- Taiwan

- /

- Tech Hardware

- /

- TWSE:8210

Exploring Three High Growth Tech Stocks in Asia

Reviewed by Simply Wall St

As global markets experience shifts, with small-cap stocks leading gains and technology sectors outperforming due to positive sentiment around AI-related advancements, Asia's tech landscape is drawing significant attention. In this context, identifying high-growth tech stocks involves looking for companies that can leverage emerging technologies and navigate the broader economic climate effectively.

Top 10 High Growth Tech Companies In Asia

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Suzhou TFC Optical Communication | 29.78% | 30.32% | ★★★★★★ |

| Shengyi Electronics | 22.99% | 35.16% | ★★★★★★ |

| Shanghai Huace Navigation Technology | 24.44% | 23.48% | ★★★★★★ |

| Fositek | 26.71% | 33.90% | ★★★★★★ |

| Range Intelligent Computing Technology Group | 27.31% | 28.63% | ★★★★★★ |

| Nanya New Material TechnologyLtd | 22.72% | 63.29% | ★★★★★★ |

| eWeLLLtd | 24.95% | 24.40% | ★★★★★★ |

| PharmaResearch | 24.40% | 25.85% | ★★★★★★ |

| Global Security Experts | 20.56% | 28.04% | ★★★★★★ |

| JNTC | 54.24% | 87.93% | ★★★★★★ |

We'll examine a selection from our screener results.

Beijing Yuanlong Yato Culture DisseminationLtd (SZSE:002878)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Beijing Yuanlong Yato Culture Dissemination Co., Ltd. operates in the cultural dissemination industry with a market capitalization of CN¥5.94 billion.

Operations: The company is engaged in the cultural dissemination sector, focusing on providing products and services that cater to this industry.

Beijing Yuanlong Yato Culture DisseminationLtd. is navigating a transformative phase, with first-quarter sales jumping to CNY 685.17 million from CNY 593.71 million year-over-year, despite a slight dip in net income to CNY 24.77 million from CNY 28.71 million. This performance underscores a robust annual revenue growth rate of 15.4%, positioning the company favorably against the broader Chinese market's growth rate of 12.3%. Looking ahead, the firm is expected to pivot into profitability within three years, buoyed by an anticipated earnings growth of approximately 76.9% annually—a testament to its strategic focus and operational adjustments amid high market volatility and competitive pressures in the tech sector.

Rakus (TSE:3923)

Simply Wall St Growth Rating: ★★★★★☆

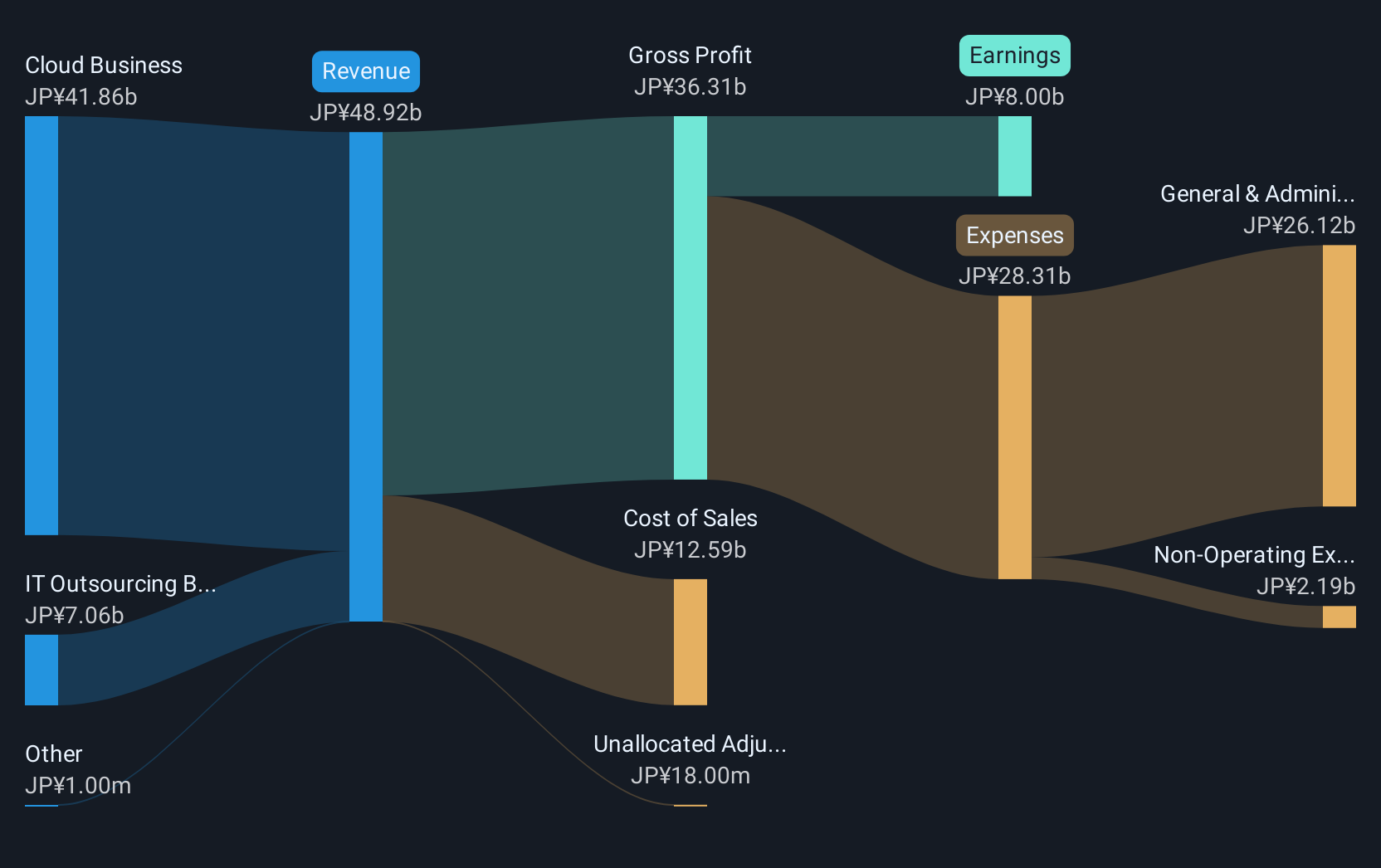

Overview: Rakus Co., Ltd. operates in Japan offering cloud services through its subsidiaries, with a market capitalization of ¥427.83 billion.

Operations: The company generates revenue primarily from its Cloud Business, which accounts for ¥41.86 billion, and also engages in IT Outsourcing with a contribution of ¥7.06 billion.

Rakus Co., Ltd. is demonstrating robust growth in the competitive software industry, with a notable annual revenue increase of 15.6% and earnings growth surging by 91.2% over the past year, outpacing the industry's average of 11.6%. The company's strategic share buybacks, repurchasing shares for ¥1,999.85 million recently, reflect its commitment to enhancing shareholder value and capital efficiency. With R&D expenses aligned closely with revenue growth trends, Rakus invests strategically to fuel innovation and maintain its market edge in a rapidly evolving tech landscape. Looking forward, Rakus anticipates continued strong performance with projected earnings growth at an impressive rate of 23.5% annually and an expected rise in dividends from JPY 4.50 per share to JPY 6.50 next year, signaling confidence in sustained profitability and financial health.

- Take a closer look at Rakus' potential here in our health report.

Examine Rakus' past performance report to understand how it has performed in the past.

Chenbro Micom (TWSE:8210)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Chenbro Micom Co., Ltd. is involved in the R&D, design, manufacture, processing, and trading of computer peripherals and expendable systems across various international markets including the United States, China, Taiwan, and Singapore with a market cap of NT$46.28 billion.

Operations: Chenbro Micom generates revenue primarily from the computer peripherals segment, amounting to NT$15.90 billion. The company operates across multiple international markets, focusing on research and development, design, and manufacturing processes.

Chenbro Micom is capturing attention in the tech sector with its recent performance and strategic initiatives. The company reported a significant earnings surge, with first-quarter net income climbing to TWD 666.8 million from TWD 364.92 million year-over-year, reflecting a robust growth rate of 57.1%, which surpasses the industry average of 12.3%. This financial uptrend is supported by a revenue jump of 22.1% per annum, outpacing the Taiwan market's growth of 9.4%. At COMPUTEX 2025, Chenbro showcased its innovative AI server solutions and strategic partnerships with industry giants like NVIDIA, underscoring its commitment to R&D and manufacturing prowess in high-demand tech sectors such as cloud computing and AI applications.

- Dive into the specifics of Chenbro Micom here with our thorough health report.

Evaluate Chenbro Micom's historical performance by accessing our past performance report.

Turning Ideas Into Actions

- Embark on your investment journey to our 494 Asian High Growth Tech and AI Stocks selection here.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TWSE:8210

Chenbro Micom

Engages in the research and development, design, manufacture, processing, and trading of computer peripherals and system of expendables in the United States, China, Taiwan, Europe, and internationally.

Exceptional growth potential with outstanding track record.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Constellation Energy Dividends and Growth

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026