- Taiwan

- /

- Electronic Equipment and Components

- /

- TWSE:2472

3 Reliable Dividend Stocks Offering Up To 4.4% Yield

Reviewed by Simply Wall St

In the face of recent market volatility, driven by cautious Federal Reserve commentary and looming government shutdown fears, investors are increasingly seeking stability in their portfolios. Amid this backdrop, dividend stocks have emerged as a reliable option for those looking to balance risk with steady income streams.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Guaranty Trust Holding (NGSE:GTCO) | 6.30% | ★★★★★★ |

| Tsubakimoto Chain (TSE:6371) | 4.22% | ★★★★★★ |

| Yamato Kogyo (TSE:5444) | 4.10% | ★★★★★★ |

| Padma Oil (DSE:PADMAOIL) | 7.48% | ★★★★★★ |

| Southside Bancshares (NYSE:SBSI) | 4.53% | ★★★★★★ |

| FALCO HOLDINGS (TSE:4671) | 6.62% | ★★★★★★ |

| E J Holdings (TSE:2153) | 3.85% | ★★★★★★ |

| Citizens & Northern (NasdaqCM:CZNC) | 6.04% | ★★★★★★ |

| Premier Financial (NasdaqGS:PFC) | 4.73% | ★★★★★★ |

| Banque Cantonale Vaudoise (SWX:BCVN) | 5.23% | ★★★★★★ |

Click here to see the full list of 1959 stocks from our Top Dividend Stocks screener.

Let's uncover some gems from our specialized screener.

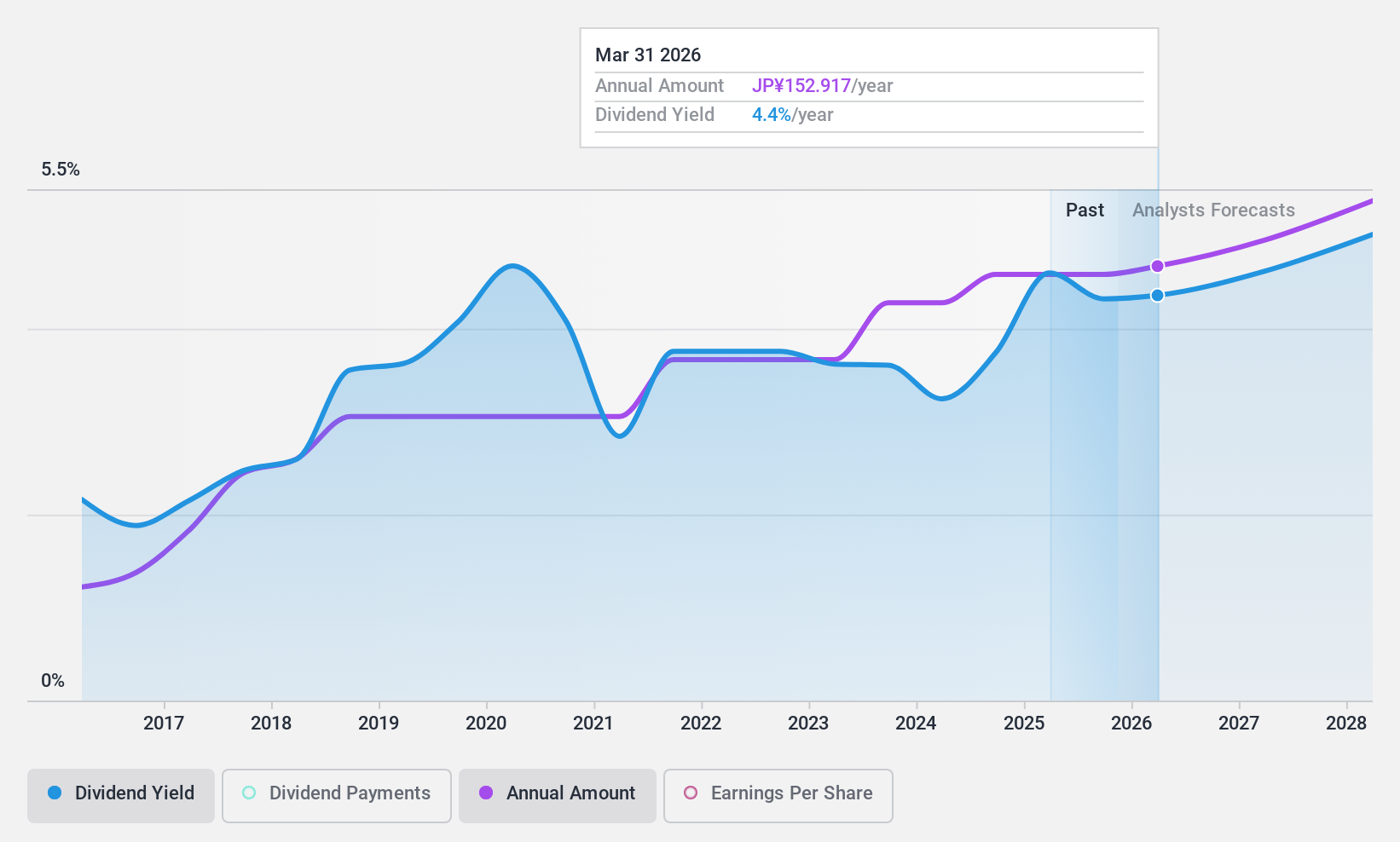

Mitsui Chemicals (TSE:4183)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Mitsui Chemicals, Inc. operates globally in sectors such as mobility, life and health care, basic and green materials, and ICT, with a market cap of ¥619.08 billion.

Operations: Mitsui Chemicals, Inc.'s revenue is derived from its key segments: Basic & Green Materials at ¥810.42 billion, Mobility Solutions at ¥570.13 billion, Life & Healthcare Solutions at ¥294.21 billion, and ICT Solutions at ¥241.26 billion.

Dividend Yield: 4.5%

Mitsui Chemicals' dividend yield of 4.46% ranks in the top 25% of JP market payers, supported by a reasonable payout ratio (53.5%) and cash flow coverage (62.2%). However, dividends have been volatile over the past decade. The company is executing a ¥10 billion share buyback to enhance shareholder returns and improve capital efficiency amid ongoing business reorganization efforts with Idemitsu Kosan to consolidate ethylene facilities for greater efficiency.

- Unlock comprehensive insights into our analysis of Mitsui Chemicals stock in this dividend report.

- In light of our recent valuation report, it seems possible that Mitsui Chemicals is trading beyond its estimated value.

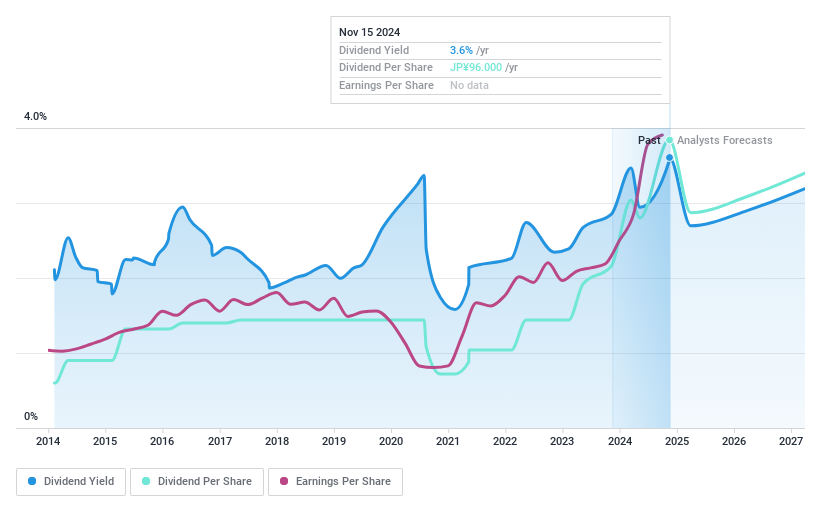

Konoike TransportLtd (TSE:9025)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Konoike Transport Co., Ltd. offers logistics services both in Japan and internationally, with a market cap of ¥159.48 billion.

Operations: Konoike Transport Co., Ltd.'s revenue is primarily derived from its Integrated Solutions Business at ¥210.92 billion, followed by the International Logistics Business at ¥64.29 billion and the Domestic Logistics Business at ¥56.58 billion.

Dividend Yield: 3.2%

Konoike Transport's dividend payments have grown over the past decade, with a recent increase from ¥24.00 to ¥35.00 per share for the second quarter and an annual forecast of ¥61.00 per share, up from ¥41.00 last year. Despite a low payout ratio of 14% and cash payout ratio of 38.4%, dividends have been volatile, impacting reliability. The stock trades below estimated fair value but offers a lower yield than top-tier JP market payers at 3.15%.

- Click here to discover the nuances of Konoike TransportLtd with our detailed analytical dividend report.

- According our valuation report, there's an indication that Konoike TransportLtd's share price might be on the cheaper side.

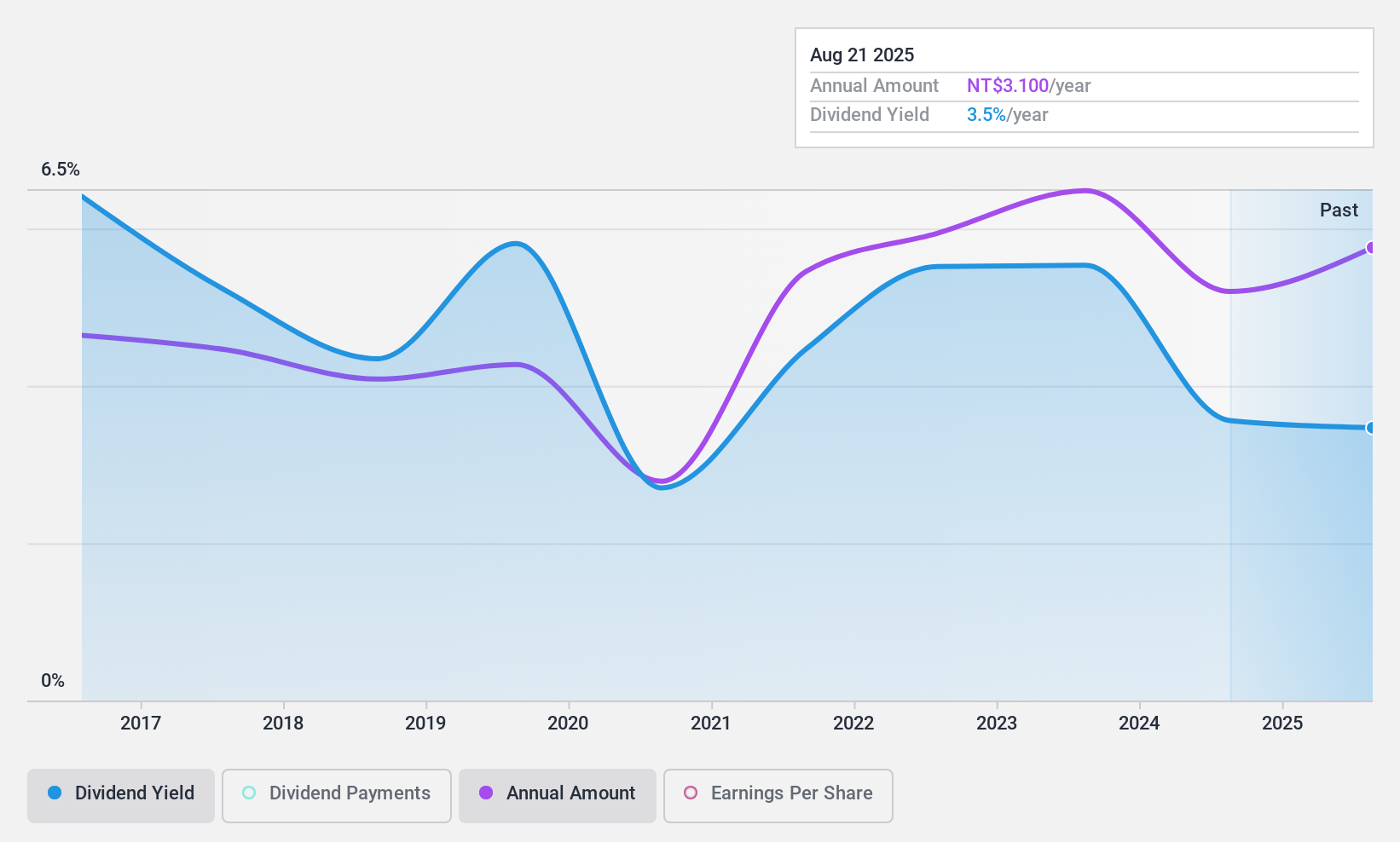

Lelon Electronics (TWSE:2472)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Lelon Electronics Corp. develops, manufactures, markets, trades in, and sells electrolytic capacitors worldwide with a market cap of NT$13.34 billion.

Operations: Lelon Electronics Corp.'s revenue is primarily derived from its LELON Department, contributing NT$6.29 billion, and the Li Dun Department, adding NT$4.15 billion.

Dividend Yield: 3.5%

Lelon Electronics' dividends are well-covered by both earnings and cash flows, with payout ratios of 43.3% and 38%, respectively. Despite these strong coverage metrics, the dividend history is volatile over the past decade, impacting reliability. Recent earnings show a mixed picture with increased sales but slightly lower quarterly net income compared to last year. The dividend yield of 3.47% is below Taiwan's top-tier market payers at 4.58%.

- Dive into the specifics of Lelon Electronics here with our thorough dividend report.

- Insights from our recent valuation report point to the potential undervaluation of Lelon Electronics shares in the market.

Seize The Opportunity

- Embark on your investment journey to our 1959 Top Dividend Stocks selection here.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TWSE:2472

Lelon Electronics

Develops, manufactures, markets, trades in, and sells electrolytic capacitors worldwide.

Flawless balance sheet, good value and pays a dividend.

Similar Companies

Market Insights

Community Narratives