- United States

- /

- Auto

- /

- NasdaqGS:LCID

Lucid (LCID) Valuation Check After Prolonged Share Price Weakness and Robotaxi Growth Hopes

Reviewed by Simply Wall St

Lucid Group (LCID) has been grinding through a tough stretch, with the stock sliding over the past month and past 3 months, even as revenue keeps growing from a small base.

See our latest analysis for Lucid Group.

Despite a sharp 1 day share price gain, Lucid’s 30 day share price return of minus 24.45 percent and 1 year total shareholder return of minus 46.58 percent show that momentum is still fading as investors reassess execution risks against long term EV potential.

If Lucid’s volatility has you rethinking your exposure to carmakers, it might be worth scanning other auto manufacturers to see how the rest of the sector is shaping up.

With shares still far below past peaks yet analysts seeing upside to current prices, the real question is whether Lucid is a beaten down growth story on sale or if the market already discounts its future expansion.

Most Popular Narrative Narrative: 30.0% Undervalued

With Lucid Group’s fair value in the narrative sitting meaningfully above the recent 12.98 dollar close, the story frames a stock priced below its long term ambitions.

The newly announced Uber and Nuro partnership, including a planned 300 million dollar Uber investment and a commitment to deploy at least 20,000 Lucid Gravity vehicles as robotaxis over six years, is expected to open a large and fast growing autonomous fleet market to Lucid, driving significant revenue expansion and potential margin improvement via technology licensing and high volume fleet sales.

Curious how a premium EV maker, steep losses, and aggressive growth forecasts can still add up to a higher fair value? The narrative leans on rapid scaling, improving margins, and a rich future earnings multiple to bridge that gap. Want to see exactly which revenue and profit assumptions carry that valuation vision?

Result: Fair Value of $18.43 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent negative margins and heavy reliance on external capital could derail the upbeat robotaxi and scaling story if profitability milestones keep slipping.

Find out about the key risks to this Lucid Group narrative.

Another Lens on Valuation

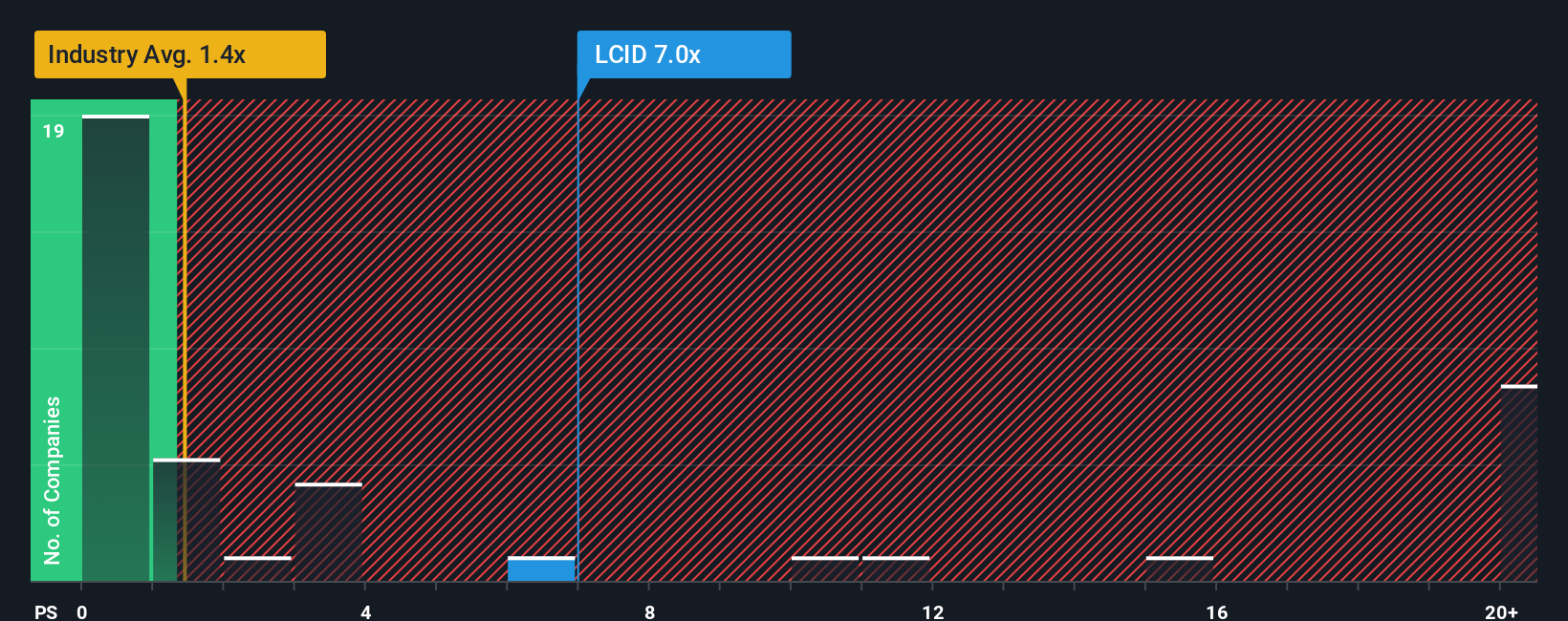

While the narrative suggests Lucid is nearly 30 percent undervalued, its 3.9 times price to sales ratio looks steep against the US auto industry at 0.9 times and peers at 1.3 times. This points to a stock that still carries rich expectations despite deep losses.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Lucid Group Narrative

If you see Lucid’s story differently or want to stress test the numbers yourself, you can build a full narrative in minutes, Do it your way.

A great starting point for your Lucid Group research is our analysis highlighting 1 key reward and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Before you move on, consider your next set of opportunities using the Simply Wall Street Screener so you are not left watching others capture potential upside.

- Target income first and let growth follow by reviewing these 12 dividend stocks with yields > 3% that can potentially strengthen your portfolio’s cash flow.

- Explore the next wave of innovation by focusing on these 26 AI penny stocks that may benefit from advances in artificial intelligence.

- Sharpen your value strategy by zeroing in on these 900 undervalued stocks based on cash flows that may be trading below their estimated intrinsic worth based on cash flows.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:LCID

Lucid Group

A technology company, designs, engineers, manufactures, and sells electric vehicles (EV), EV powertrains, and battery systems.

Adequate balance sheet with limited growth.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Near zero debt, Japan centric focus provides future growth

GE Vernova revenue will grow by 13% with a future PE of 64.7x

A buy recommendation

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026