In the midst of fluctuating global markets, where U.S. stocks have faced recent declines due to cautious Federal Reserve commentary and political uncertainties, investors are seeking stability in their portfolios. Dividend stocks, known for providing consistent income through regular payouts, can offer a reliable option during such volatile times.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Guaranty Trust Holding (NGSE:GTCO) | 6.30% | ★★★★★★ |

| Peoples Bancorp (NasdaqGS:PEBO) | 4.96% | ★★★★★★ |

| Tsubakimoto Chain (TSE:6371) | 4.23% | ★★★★★★ |

| Wuliangye YibinLtd (SZSE:000858) | 3.28% | ★★★★★★ |

| CAC Holdings (TSE:4725) | 4.78% | ★★★★★★ |

| Padma Oil (DSE:PADMAOIL) | 7.53% | ★★★★★★ |

| Southside Bancshares (NYSE:SBSI) | 4.53% | ★★★★★★ |

| GakkyushaLtd (TSE:9769) | 4.34% | ★★★★★★ |

| Citizens & Northern (NasdaqCM:CZNC) | 6.04% | ★★★★★★ |

| Premier Financial (NasdaqGS:PFC) | 4.73% | ★★★★★★ |

Click here to see the full list of 1956 stocks from our Top Dividend Stocks screener.

Underneath we present a selection of stocks filtered out by our screen.

Sesoda (TWSE:1708)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Sesoda Corporation is a Taiwanese company that manufactures and markets sulfate of potash (SOP), with a market cap of NT$9.36 billion.

Operations: Sesoda Corporation's revenue segments include Catering (NT$33.11 million), Shipping (NT$1.81 billion), Motor Freight (NT$19.02 million), Textile Products - Export (NT$2.61 billion), and Textile Products - Domestic Sale (NT$1.70 billion).

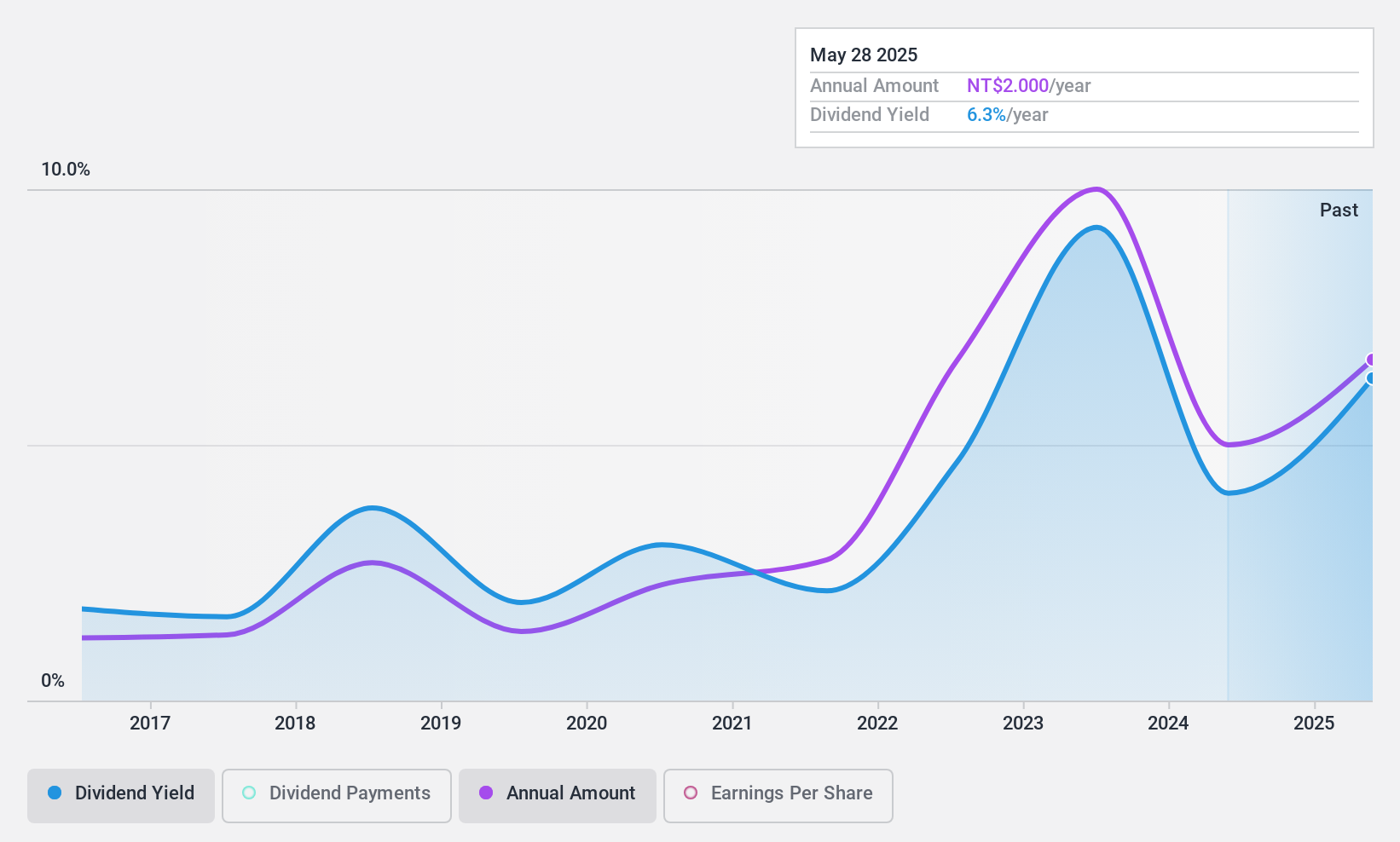

Dividend Yield: 4%

Sesoda's dividend yield of 3.99% falls short of the top quartile in Taiwan, and its dividends have been volatile over the past decade. However, with a payout ratio of 42.6% and cash payout ratio at 27.9%, dividends are well covered by earnings and cash flows, indicating sustainability despite past unreliability. Recent financial improvements show net income growth to TWD 291.24 million for Q3 2024 from TWD 105.71 million a year ago, highlighting profitability progress this year.

- Delve into the full analysis dividend report here for a deeper understanding of Sesoda.

- Our expertly prepared valuation report Sesoda implies its share price may be lower than expected.

Ampoc Far-East (TWSE:2493)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Ampoc Far-East Co., Ltd. and its subsidiaries engage in the research, manufacturing, and sale of equipment and materials for the electrical industry across Taiwan, China, and Hong Kong, with a market cap of NT$11.07 billion.

Operations: Ampoc Far-East Co., Ltd.'s revenue is primarily derived from its segments in machine equipment (NT$2.87 billion) and consumable materials (NT$1.55 billion).

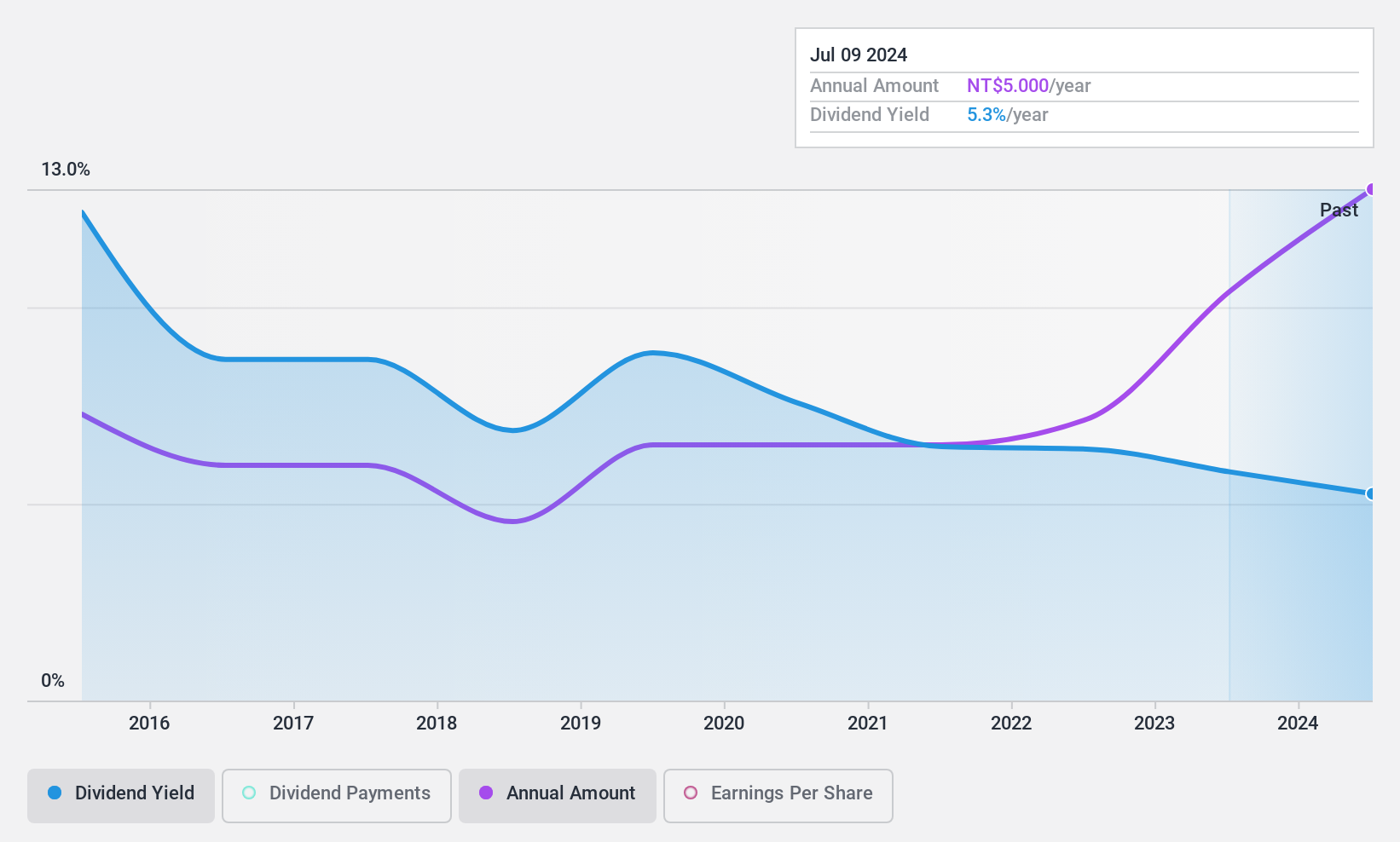

Dividend Yield: 5.2%

Ampoc Far-East's dividend yield of 5.17% ranks in the top 25% of Taiwan's market, yet its dividend history has been volatile over the past decade. Despite this instability, dividends are currently covered by earnings and cash flows with payout ratios at 85.1% and 82.9%, respectively, suggesting sustainability for now. Recent financials show Q3 sales increased to TWD 969.28 million from TWD 841.99 million last year, though net income declined slightly to TWD 181.99 million from TWD 206.47 million a year ago.

- Navigate through the intricacies of Ampoc Far-East with our comprehensive dividend report here.

- The analysis detailed in our Ampoc Far-East valuation report hints at an deflated share price compared to its estimated value.

Darfon Electronics (TWSE:8163)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Darfon Electronics Corp. specializes in eco-friendly technologies for IT peripherals, passive components, and green energy solutions, with a market cap of NT$12.16 billion.

Operations: Darfon Electronics Corp.'s revenue is primarily derived from Intelligent Products, contributing NT$12.40 billion, and Green Energy Products, which account for NT$9.87 billion.

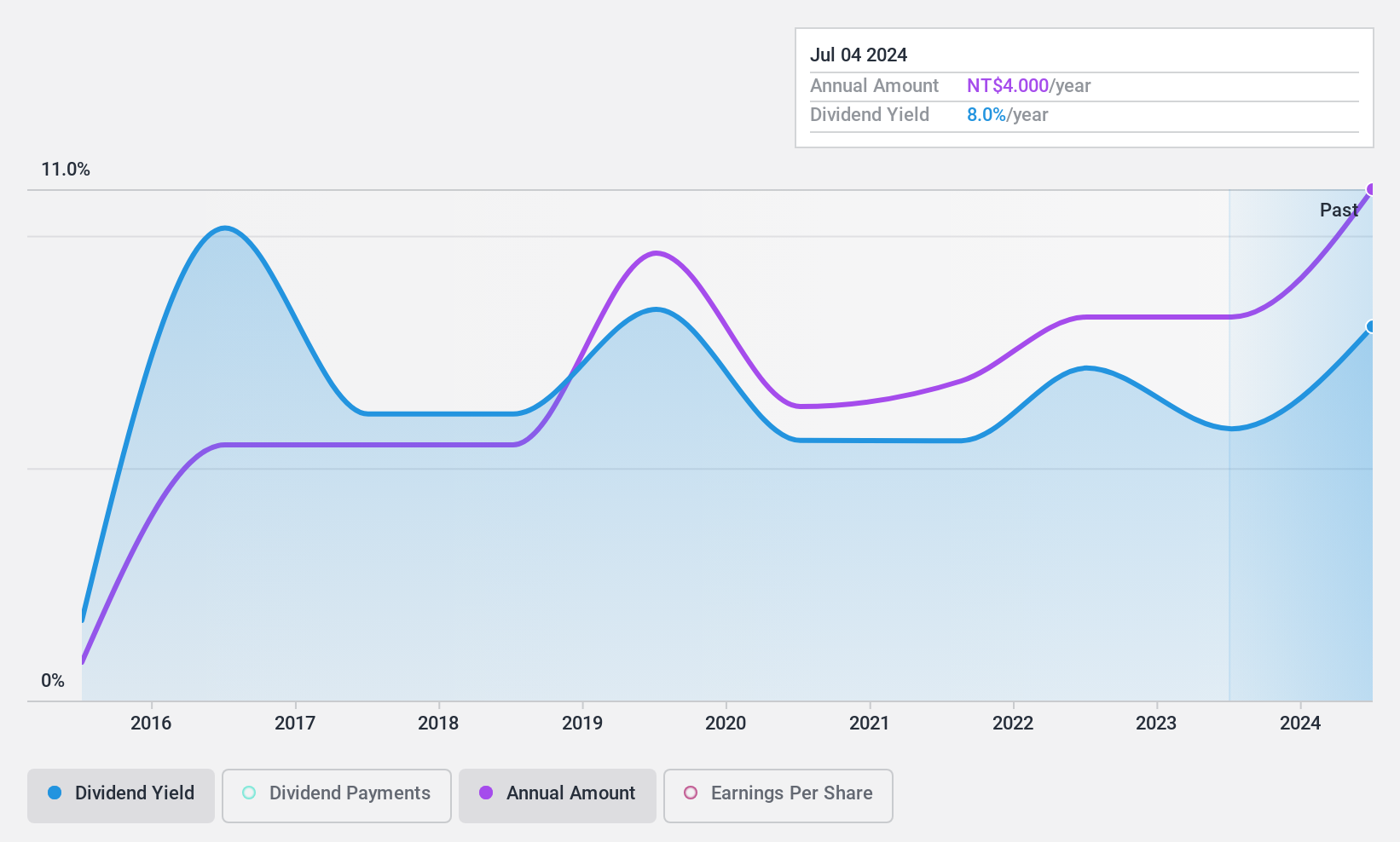

Dividend Yield: 9.1%

Darfon Electronics offers a high dividend yield of 9.14%, placing it among the top 25% in Taiwan's market, yet its dividends have been volatile over the past decade. The payout ratio is high at 156.6%, indicating dividends are not well covered by earnings, though cash flow coverage is adequate with a cash payout ratio of 39.6%. Recent financials show declining sales and net income, potentially impacting future dividend stability and growth prospects.

- Click here and access our complete dividend analysis report to understand the dynamics of Darfon Electronics.

- The valuation report we've compiled suggests that Darfon Electronics' current price could be quite moderate.

Taking Advantage

- Delve into our full catalog of 1956 Top Dividend Stocks here.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TWSE:1708

Flawless balance sheet, good value and pays a dividend.