- United States

- /

- Auto

- /

- NasdaqGS:LI

Loss-making Li Auto (NASDAQ:LI) has seen earnings and shareholder returns follow the same downward trajectory over past -16%

While not a mind-blowing move, it is good to see that the Li Auto Inc. (NASDAQ:LI) share price has gained 24% in the last three months. But that is minimal compensation for the share price under-performance over the last year. The cold reality is that the stock has dropped 16% in one year, under-performing the market.

While the last year has been tough for Li Auto shareholders, this past week has shown signs of promise. So let's look at the longer term fundamentals and see if they've been the driver of the negative returns.

View our latest analysis for Li Auto

Given that Li Auto didn't make a profit in the last twelve months, we'll focus on revenue growth to form a quick view of its business development. When a company doesn't make profits, we'd generally expect to see good revenue growth. That's because it's hard to be confident a company will be sustainable if revenue growth is negligible, and it never makes a profit.

In the last year Li Auto saw its revenue grow by 68%. That's a strong result which is better than most other loss making companies. The share price drop of 16% over twelve months would be considered disappointing by many, so you might argue the company is getting little credit for its impressive revenue growth. On the bright side, if this company is moving profits in the right direction, top-line growth like that could be an opportunity. Our brains have evolved to think in linear fashion, so there's value in learning to recognize exponential growth. We are, in some ways, simply the wisest of the monkeys.

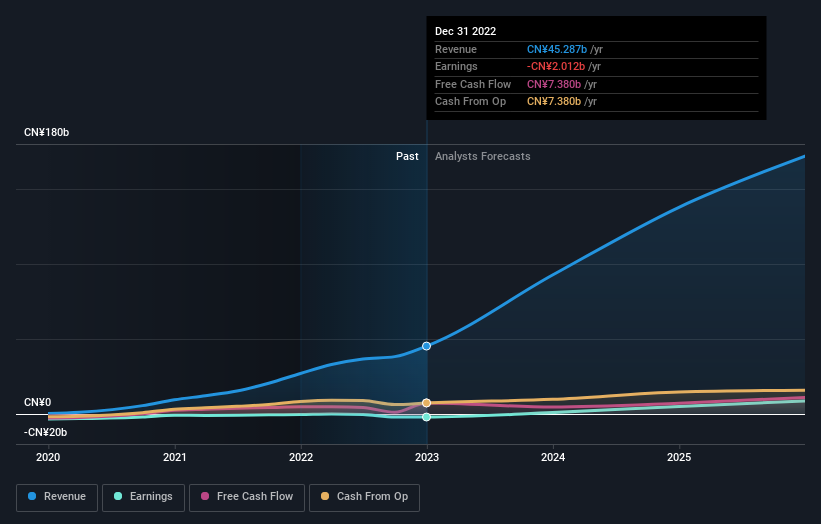

The graphic below depicts how earnings and revenue have changed over time (unveil the exact values by clicking on the image).

Li Auto is well known by investors, and plenty of clever analysts have tried to predict the future profit levels. If you are thinking of buying or selling Li Auto stock, you should check out this free report showing analyst consensus estimates for future profits.

A Different Perspective

We doubt Li Auto shareholders are happy with the loss of 16% over twelve months. That falls short of the market, which lost 12%. There's no doubt that's a disappointment, but the stock may well have fared better in a stronger market. Putting aside the last twelve months, it's good to see the share price has rebounded by 24%, in the last ninety days. This could just be a bounce because the selling was too aggressive, but fingers crossed it's the start of a new trend. Before spending more time on Li Auto it might be wise to click here to see if insiders have been buying or selling shares.

We will like Li Auto better if we see some big insider buys. While we wait, check out this free list of growing companies with considerable, recent, insider buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on American exchanges.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGS:LI

Li Auto

Operates in the energy vehicle market in the People’s Republic of China.

Flawless balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives