- United States

- /

- Auto

- /

- NasdaqGS:LCID

Lucid Group (NasdaqGS:LCID) Unveils 2026 Gravity SUV With Next-Gen EV Tech And Features

Reviewed by Simply Wall St

Lucid Group (NasdaqGS:LCID) witnessed a 21% share price increase over the past month, potentially driven by its recent announcement of the 2026 Lucid Gravity Grand Touring, an entry into the luxury SUV market. This move aligns with the broader market’s climb, highlighted by gains in the tech sector and overall resilience amid U.S.-China trade tensions. The launch of the luxury SUV might have enhanced investor confidence by showcasing Lucid's innovation in electric vehicles. Despite some market volatility, the company's expansion into new vehicle segments likely contributed positively to its stock momentum.

We've identified 2 warning signs for Lucid Group (1 can't be ignored) that you should be aware of.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

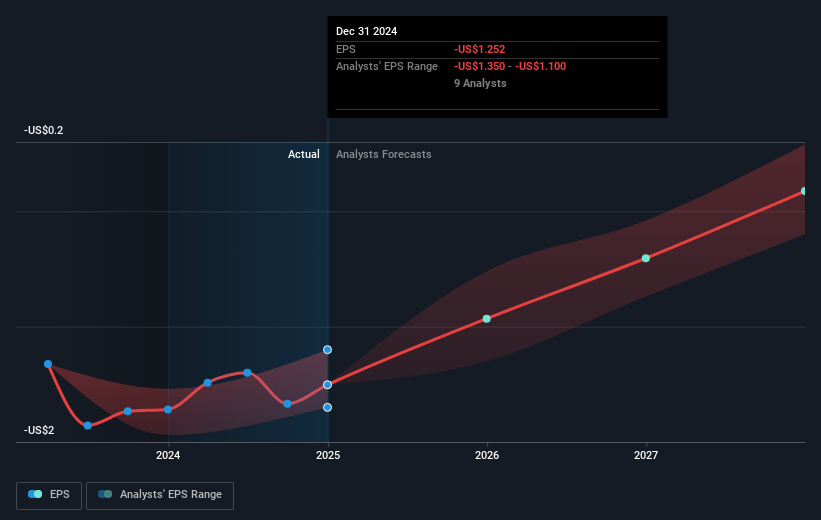

The recent unveiling of Lucid Group's 2026 Lucid Gravity Grand Touring SUV marks a key development that could significantly impact the company's revenue and earnings forecasts. By entering the luxury SUV market, Lucid could tap into a new consumer base, potentially driving substantial revenue growth as anticipated demand for this vehicle increases. Analysts predict a marked improvement in profitability, though Lucid is still forecasted to remain unprofitable in the near term. The strategic ramp-up in production and operational efficiencies might bolster earnings performance, but Lucid faces challenges like production constraints and competitive pressures. The market's optimistic reaction, reflected in the recent share price surge, aligns with this expansion narrative.

Over the past year, Lucid's total shareholder return, which includes both share price performance and dividends, was 5.42%. In comparison, the company's performance against the broader US Auto industry, which saw a 42.1% gain over the same period, indicates that Lucid has underperformed relative to its sector peers. With the current share price at US$2.32, slightly below the analyst consensus price target of US$2.55, there remains a 9.2% upside potential. However, for this price target to materialize, Lucid would need to attain an assumed profit margin improvement and hit ambitious revenue figures projected by analysts.

Examine Lucid Group's earnings growth report to understand how analysts expect it to perform.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

If you're looking to trade Lucid Group, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:LCID

Lucid Group

A technology company, designs, engineers, manufactures, and sells electric vehicles (EV), EV powertrains, and battery systems.

Excellent balance sheet with limited growth.

Similar Companies

Market Insights

Community Narratives