- Taiwan

- /

- Marine and Shipping

- /

- TWSE:2612

Market Cool On Chinese Maritime Transport Ltd.'s (TWSE:2612) Earnings

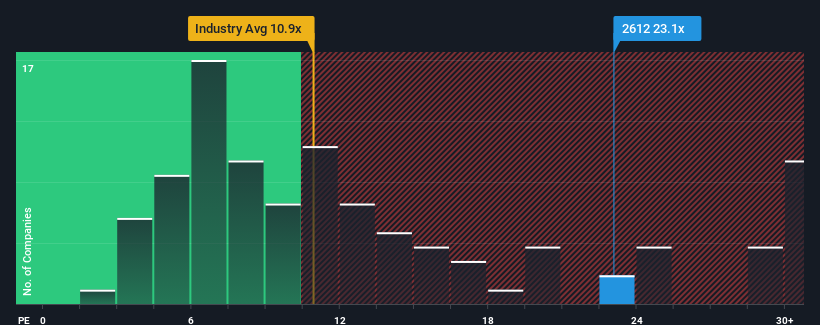

With a median price-to-earnings (or "P/E") ratio of close to 22x in Taiwan, you could be forgiven for feeling indifferent about Chinese Maritime Transport Ltd.'s (TWSE:2612) P/E ratio of 23.1x. While this might not raise any eyebrows, if the P/E ratio is not justified investors could be missing out on a potential opportunity or ignoring looming disappointment.

While the market has experienced earnings growth lately, Chinese Maritime Transport's earnings have gone into reverse gear, which is not great. One possibility is that the P/E is moderate because investors think this poor earnings performance will turn around. If not, then existing shareholders may be a little nervous about the viability of the share price.

See our latest analysis for Chinese Maritime Transport

Does Growth Match The P/E?

There's an inherent assumption that a company should be matching the market for P/E ratios like Chinese Maritime Transport's to be considered reasonable.

If we review the last year of earnings, dishearteningly the company's profits fell to the tune of 33%. This means it has also seen a slide in earnings over the longer-term as EPS is down 66% in total over the last three years. Therefore, it's fair to say the earnings growth recently has been undesirable for the company.

Shifting to the future, estimates from the only analyst covering the company suggest earnings should grow by 52% over the next year. Meanwhile, the rest of the market is forecast to only expand by 25%, which is noticeably less attractive.

In light of this, it's curious that Chinese Maritime Transport's P/E sits in line with the majority of other companies. Apparently some shareholders are skeptical of the forecasts and have been accepting lower selling prices.

The Final Word

Typically, we'd caution against reading too much into price-to-earnings ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

Our examination of Chinese Maritime Transport's analyst forecasts revealed that its superior earnings outlook isn't contributing to its P/E as much as we would have predicted. When we see a strong earnings outlook with faster-than-market growth, we assume potential risks are what might be placing pressure on the P/E ratio. At least the risk of a price drop looks to be subdued, but investors seem to think future earnings could see some volatility.

It's always necessary to consider the ever-present spectre of investment risk. We've identified 3 warning signs with Chinese Maritime Transport (at least 1 which is concerning), and understanding them should be part of your investment process.

If P/E ratios interest you, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

If you're looking to trade Chinese Maritime Transport, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TWSE:2612

Chinese Maritime Transport

Operates bulk carriers, and inland container transportation and terminals in Asia, the United States, Europe, and Oceania.

Proven track record with mediocre balance sheet.

Market Insights

Community Narratives