- United States

- /

- Auto

- /

- NasdaqGS:LCID

Lucid (LCID): Assessing Valuation After Landmark Uber Deal, EU Gravity Launch, and Expansion Push

Reviewed by Simply Wall St

If you’ve been following Lucid Group (LCID) lately, there’s no shortage of fresh headlines to digest. The company has been busy, launching its Gravity SUV in Europe, collaborating with NVIDIA on next-generation driver-assistance systems, and signing a $300 million partnership with Uber to supply thousands of autonomous-capable vehicles. Lucid’s recent push to broaden its lineup with a lower-cost midsize EV aimed at Tesla’s core market only adds to the intrigue for anyone wondering what comes next for this ambitious electric automaker.

All these moves have certainly caught investor attention, but the market’s response has been mixed over the past year. While Lucid is introducing new products and partnerships, the stock is still under pressure, reflecting persistent worries about production scale and cost control. After a challenging year that saw shares trend lower, momentum has been tough to regain, even as Lucid looks to expand into wider markets and attract fresh demand in Europe and beyond.

So, is the current price a sign that Lucid Group is a value waiting to be unlocked, or are investors simply pricing in the risks along with the growth story?

Most Popular Narrative: 17.1% Undervalued

The prevailing market narrative sees Lucid Group as meaningfully undervalued, reflecting optimism around its growth drivers and long-term outlook.

The newly announced Uber and Nuro partnership, including a planned $300 million Uber investment and a commitment to deploy at least 20,000 Lucid Gravity vehicles as robotaxis over six years, is expected to open a large and fast-growing autonomous fleet market to Lucid. This may drive significant revenue expansion and potential margin improvement via technology licensing and high-volume fleet sales.

Curious about why this valuation is making waves? The story isn't just about product launches; it is about ambitious earnings forecasts and a financial trajectory that rivals only the boldest growth companies. What unique industry assumptions and future profit multiples are hiding beneath the surface of this fair value? You might be surprised by the numbers behind this bullish outlook.

Result: Fair Value of $23.25 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, persistent losses and ongoing dilution risk could quickly change the investment story if Lucid cannot deliver profitable growth at scale.

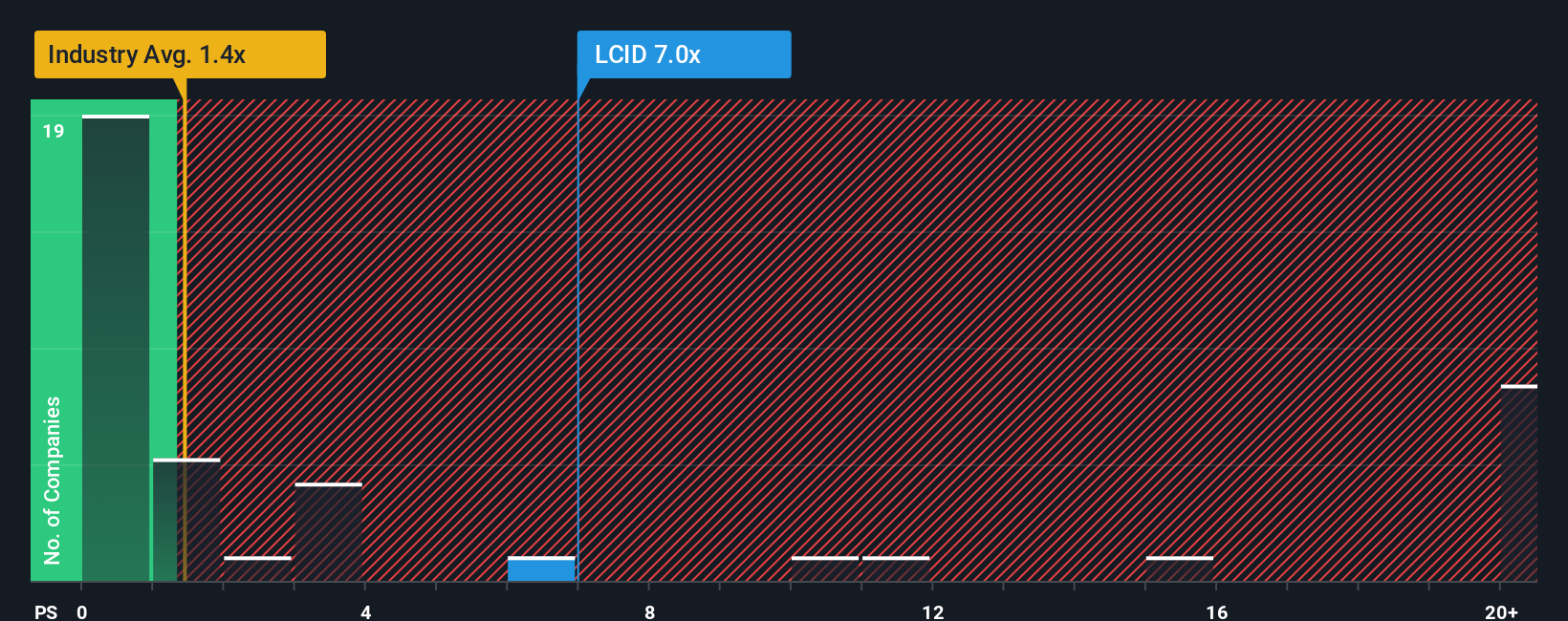

Find out about the key risks to this Lucid Group narrative.Another View: Price Ratios Tell a Different Story

Looking at Lucid Group through the lens of sales ratios paints a less optimistic picture compared to the previous outlook. By this measure, Lucid appears expensive relative to the industry, which raises new questions about its valuation. Can such a premium truly be justified?

See what the numbers say about this price — find out in our valuation breakdown.

Stay updated when valuation signals shift by adding Lucid Group to your watchlist or portfolio. Alternatively, explore our screener to discover other companies that fit your criteria.

Build Your Own Lucid Group Narrative

If you see things differently or want to dig deeper into the numbers, you can craft your own perspective in just a few minutes: Do it your way.

A great starting point for your Lucid Group research is our analysis highlighting 1 key reward and 3 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Smart investors know that opportunities extend far beyond a single company. Miss out, and you could overlook what’s fueling tomorrow’s market winners. Act now and get ahead.

- Spot tomorrow’s standout bargains by using the undervalued stocks based on cash flows to uncover stocks trading below their true worth.

- Tap into the ever-expanding world of artificial intelligence and find the most promising up-and-comers with the AI penny stocks.

- Boost your portfolio’s income stream by zeroing in on reliable high yielders through the dividend stocks with yields > 3%.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:LCID

Lucid Group

A technology company, designs, engineers, manufactures, and sells electric vehicles (EV), EV powertrains, and battery systems.

Adequate balance sheet with limited growth.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Positioned globally, partnered locally

When will fraudsters be investigated in depth. Fraud was ongoing in France too.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026