- Japan

- /

- Infrastructure

- /

- TSE:9377

Global Dividend Stocks To Consider For Your Portfolio

Reviewed by Simply Wall St

In the current global market, investors are navigating a landscape marked by easing trade tensions and mixed economic signals, with U.S. equities rebounding on positive trade developments while growth concerns linger. Amid these dynamics, dividend stocks can offer a compelling option for those seeking stability and income, as they tend to provide regular returns even in uncertain times.

Top 10 Dividend Stocks Globally

| Name | Dividend Yield | Dividend Rating |

| CAC Holdings (TSE:4725) | 4.89% | ★★★★★★ |

| Nihon Parkerizing (TSE:4095) | 4.20% | ★★★★★★ |

| Daito Trust ConstructionLtd (TSE:1878) | 4.03% | ★★★★★★ |

| Nissan Chemical (TSE:4021) | 3.95% | ★★★★★★ |

| Wuliangye YibinLtd (SZSE:000858) | 3.94% | ★★★★★★ |

| China South Publishing & Media Group (SHSE:601098) | 3.92% | ★★★★★★ |

| Guangxi LiuYao Group (SHSE:603368) | 3.63% | ★★★★★★ |

| HUAYU Automotive Systems (SHSE:600741) | 4.52% | ★★★★★★ |

| Japan Excellent (TSE:8987) | 4.49% | ★★★★★★ |

| Banque Cantonale Vaudoise (SWX:BCVN) | 4.46% | ★★★★★★ |

Click here to see the full list of 1516 stocks from our Top Global Dividend Stocks screener.

Here we highlight a subset of our preferred stocks from the screener.

Macnica Galaxy (TPEX:6227)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Macnica Galaxy Inc., with a market cap of NT$7.03 billion, operates in the agency trading and technical service of semiconductor electronic components in Taiwan, other parts of Asia, and internationally.

Operations: Macnica Galaxy Inc.'s revenue segments include NT$1.38 billion from the Maojing Department, NT$10.93 billion from the Polyester Department, and NT$178.93 million from the Digital Information Security Department.

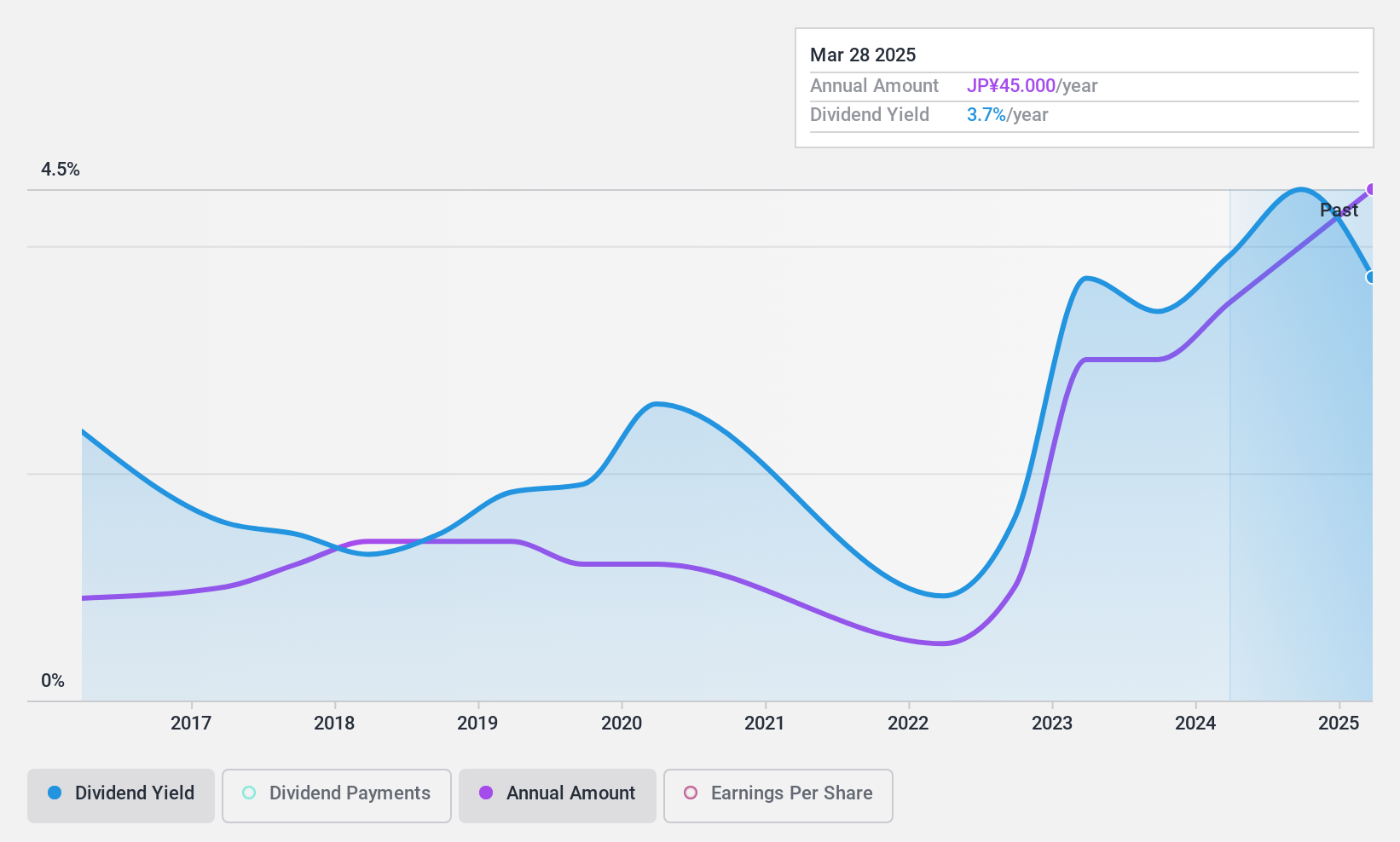

Dividend Yield: 3.7%

Macnica Galaxy's dividend payments are well covered by earnings and cash flows, with a payout ratio of 58% and a cash payout ratio of 21.3%. Despite this, the company's dividend history has been volatile over the past decade, showing unreliability. Recent financial results indicate improved earnings with net income rising to TWD 490 million from TWD 318.43 million year-on-year. However, its dividend yield of 3.74% remains below the top tier in the TW market.

- Get an in-depth perspective on Macnica Galaxy's performance by reading our dividend report here.

- Upon reviewing our latest valuation report, Macnica Galaxy's share price might be too pessimistic.

AGP (TSE:9377)

Simply Wall St Dividend Rating: ★★★☆☆☆

Overview: AGP Corporation is involved in supporting airport infrastructure in Japan, with a market cap of ¥14.55 billion.

Operations: AGP Corporation's revenue is derived from its Engineering Business at ¥7.09 billion, Power Supply Business at ¥5.70 billion, and Product Sales Business at ¥1.29 billion.

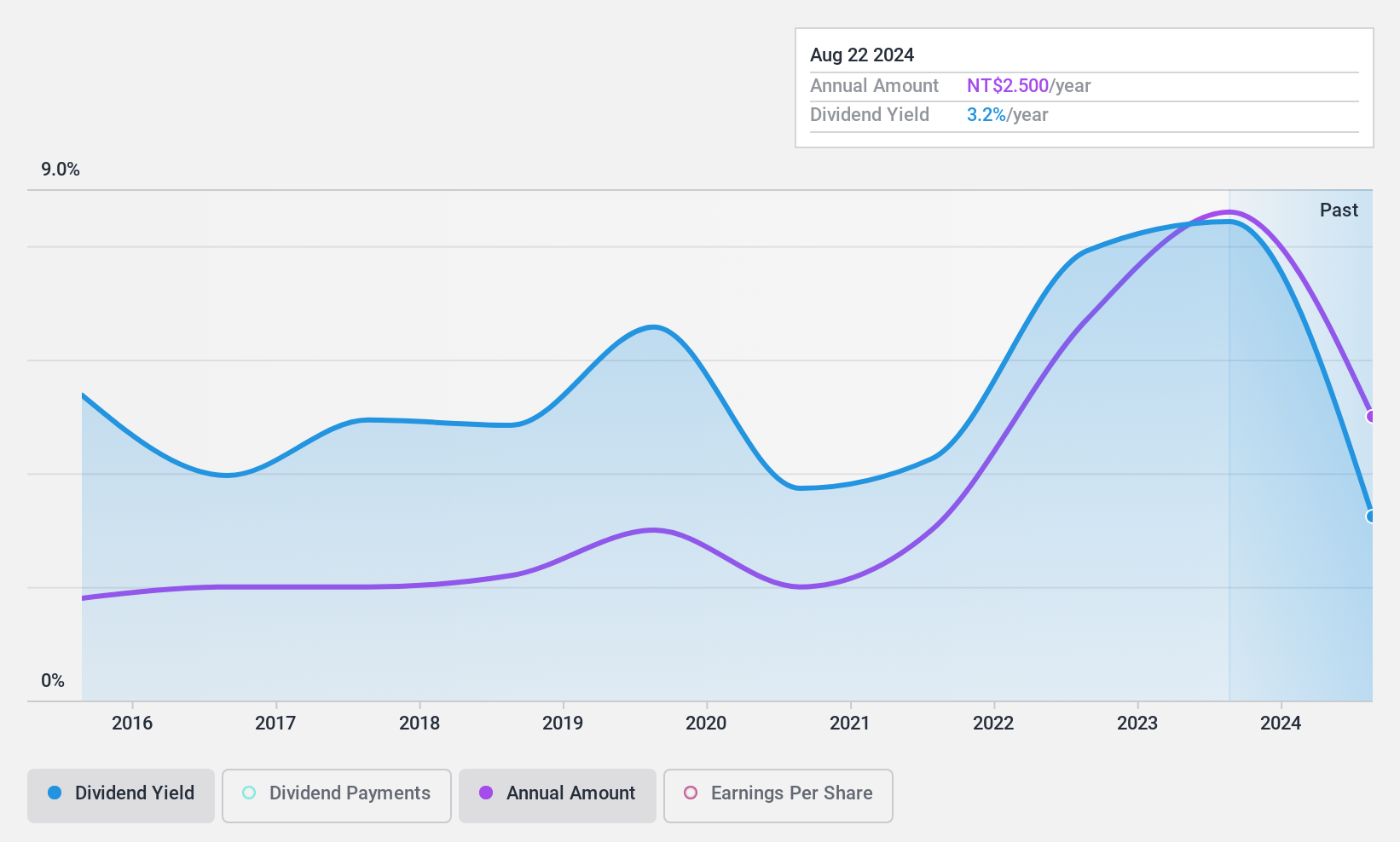

Dividend Yield: 3.2%

AGP's dividend payments have been inconsistent and volatile over the past decade, with a payout ratio of 70.6% indicating coverage by earnings but not by free cash flows. The dividend yield of 3.18% is lower than the top quartile in Japan's market, and recent shareholder proposals from Japan Airlines aim to privatize AGP shares through stock consolidation, potentially impacting future dividends and shareholder composition if approved at the upcoming AGM.

- Dive into the specifics of AGP here with our thorough dividend report.

- The valuation report we've compiled suggests that AGP's current price could be inflated.

Creative Sensor (TWSE:8249)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Creative Sensor Inc. is involved in the manufacturing and trading of image sensors and electronic components across China, Thailand, the Philippines, and internationally, with a market cap of NT$5.55 billion.

Operations: Creative Sensor Inc. generates revenue of NT$4.20 billion from its electronic components and parts segment.

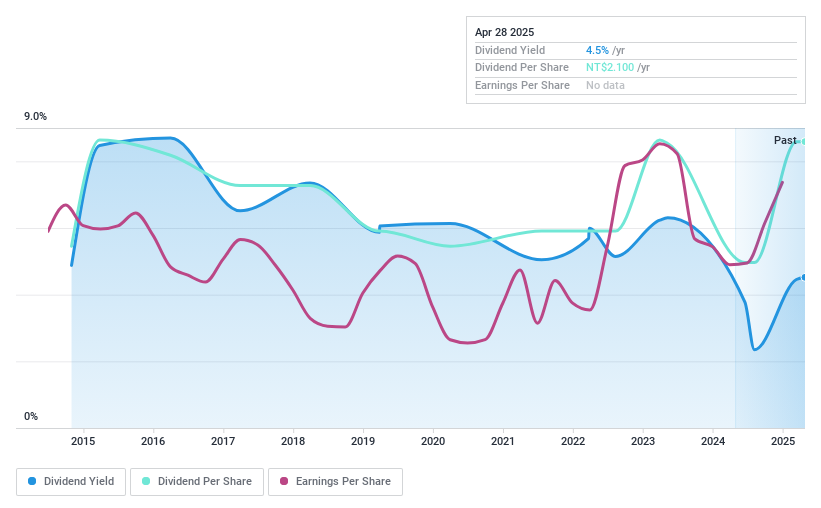

Dividend Yield: 4.5%

Creative Sensor's dividend payments, covered by a payout ratio of 64.1% and a cash payout ratio of 37.7%, have been volatile over the past decade, raising concerns about reliability. Despite earnings growth of 46.4% last year, the dividend yield of 4.52% remains below Taiwan's top quartile benchmark of 5.39%. Recent financial results showed increased sales and net income for 2024, while upcoming shareholder meetings will address potential changes in corporate governance and capital structure through private placements.

- Navigate through the intricacies of Creative Sensor with our comprehensive dividend report here.

- In light of our recent valuation report, it seems possible that Creative Sensor is trading behind its estimated value.

Turning Ideas Into Actions

- Investigate our full lineup of 1516 Top Global Dividend Stocks right here.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:9377

Excellent balance sheet second-rate dividend payer.

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

A case for USD $14.81 per share based on book value. Be warned, this is a micro-cap dependent on a single mine.

Occidental Petroleum to Become Fairly Priced at $68.29 According to Future Projections

Agfa-Gevaert is a digital and materials turnaround opportunity, with growth potential in ZIRFON, but carrying legacy risks.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)