As global markets grapple with cautious Fed commentary and looming political uncertainties, investors are navigating a complex landscape marked by fluctuating indices and economic data. Amidst these challenges, dividend stocks can offer a measure of stability through regular income streams, making them an attractive consideration for those looking to weather market volatility.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Guaranty Trust Holding (NGSE:GTCO) | 6.30% | ★★★★★★ |

| Tsubakimoto Chain (TSE:6371) | 4.23% | ★★★★★★ |

| Yamato Kogyo (TSE:5444) | 4.11% | ★★★★★★ |

| Padma Oil (DSE:PADMAOIL) | 7.53% | ★★★★★★ |

| Southside Bancshares (NYSE:SBSI) | 4.53% | ★★★★★★ |

| FALCO HOLDINGS (TSE:4671) | 6.61% | ★★★★★★ |

| Citizens & Northern (NasdaqCM:CZNC) | 6.04% | ★★★★★★ |

| Premier Financial (NasdaqGS:PFC) | 4.73% | ★★★★★★ |

| Banque Cantonale Vaudoise (SWX:BCVN) | 5.23% | ★★★★★★ |

| E J Holdings (TSE:2153) | 3.84% | ★★★★★☆ |

Click here to see the full list of 1959 stocks from our Top Dividend Stocks screener.

Here we highlight a subset of our preferred stocks from the screener.

First Philippine Holdings (PSE:FPH)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: First Philippine Holdings Corporation operates in power generation, real estate development, energy solutions, and construction in the Philippines with a market cap of ₱27.76 billion.

Operations: First Philippine Holdings Corporation's revenue primarily comes from power generation (₱137.65 billion), real estate development (₱17.64 billion), construction and other services (₱15.41 billion), and energy solutions (₱5.15 billion).

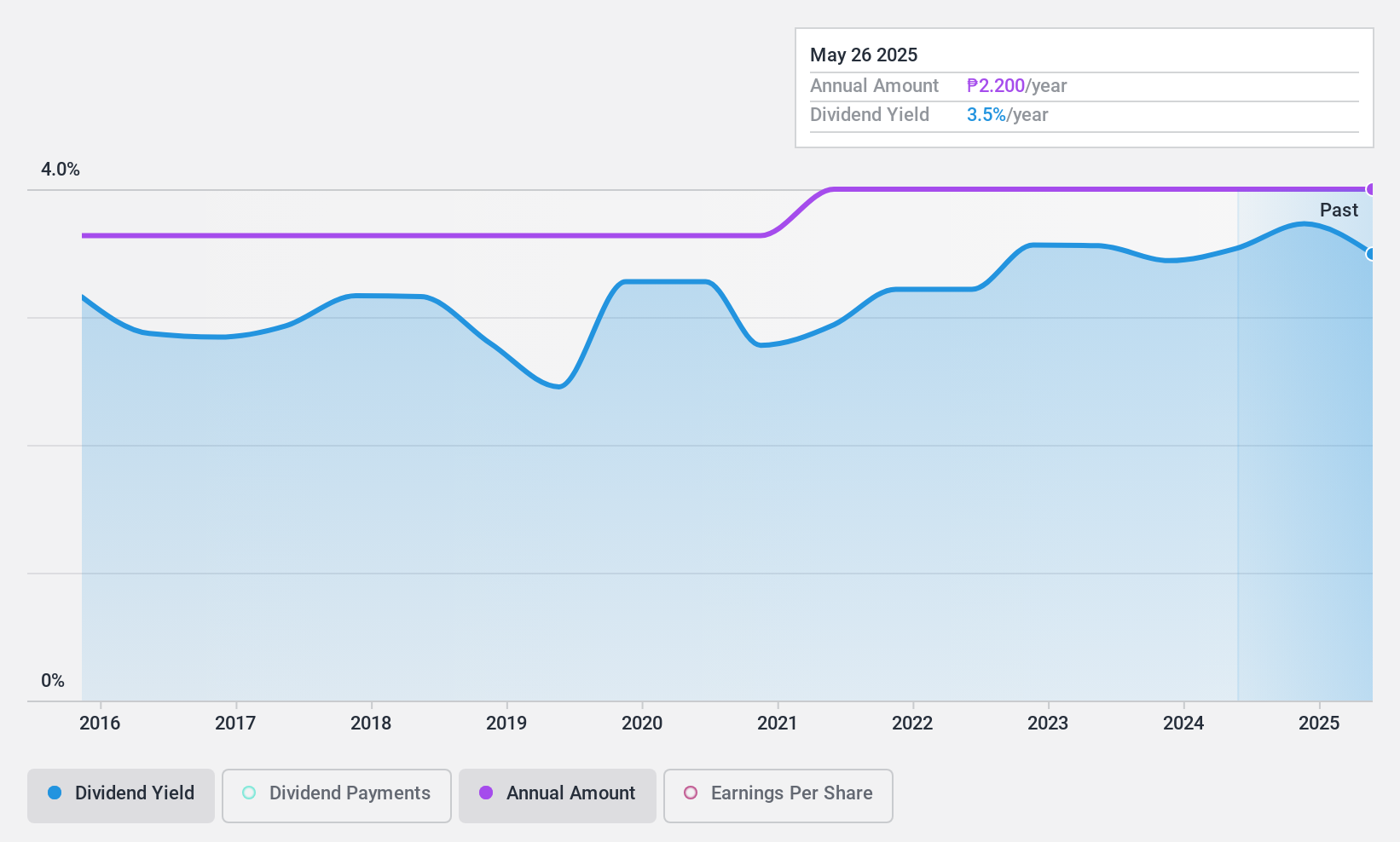

Dividend Yield: 3.7%

First Philippine Holdings offers a stable dividend profile with consistent payments over the past decade, supported by a low payout ratio of 7.4%. However, its 3.67% yield is below the top quartile in the Philippines market and not covered by free cash flows, raising sustainability concerns. Recent earnings showed a decline in net income to PHP 3.21 billion for Q3 2024 from PHP 4.56 billion in Q3 2023, potentially impacting future dividend capacity.

- Get an in-depth perspective on First Philippine Holdings' performance by reading our dividend report here.

- Our expertly prepared valuation report First Philippine Holdings implies its share price may be lower than expected.

Univacco Technology (TPEX:3303)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Univacco Technology Inc. operates in the stamping foil industry under the UNIVACCO brand both in Taiwan and internationally, with a market cap of NT$5.03 billion.

Operations: Univacco Technology Inc.'s revenue primarily comes from its Vacuum-Evaporated Thin Films and Optoelectronic Materials segment, generating NT$2.93 billion.

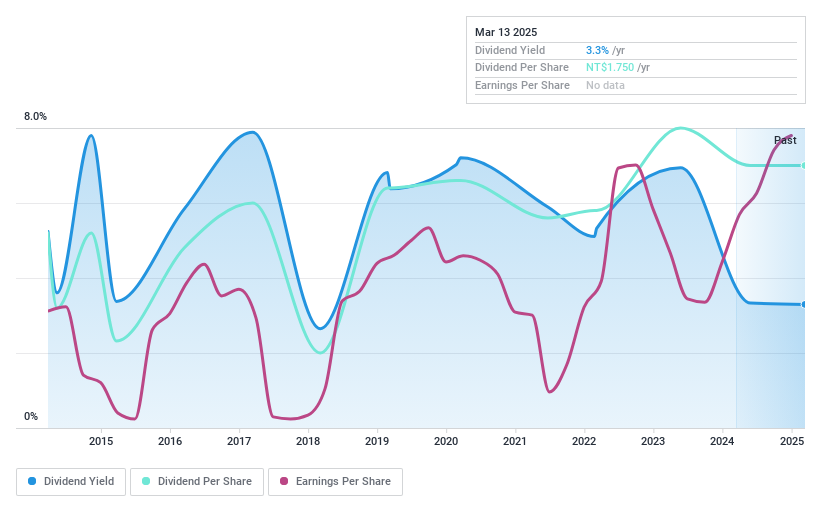

Dividend Yield: 3.4%

Univacco Technology's dividend profile reveals both strengths and weaknesses. While the payout ratio of 47.2% suggests dividends are well covered by earnings and cash flows, indicating sustainability, the dividend yield of 3.36% is below Taiwan's top quartile payers. Despite a history of increased payments over ten years, dividends have been unstable with significant volatility. Recent earnings growth is strong; however, shareholder dilution and share price volatility present additional risks for investors seeking reliable income streams.

- Delve into the full analysis dividend report here for a deeper understanding of Univacco Technology.

- Insights from our recent valuation report point to the potential undervaluation of Univacco Technology shares in the market.

Aerospace Industrial Development (TWSE:2634)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Aerospace Industrial Development Corporation is involved in the development, manufacturing, integration, assembly, and testing of aircraft systems and parts both in Taiwan and internationally with a market cap of NT$41.16 billion.

Operations: Aerospace Industrial Development Corporation generates revenue of NT$37.66 billion from its Aerospace & Defense segment.

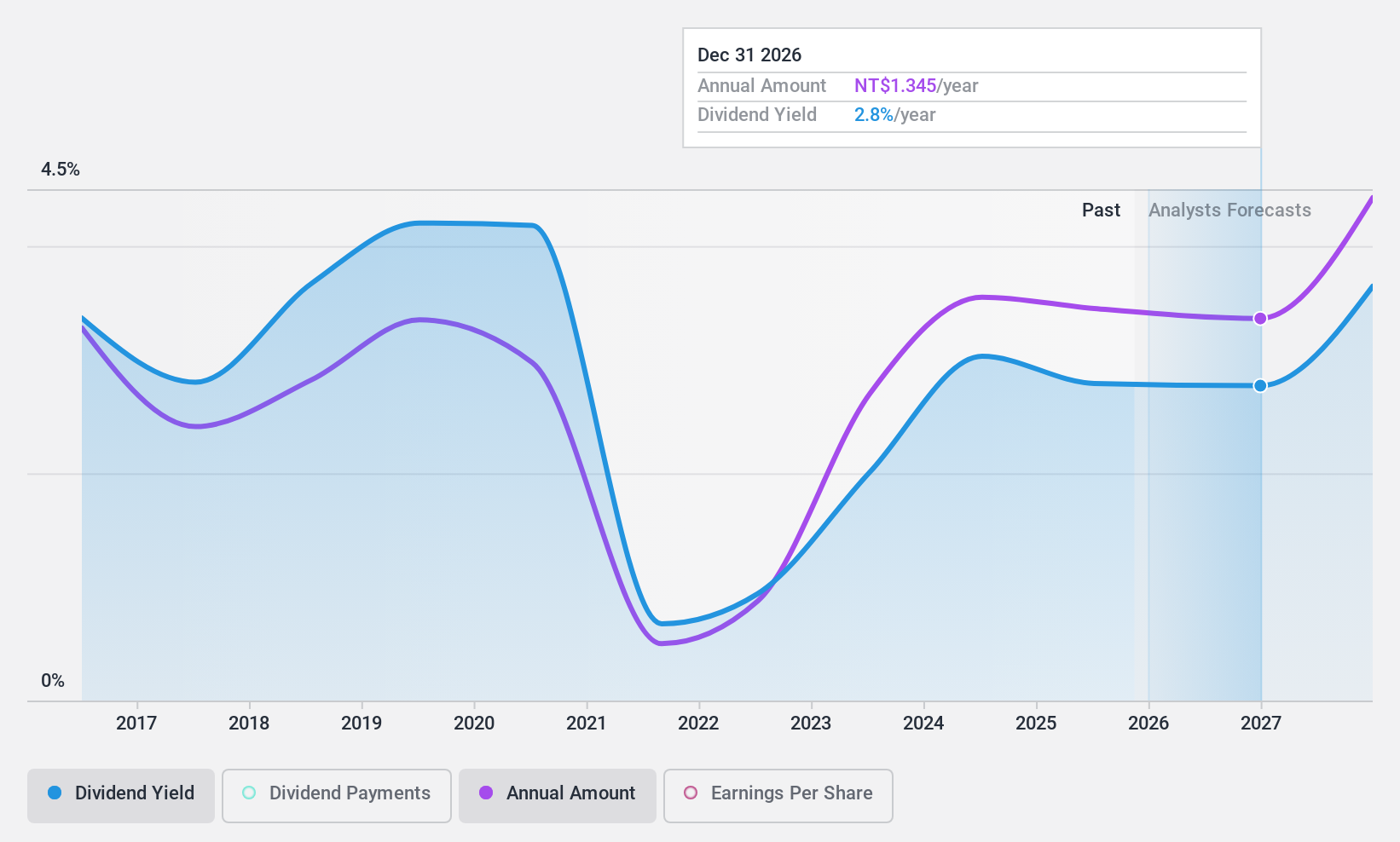

Dividend Yield: 3.2%

Aerospace Industrial Development's dividend profile is mixed, with a reasonable payout ratio of 70.8% and cash payout ratio of 42%, indicating coverage by earnings and cash flows. However, dividends have been volatile over the past decade despite overall growth. The yield of 3.25% is lower than Taiwan's top quartile payers. Recent earnings show a decline in net income and sales, which may impact future dividend stability amidst high debt levels.

- Click here and access our complete dividend analysis report to understand the dynamics of Aerospace Industrial Development.

- Insights from our recent valuation report point to the potential overvaluation of Aerospace Industrial Development shares in the market.

Summing It All Up

- Reveal the 1959 hidden gems among our Top Dividend Stocks screener with a single click here.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TPEX:3303

Univacco Technology

Operates in the stamping foil industry under the UNIVACCO brand in Taiwan and internationally.

Flawless balance sheet with solid track record and pays a dividend.