- Taiwan

- /

- Marine and Shipping

- /

- TWSE:2615

Insufficient Growth At Wan Hai Lines Ltd. (TWSE:2615) Hampers Share Price

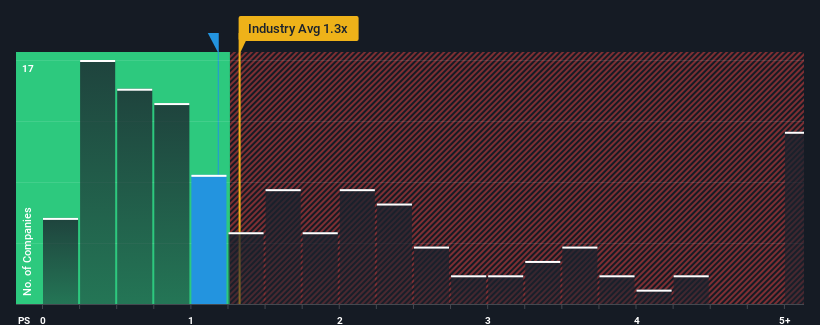

Wan Hai Lines Ltd.'s (TWSE:2615) price-to-sales (or "P/S") ratio of 1.2x may look like a pretty appealing investment opportunity when you consider close to half the companies in the Shipping industry in Taiwan have P/S ratios greater than 2.3x. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's limited.

View our latest analysis for Wan Hai Lines

How Wan Hai Lines Has Been Performing

With revenue that's retreating more than the industry's average of late, Wan Hai Lines has been very sluggish. Perhaps the market isn't expecting future revenue performance to improve, which has kept the P/S suppressed. If you still like the company, you'd want its revenue trajectory to turn around before making any decisions. Or at the very least, you'd be hoping the revenue slide doesn't get any worse if your plan is to pick up some stock while it's out of favour.

Want the full picture on analyst estimates for the company? Then our free report on Wan Hai Lines will help you uncover what's on the horizon.How Is Wan Hai Lines' Revenue Growth Trending?

The only time you'd be truly comfortable seeing a P/S as low as Wan Hai Lines' is when the company's growth is on track to lag the industry.

Retrospectively, the last year delivered a frustrating 60% decrease to the company's top line. Even so, admirably revenue has lifted 57% in aggregate from three years ago, notwithstanding the last 12 months. Although it's been a bumpy ride, it's still fair to say the revenue growth recently has been more than adequate for the company.

Looking ahead now, revenue is anticipated to plummet, contracting by 15% during the coming year according to the dual analysts following the company. Meanwhile, the broader industry is forecast to moderate by 10%, which indicates the company should perform poorly indeed.

In light of this, it's understandable that Wan Hai Lines' P/S sits below the majority of other companies. However, when revenue shrink rapidly the P/S often shrinks too, which could set up shareholders for future disappointment. Even just maintaining these prices could be difficult to achieve as the weak outlook is already weighing down the shares heavily.

The Bottom Line On Wan Hai Lines' P/S

It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

As expected, our analysis of Wan Hai Lines' analyst forecasts confirms that the company's even more precarious outlook against the industry is a major contributor to its low P/S. With such a gloomy outlook, investors feel the potential for an improvement in revenue isn't great enough to justify paying a premium resulting in a higher P/S ratio. Typically when industry conditions are tough, there's a real risk of company revenues sliding further, which is a concern of ours in this case. In the meantime, unless the company's prospects improve they will continue to form a barrier for the share price around these levels.

We don't want to rain on the parade too much, but we did also find 2 warning signs for Wan Hai Lines (1 is potentially serious!) that you need to be mindful of.

Of course, profitable companies with a history of great earnings growth are generally safer bets. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

Valuation is complex, but we're here to simplify it.

Discover if Wan Hai Lines might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TWSE:2615

Wan Hai Lines

Operates as a fully containerized shipping company in Asia, the Middle East, India, Red Sea, the United States, and South America.

Flawless balance sheet average dividend payer.

Market Insights

Community Narratives