3 Asian Growth Companies With High Insider Ownership And Earnings Growth Up To 112%

Reviewed by Simply Wall St

As global markets navigate a complex landscape marked by economic uncertainties and policy shifts, Asian markets have shown resilience, with notable activity in sectors like technology and consumer goods. In this context, companies that combine strong earnings growth with high insider ownership can offer potential stability and alignment of interests between management and shareholders.

Top 10 Growth Companies With High Insider Ownership In Asia

| Name | Insider Ownership | Earnings Growth |

| Seers Technology (KOSDAQ:A458870) | 33.9% | 84.6% |

| Samyang Foods (KOSE:A003230) | 11.7% | 28.6% |

| PharmaResearch (KOSDAQ:A214450) | 35% | 30.9% |

| Oscotec (KOSDAQ:A039200) | 12.7% | 104.1% |

| Novoray (SHSE:688300) | 23.6% | 30.3% |

| Laopu Gold (SEHK:6181) | 35.5% | 34% |

| J&V Energy Technology (TWSE:6869) | 17.5% | 24.9% |

| Gold Circuit Electronics (TWSE:2368) | 31.4% | 35.2% |

| Fulin Precision (SZSE:300432) | 11.7% | 50.7% |

| Ascentage Pharma Group International (SEHK:6855) | 12.8% | 91.9% |

We'll examine a selection from our screener results.

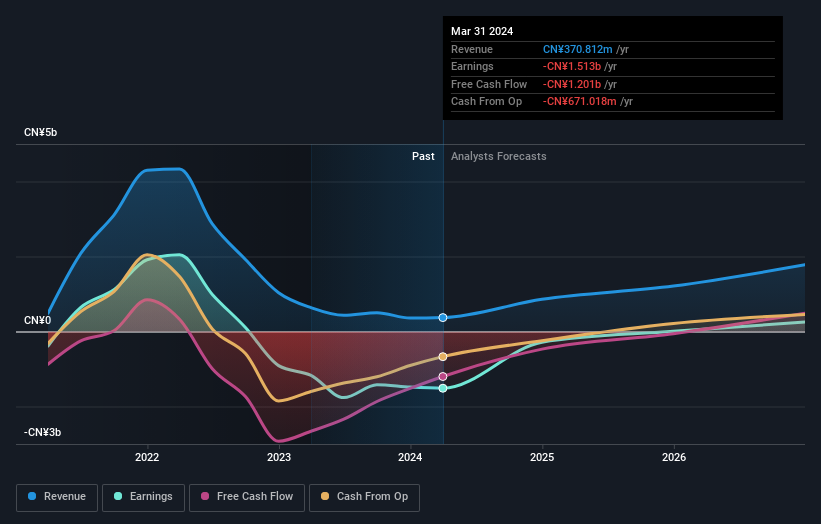

CanSino Biologics (SEHK:6185)

Simply Wall St Growth Rating: ★★★★★☆

Overview: CanSino Biologics Inc. develops, manufactures, and commercializes vaccines in the People’s Republic of China with a market cap of HK$16.83 billion.

Operations: The company's revenue segment includes CN¥925.24 million from the research and development of vaccine products for human use in China.

Insider Ownership: 31.4%

Earnings Growth Forecast: 112.0% p.a.

CanSino Biologics, with high insider ownership, reported a significant improvement in its financials for H1 2025. Revenue increased to CNY 382.33 million from CNY 303.43 million, and net loss dramatically reduced to CNY 13.49 million from CNY 225.37 million year-on-year. The company is expected to achieve profitability within three years and boasts forecasted revenue growth of 28.9% annually, outpacing the Hong Kong market average growth rate of 8.8%.

- Navigate through the intricacies of CanSino Biologics with our comprehensive analyst estimates report here.

- Upon reviewing our latest valuation report, CanSino Biologics' share price might be too pessimistic.

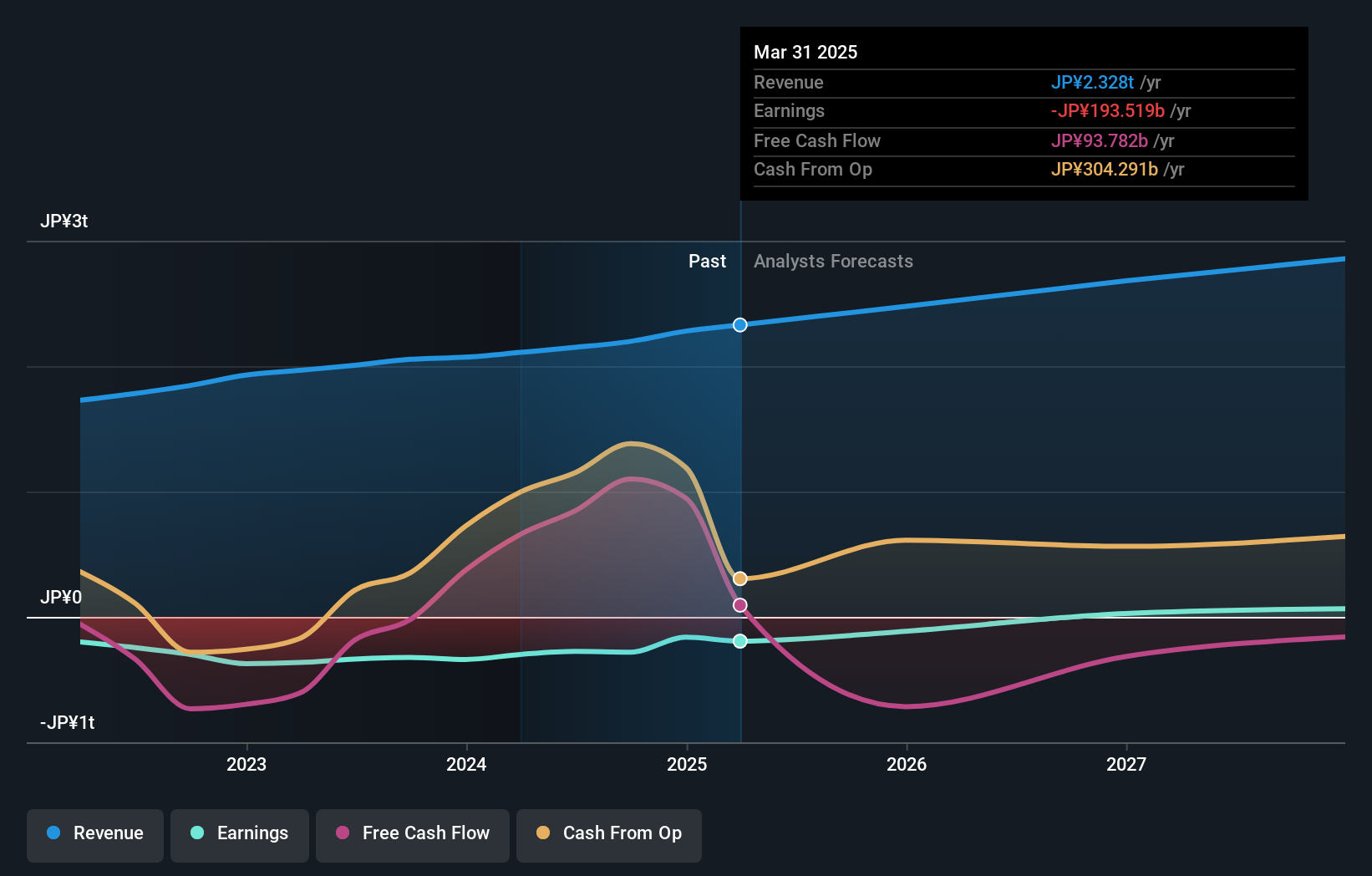

Rakuten Group (TSE:4755)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Rakuten Group, Inc. operates in e-commerce, fintech, digital content, and communications globally with a market cap of approximately ¥2.11 trillion.

Operations: The company's revenue segments include Mobile at ¥468.73 million, Fin Tech at ¥880.53 million, and Internet Services at ¥1.32 billion.

Insider Ownership: 12%

Earnings Growth Forecast: 77.2% p.a.

Rakuten Group, with substantial insider ownership, is forecasted to achieve profitability within three years, with earnings expected to grow significantly at 77.23% annually. However, revenue growth is projected at a slower pace of 6.6% per year compared to the broader market's expectations. Recent financial activities include an impairment loss of ¥27 billion and early redemptions of bonds totaling ¥36 billion, reflecting strategic debt management efforts amidst ongoing expansion plans.

- Take a closer look at Rakuten Group's potential here in our earnings growth report.

- According our valuation report, there's an indication that Rakuten Group's share price might be on the cheaper side.

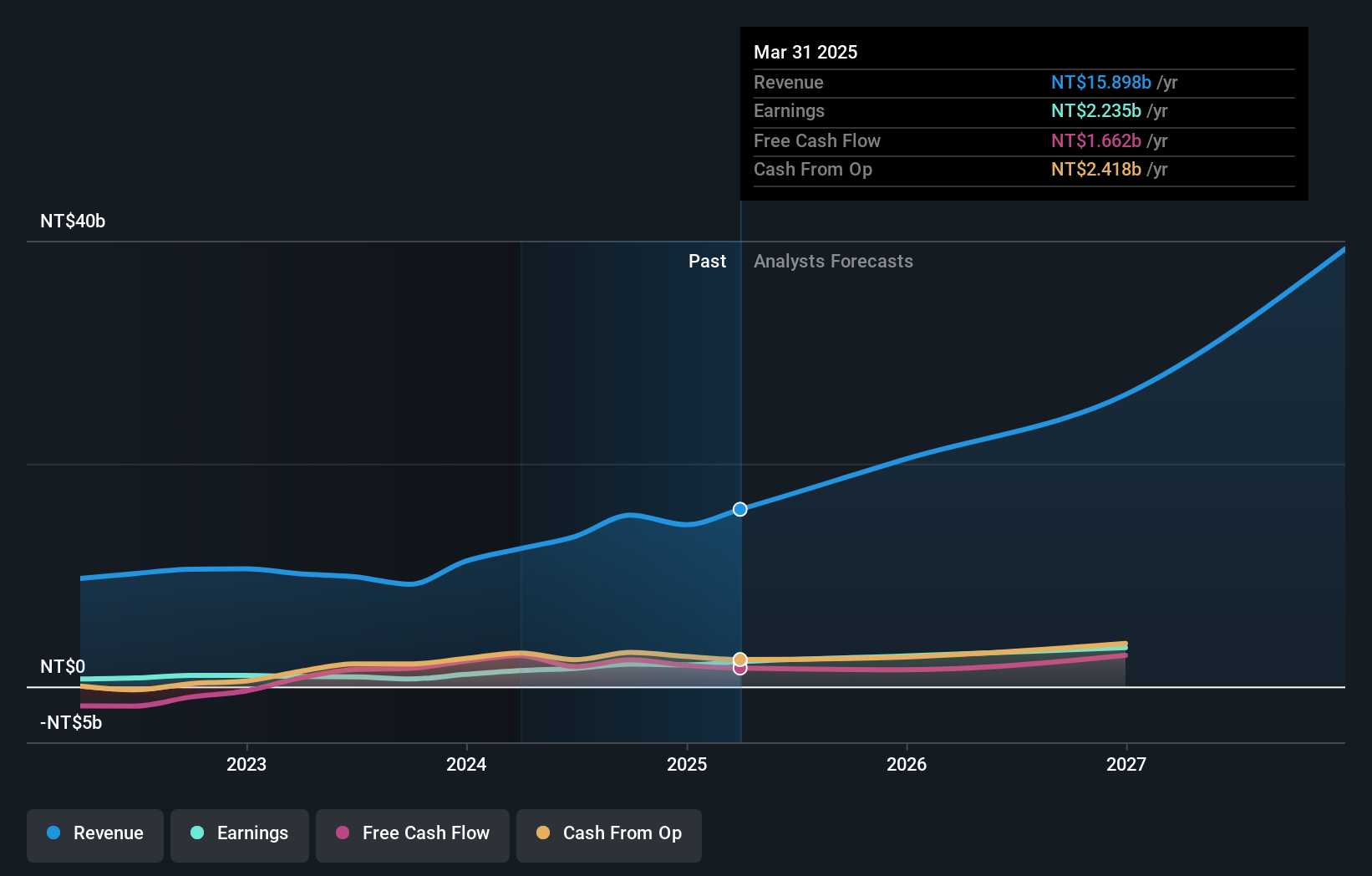

Chenbro Micom (TWSE:8210)

Simply Wall St Growth Rating: ★★★★★★

Overview: Chenbro Micom Co., Ltd. specializes in the R&D, design, manufacture, processing, and trading of computer peripherals and expendable systems across the United States, China, Taiwan, Singapore, and other international markets with a market cap of NT$74.29 billion.

Operations: The company's revenue primarily comes from its computer peripherals segment, generating NT$17.73 billion.

Insider Ownership: 24.8%

Earnings Growth Forecast: 25.4% p.a.

Chenbro Micom demonstrates strong growth potential, with earnings and revenue forecasted to grow significantly above the market average at 25.42% and 25.1% annually, respectively. Despite recent share price volatility, its high expected return on equity of 34.3% in three years underscores robust performance prospects. Recent financial results show substantial year-over-year sales and net income increases for Q2 2025, highlighting operational strength amidst no significant insider trading activity reported recently.

- Click here and access our complete growth analysis report to understand the dynamics of Chenbro Micom.

- The valuation report we've compiled suggests that Chenbro Micom's current price could be inflated.

Key Takeaways

- Get an in-depth perspective on all 617 Fast Growing Asian Companies With High Insider Ownership by using our screener here.

- Interested In Other Possibilities? Explore 26 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:4755

Rakuten Group

Provides services in e-commerce, fintech, digital content, and communications to various users in worldwide.

Reasonable growth potential with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives