- United States

- /

- Auto

- /

- NasdaqGS:LI

Li Auto (NasdaqGS:LI) Valuation in Focus After Li i6 Launch and New Export Licensing Rules

Reviewed by Kshitija Bhandaru

Li Auto (NasdaqGS:LI) just introduced the Li i6, its first five-seat all-electric SUV and a move that puts the company directly into the heat of China’s battery EV competition. At a starting price near $34,000 and with deliveries set to begin immediately, this launch marks more than another car rolling out. It signals an aggressive push to broaden Li Auto’s addressable market as the battle for EV buyers intensifies. This move also arrives at a delicate moment, as fresh government licensing rules for EV exports are set to kick in next year, potentially reshaping how companies like Li Auto realize overseas growth.

Against this backdrop, Li Auto’s stock has been far from predictable. Over the past year, shares have slipped about 6%, but the past month has brought a rebound of about 8%, suggesting that confidence might be returning or that volatility remains part of the story. These swings stand out even more with the company’s expanding product line and efforts to shore up its supply chain through new partnerships, underscoring long-term ambitions even as short-term risks persist.

After the Li i6 reveal and these shifting regulatory headwinds, is Li Auto a bargain hiding in plain sight or has the market already factored in those big future growth bets?

Most Popular Narrative: 17% Undervalued

According to the most widely followed narrative, Li Auto’s current share price is seen as undervalued by nearly 17% compared to its estimated fair value, based on expectations for rapid profit growth and ambitious expansion plans.

Aggressive investment in proprietary intelligent driving systems (e.g., the VLA driver model and in-house AI chips), along with the rapid rollout of these features across the lineup, are expected to unlock high-margin, recurring software and services revenue. This could enhance net margins and support premium product positioning.

Want to know what’s behind this valuation gap? Bold revenue forecasts, accelerating profit margins, and a confidence in future earnings multiples set the stage. What are the hidden numbers fueling analyst optimism, and could they change how investors see Li Auto in years to come?

Result: Fair Value of $29.30 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, ongoing pressure from fierce EV competition and potential profit margin declines could quickly challenge the bullish case regarding Li Auto’s long-term value.

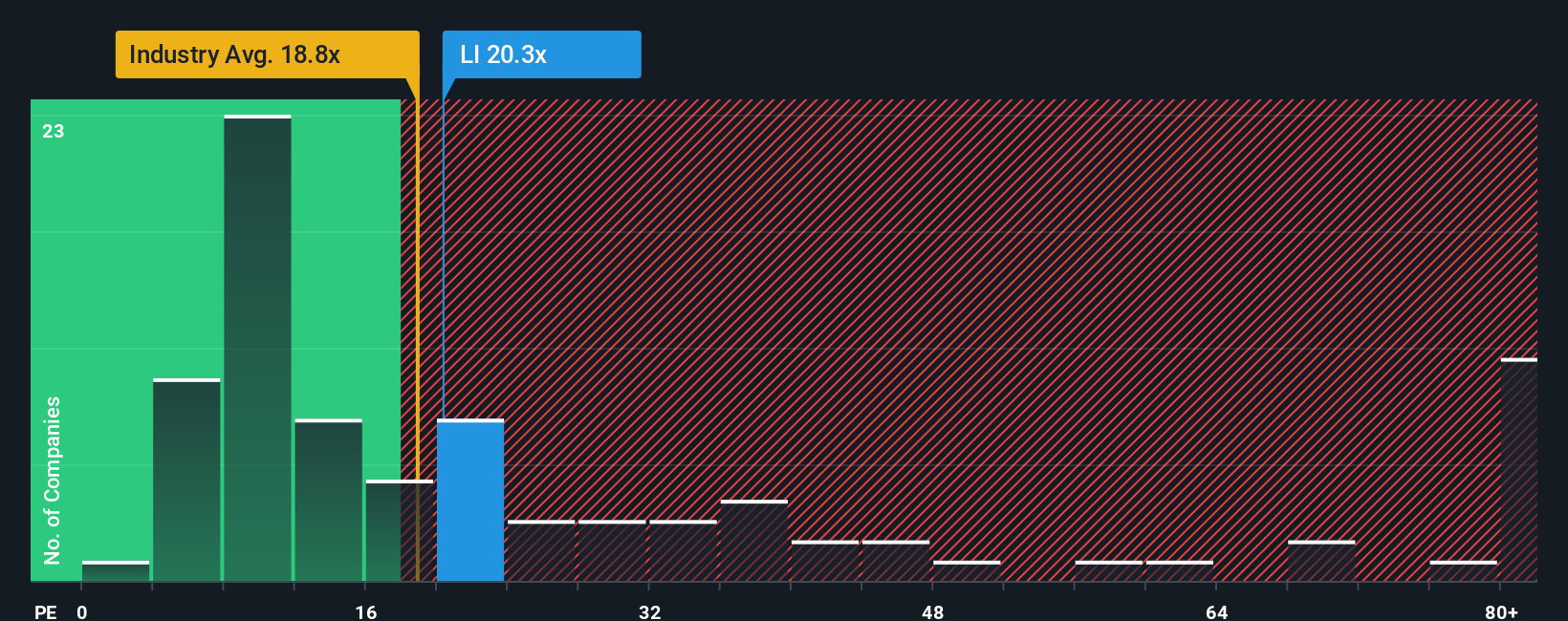

Find out about the key risks to this Li Auto narrative.Another View: Multiples Tell a Different Story

While our main valuation suggests upside for Li Auto, looking at traditional market comparisons offers a less optimistic angle. Based on this method, the company actually appears more expensive than many global auto rivals. Which view should investors trust?

See what the numbers say about this price — find out in our valuation breakdown.

Stay updated when valuation signals shift by adding Li Auto to your watchlist or portfolio. Alternatively, explore our screener to discover other companies that fit your criteria.

Build Your Own Li Auto Narrative

If you see the numbers differently, or you want to dig deeper and draw your own conclusions from the data, you can put together your own view in just a few minutes. Do it your way

A good starting point is our analysis highlighting 2 key rewards investors are optimistic about regarding Li Auto.

Looking for More Smart Investment Ideas?

Don’t let a single stock define your next move. The right screener can uncover trends and opportunities you might otherwise miss. Act now and see what truly stands out.

- Unleash your strategy with undervalued stocks based on cash flows, which targets companies priced lower than their true financial potential. This approach could help you discover hidden bargains before others catch on.

- Supercharge your portfolio by tapping into AI penny stocks, where pioneers in artificial intelligence are setting the pace for tomorrow's growth and transforming entire industries right now.

- Capture reliable income and sustained returns with dividend stocks with yields > 3%, a gateway to stocks offering generous yields that can strengthen your long-term financial foundation.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:LI

Li Auto

Operates in the energy vehicle market in the People’s Republic of China.

Excellent balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives