- United States

- /

- Auto

- /

- NasdaqGS:LCID

Lucid Group (NasdaqGS:LCID) Reports Q1 Sales Growth And Key Executive Appointments

Reviewed by Simply Wall St

Lucid Group (NasdaqGS:LCID) recently announced its first-quarter earnings results, reporting increased sales and an improved net loss compared to the previous year. The company also strengthened its leadership with the appointments of Akerho AK Oghoghomeh and Adrian Price. These developments coincided with the launch of the 2026 Lucid Gravity Grand Touring SUV, which potentially contributed to the company's 2% share price increase over the past month. Amid a broadly mixed market landscape, these announcements might have lent additional support to Lucid's stock, aligning with ongoing trends of innovation and executive leadership changes across industries.

Outshine the giants: these 28 early-stage AI stocks could fund your retirement.

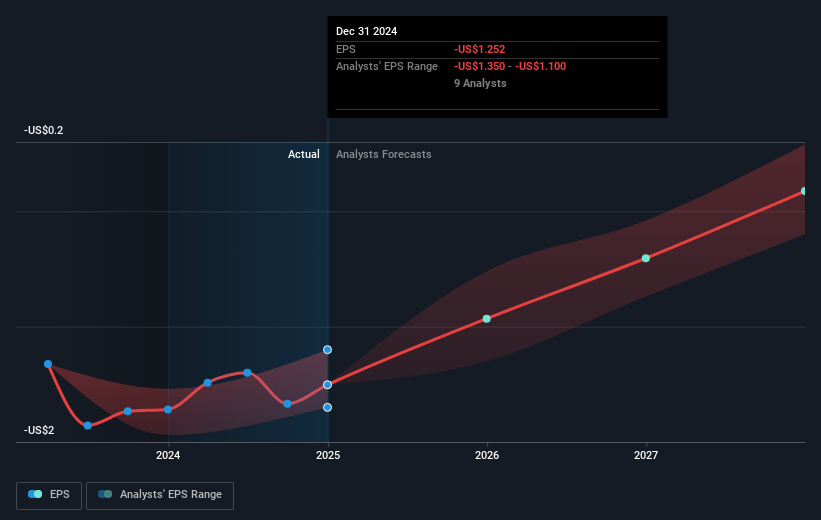

The recent developments mentioned in Lucid Group's initial announcement, particularly the launch of the Lucid Gravity Grand Touring SUV, have the potential to bolster future revenue by addressing a growing segment in the electric vehicle market. This launch, paired with strengthened leadership, aims to position Lucid for improved operational efficiency and revenue diversification, though challenges remain. Despite optimistic forecasts of substantial growth driven by strategic initiatives, Lucid's current financial situation presents hurdles with an unprofitable status and earnings projected to remain negative for the next three years.

Lately, Lucid's shares have experienced a 2% increase over the past month, reflecting cautious optimism around these developments. However, examining longer-term performance reveals a different picture. Over the past year, Lucid's total return, including share price and dividends, was a decline of 11.07%, underperforming compared to the US Auto industry's 41.4% return in the same period. This emphasizes the difficulty faced by the company in gaining market traction amid broader challenges.

Furthermore, share price movement in relation to consensus price targets shows little divergence. With Lucid currently trading at US$2.56, slightly above the price target of US$2.53, it indicates that analysts perceive limited upside under current conditions. These factors combined suggest that while product and leadership developments are positive, they are yet to translate into substantial financial improvement or altered market sentiment.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

If you're looking to trade Lucid Group, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:LCID

Lucid Group

A technology company, designs, engineers, manufactures, and sells electric vehicles (EV), EV powertrains, and battery systems.

Excellent balance sheet with limited growth.

Similar Companies

Market Insights

Community Narratives