVs) to pure battery electric vehicles (BEVs), including successful launches of the Li MEGA and Li i8, and the upcoming Li i6, positions Li Auto to capture expanding market share as Chinese middle class consumers upgrade and EV adoption accelerates, directly supporting long term revenue growth and total addressable market expansion.

To understand how this product pivot, margin uplift, and ambitious earnings trajectory combine into that higher fair value, and what growth pace underpins it, explore the full narrative.

Result: Fair Value of $28.09 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, sustained cash burn, alongside intensifying EV price competition, could derail margin expansion, dampen investor confidence, and ultimately challenge the upside case.

Find out about the key risks to this Li Auto narrative.

Another View on Value

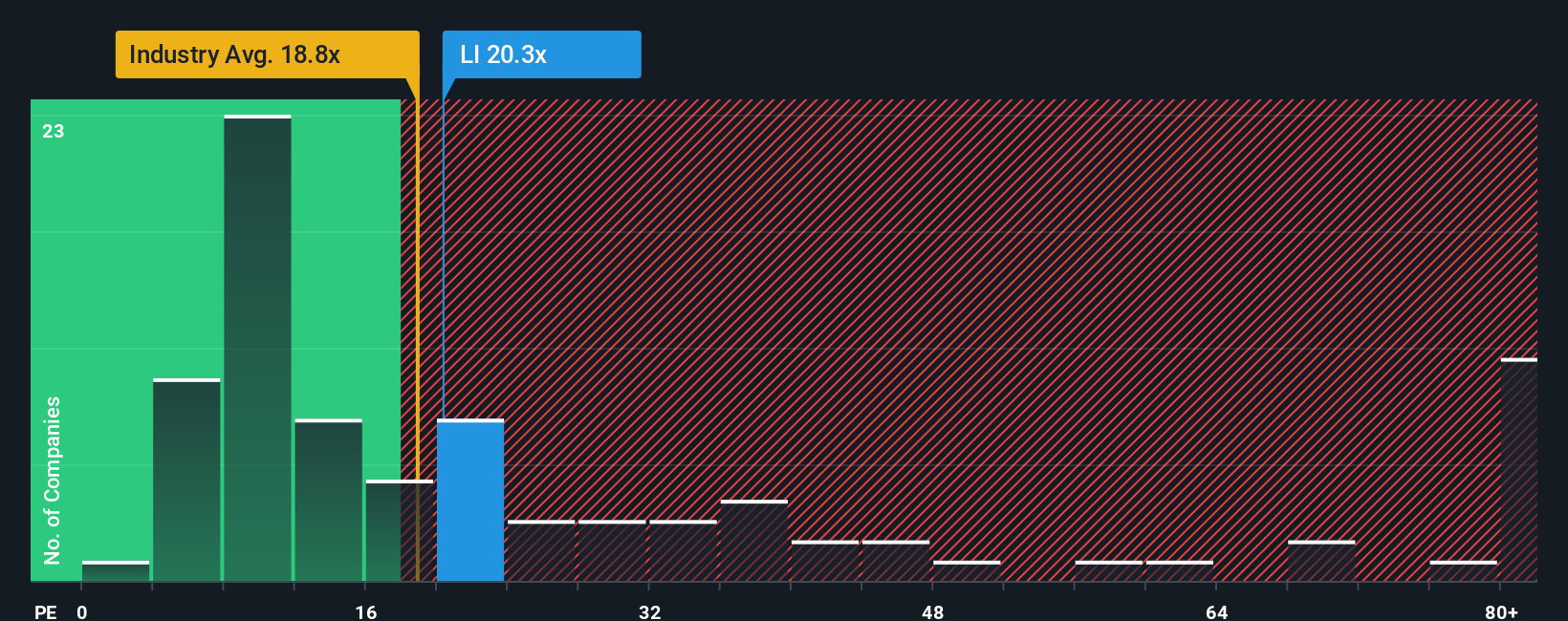

On earnings, Li Auto looks much less cheap. The shares trade at about 27.8 times earnings versus 18.3 times for the global auto sector and 22.6 times peers, only just under a fair ratio of 29 times. That premium could vanish fast if growth stumbles again, or widen if sentiment snaps back.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Li Auto Narrative

If you see the story differently or want to dig into the numbers yourself, you can build a custom narrative in just minutes with Do it your way.

A great starting point for your Li Auto research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Before you move on, lock in your next potential opportunity by scanning fresh stock ideas tailored to different strategies using the Simply Wall Street Screener.

- Capture potential multi baggers early by zeroing in on these 3580 penny stocks with strong financials with solid financial underpinnings and room to run.

- Capitalize on the AI wave by targeting these 25 AI penny stocks positioned at the intersection of rapid innovation and scalable business models.

- Secure value focused ideas by focusing on these 927 undervalued stocks based on cash flows that look mispriced based on their future cash flows.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:LI

Li Auto

Operates in the energy vehicle market in the People’s Republic of China.

Reasonable growth potential with adequate balance sheet.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Positioned globally, partnered locally

When will fraudsters be investigated in depth. Fraud was ongoing in France too.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026