In a week marked by cautious Federal Reserve commentary and political uncertainty, U.S. stocks experienced declines, with smaller-cap indexes facing more significant losses. As investors navigate these turbulent waters, identifying stocks with strong fundamentals and growth potential becomes crucial in capitalizing on opportunities within the market's shifting landscape.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Canal Shipping Agencies | NA | 8.92% | 22.01% | ★★★★★★ |

| Suez Canal Company for Technology Settling (S.A.E) | NA | 22.31% | 13.60% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Parker Drilling | 46.05% | 0.86% | 52.25% | ★★★★★★ |

| Standard Bank | 0.13% | 27.78% | 30.36% | ★★★★★★ |

| Tianyun International Holdings | 10.09% | -5.59% | -9.92% | ★★★★★★ |

| Invest Bank | 135.69% | 11.07% | 18.67% | ★★★★☆☆ |

| A2B Australia | 15.83% | -7.78% | 25.44% | ★★★★☆☆ |

| Castellana Properties Socimi | 53.49% | 6.65% | 21.96% | ★★★★☆☆ |

| DIRTT Environmental Solutions | 58.73% | -5.34% | -5.43% | ★★★★☆☆ |

Here's a peek at a few of the choices from the screener.

TOA (TSE:1885)

Simply Wall St Value Rating: ★★★★★☆

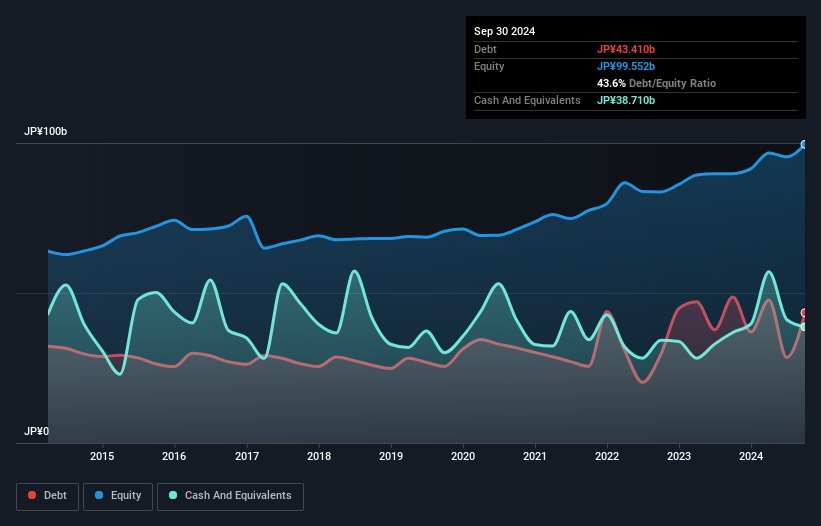

Overview: TOA Corporation offers construction and engineering services in Japan, with a market cap of ¥95.68 billion.

Operations: The primary revenue streams for TOA Corporation are its Domestic Civil Engineering Business and Domestic Construction Business, generating ¥138.17 billion and ¥99.24 billion respectively. The company's financial performance is significantly influenced by these segments, which together form the core of its revenue model.

TOA Corporation, a smaller player in its industry, has shown impressive earnings growth of 44.1% over the past year, outpacing the broader construction sector's 20.7%. Its net debt to equity ratio stands at a satisfactory 4.7%, indicating prudent financial management. Despite high share price volatility recently, TOA is trading at a significant discount of 89.1% below its estimated fair value, suggesting potential upside for investors seeking value opportunities. Recent developments include an increased dividend forecast to JPY 54 per share and revised earnings guidance with higher expected profits and operating margins for the upcoming fiscal year ending March 2025.

- Click here and access our complete health analysis report to understand the dynamics of TOA.

Explore historical data to track TOA's performance over time in our Past section.

San Fang Chemical Industry (TWSE:1307)

Simply Wall St Value Rating: ★★★★★★

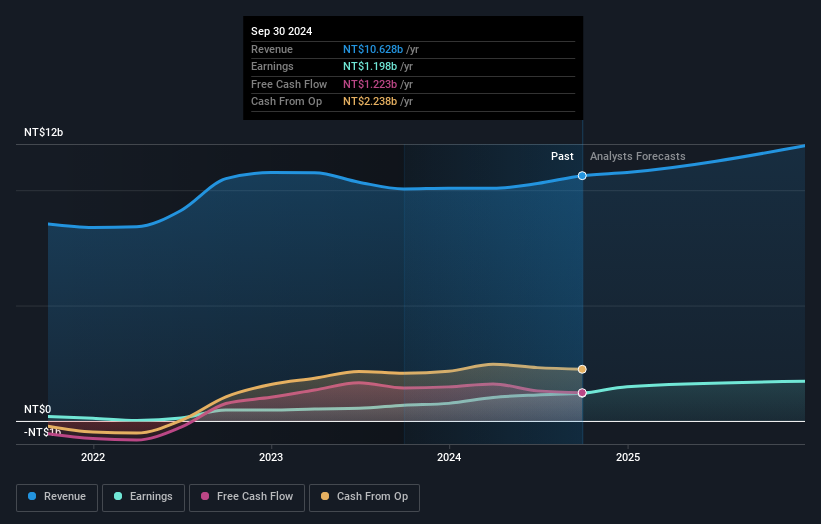

Overview: San Fang Chemical Industry Co., Ltd. specializes in the production and sale of artificial leather, synthetic resin, and other materials across Taiwan, China, Hong Kong, Southeast Asia, and international markets with a market cap of NT$15.44 billion.

Operations: San Fang Chemical Industry generates revenue primarily from its core segments, with SAN Fang Chemical Industry Co., Ltd. contributing NT$8.03 billion and Sanfang Development Co., Ltd. adding NT$1.78 billion.

San Fang Chemical Industry, a relatively small player in the chemicals sector, has been on an impressive growth trajectory. Over the past year, earnings surged by 76.4%, outpacing the industry average of 14.3%. The company reported third-quarter sales of TWD 3.11 billion and net income of TWD 385.86 million, showing solid year-over-year improvements from TWD 2.77 billion and TWD 314.68 million respectively. Basic earnings per share rose to TWD 0.97 from TWD 0.79 last year, reflecting robust financial health despite recent share price volatility over three months and a favorable debt-to-equity ratio reduction from 49% to 42%.

G-SHANK Enterprise (TWSE:2476)

Simply Wall St Value Rating: ★★★★★★

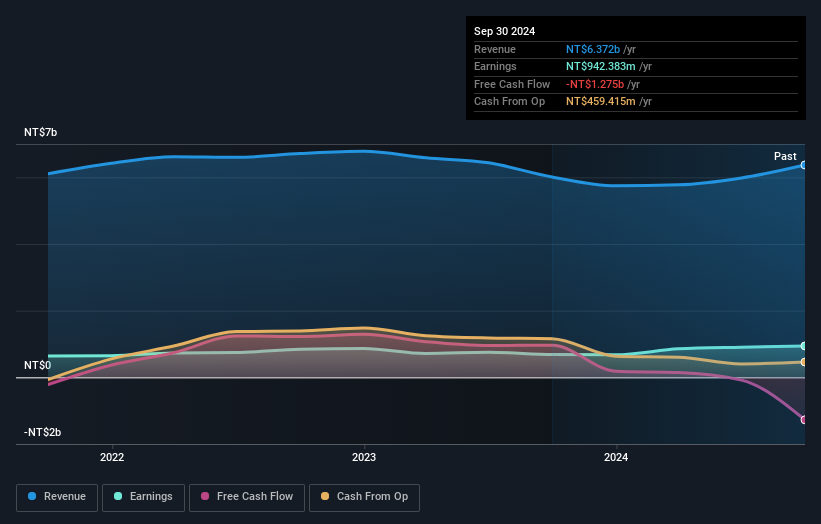

Overview: G-SHANK Enterprise Co., Ltd. is an investment holding company involved in the production and sales of molds, stamping parts, fixtures and tools, automatic machines and electrical appliances, and mechanical components both in Taiwan and internationally, with a market cap of approximately NT$17.68 billion.

Operations: The primary revenue stream for G-SHANK Enterprise comes from stamping parts, contributing NT$6.37 billion.

G-SHANK Enterprise, a promising player in the machinery sector, has shown robust financial performance recently. Over the past year, earnings surged by 37.6%, outpacing the industry's 14.6% growth rate. The company boasts a solid price-to-earnings ratio of 18.8x, which is below the TW market average of 20.7x, indicating potential undervaluation in its stock price. Despite a lack of free cash flow positivity currently, G-SHANK's sales revenue for November reached TWD 558 million compared to TWD 494 million last year and net income for Q3 increased to TWD 282 million from TWD 246 million previously, reflecting strong operational momentum and growth potential in an expanding market landscape.

Seize The Opportunity

- Discover the full array of 4624 Undiscovered Gems With Strong Fundamentals right here.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TWSE:1307

San Fang Chemical Industry

Manufactures and sells artificial leather, synthetic resin, and other materials in Taiwan, China, Hong Kong, Southeast Asia, and internationally.

Flawless balance sheet second-rate dividend payer.

Market Insights

Community Narratives