- South Korea

- /

- Electronic Equipment and Components

- /

- KOSE:A248070

High Growth Tech Stocks to Watch in February 2025

Reviewed by Simply Wall St

As global markets grapple with tariff uncertainties and mixed economic indicators, the S&P 500 Index has shown resilience despite a slight decline, while manufacturing activity in the U.S. sees a positive turn for the first time in over two years. In this fluctuating environment, identifying high-growth tech stocks requires a focus on companies that demonstrate robust earnings growth and adaptability to shifting trade dynamics.

Top 10 High Growth Tech Companies

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Clinuvel Pharmaceuticals | 21.39% | 26.17% | ★★★★★★ |

| eWeLLLtd | 26.41% | 28.82% | ★★★★★★ |

| Medley | 20.95% | 27.32% | ★★★★★★ |

| AVITA Medical | 33.20% | 51.87% | ★★★★★★ |

| Pharma Mar | 23.24% | 44.74% | ★★★★★★ |

| Mental Health TechnologiesLtd | 25.83% | 113.12% | ★★★★★★ |

| TG Therapeutics | 29.48% | 43.58% | ★★★★★★ |

| Elliptic Laboratories | 61.01% | 121.13% | ★★★★★★ |

| Alkami Technology | 21.99% | 102.65% | ★★★★★★ |

| Lumentum Holdings | 21.25% | 118.58% | ★★★★★★ |

Click here to see the full list of 1215 stocks from our High Growth Tech and AI Stocks screener.

Let's explore several standout options from the results in the screener.

Solum (KOSE:A248070)

Simply Wall St Growth Rating: ★★★★★☆

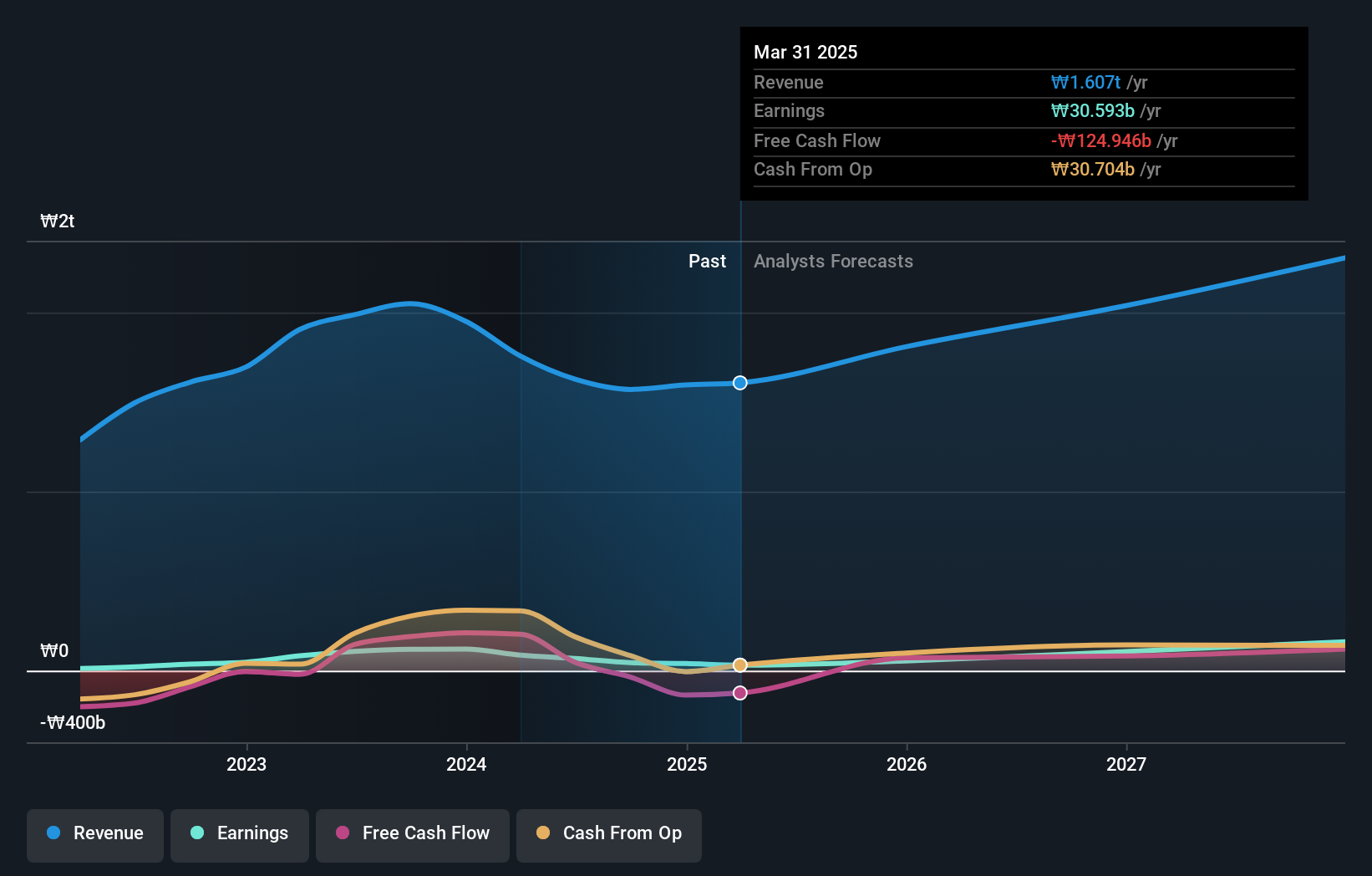

Overview: Solum Co., Ltd. is a company that manufactures and markets power modules, digital tuners, and electronic shelf labels both domestically in South Korea and internationally, with a market cap of approximately ₩897.74 billion.

Operations: The company's revenue is primarily driven by its ICT Business and Electronic Components Division, with the latter contributing significantly more at approximately ₩1.14 trillion compared to ₩432.21 billion from the former.

Solum, amidst a dynamic retail tech landscape, is capitalizing on the burgeoning demand for in-store digital advertising solutions. With its recent showcase of AI-enhanced displays at CES 2025, Solum is not just aligning with market trends—projected to hit $156 billion by 2026—but also innovating customer interaction through real-time behavior analysis and targeted ads. Financially, while grappling with a high debt level and a dip in profit margins from 5.8% to 2.8%, Solum's aggressive push in R&D has fostered promising avenues for growth; notably, its earnings are expected to surge by an impressive 50% annually. This strategic pivot towards advanced advertising technologies could significantly bolster its market position if it successfully manages the challenges posed by its financial health.

- Click here to discover the nuances of Solum with our detailed analytical health report.

Evaluate Solum's historical performance by accessing our past performance report.

Sky ICT (SET:SKY)

Simply Wall St Growth Rating: ★★★★★☆

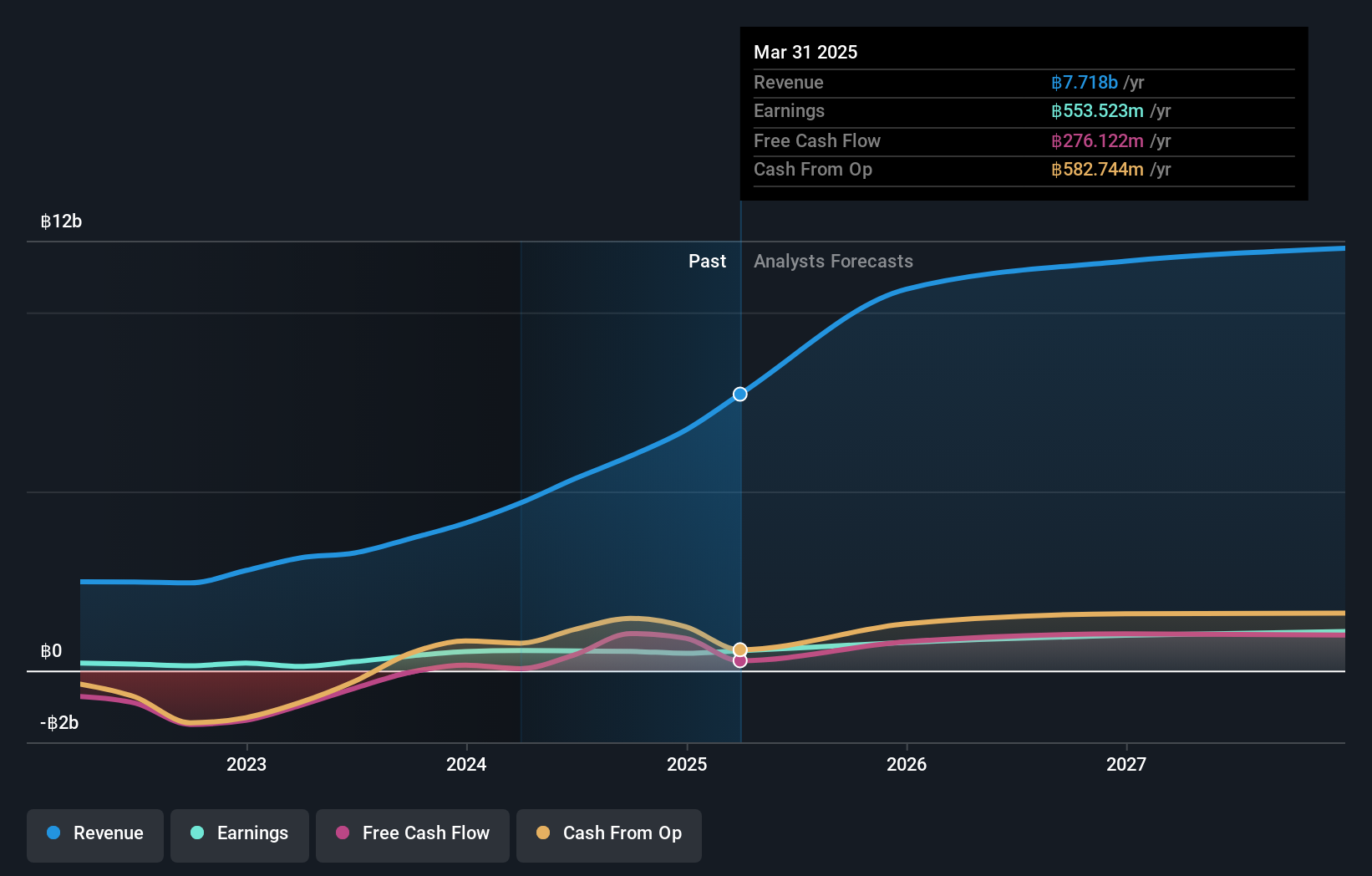

Overview: Sky ICT Public Company Limited operates in the information and communication technology and system integration sectors in Thailand, with a market capitalization of THB14.67 billion.

Operations: Sky ICT focuses on system integration services and sales and services, excluding system integration but including finance lease contracts, generating THB972.20 million and THB5.02 billion respectively. The company operates primarily in Thailand's ICT sector.

Sky ICT is demonstrating robust growth in a competitive tech landscape, with its revenue soaring by 29.7% annually and earnings projected to rise by 33.6% per year, outpacing the broader Thai market's average. This performance is underpinned by significant R&D investments that align with industry demands for innovative software solutions. Despite challenges like insufficient coverage of interest payments by earnings, Sky ICT's strategic focus on enhancing product offerings and operational efficiency could position it well for sustained growth amidst evolving market conditions. The firm’s ability to maintain a positive free cash flow while expanding its technological capabilities suggests potential resilience and adaptability in navigating future industry shifts.

- Get an in-depth perspective on Sky ICT's performance by reading our health report here.

Examine Sky ICT's past performance report to understand how it has performed in the past.

Posiflex Technology (TWSE:8114)

Simply Wall St Growth Rating: ★★★★☆☆

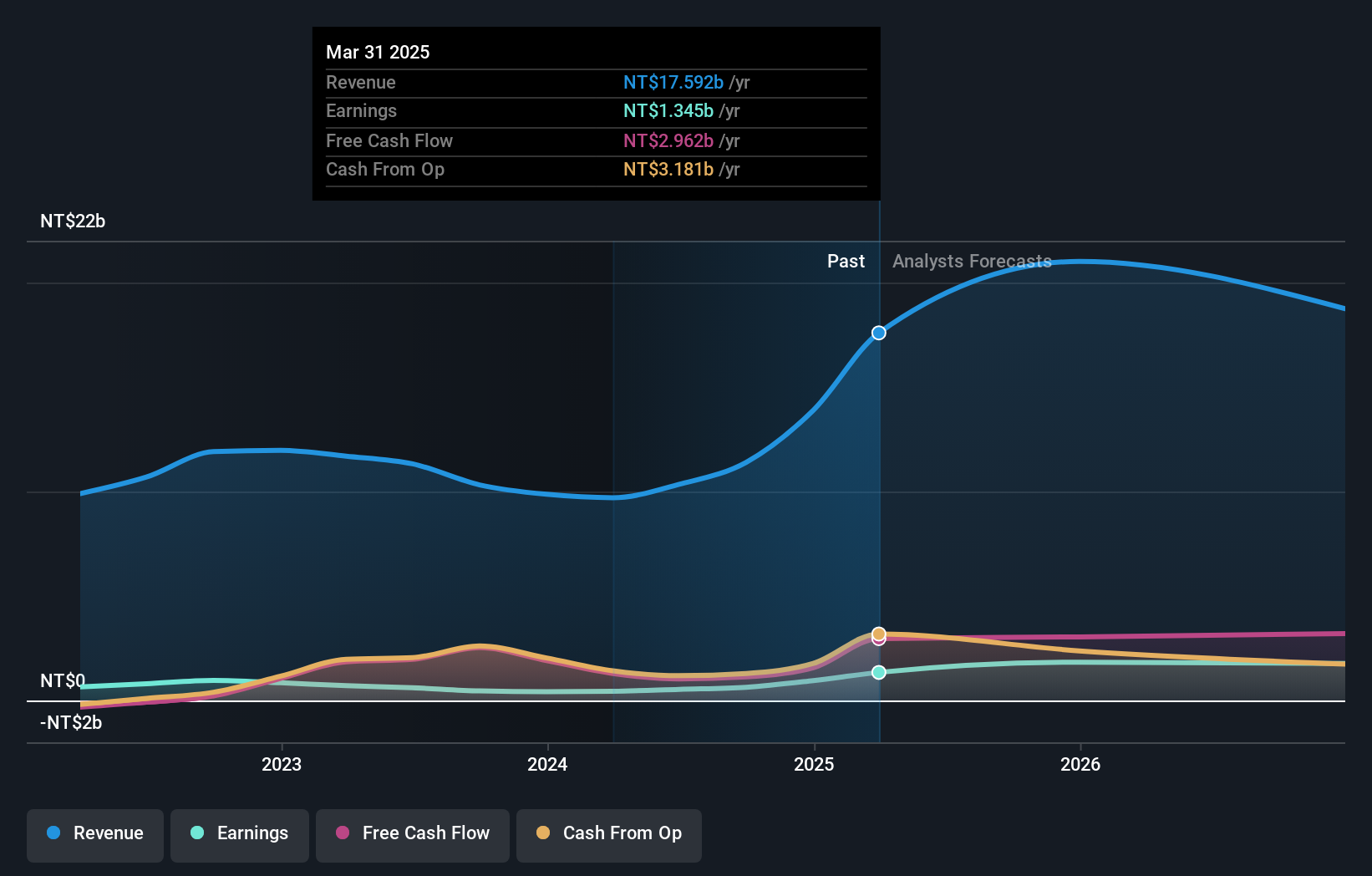

Overview: Posiflex Technology, Inc. manufactures and sells industrial computers and peripheral equipment in Taiwan, the United States, and internationally, with a market cap of NT$33.94 billion.

Operations: Posiflex Technology generates revenue primarily from the United States and domestic markets, with sales figures of NT$7 billion and NT$2.51 billion, respectively. The company focuses on industrial computers and peripheral equipment across these regions.

Posiflex Technology has showcased a robust performance, with third-quarter sales climbing to TWD 3.6 billion, up from TWD 2.5 billion the previous year, and net income reaching TWD 295 million from TWD 167 million. This surge reflects a substantial annualized revenue growth of 13.9% and earnings growth of 27.1%. The company's commitment to innovation is evident in its R&D efforts, crucial for maintaining competitive edge in the dynamic tech landscape. Despite market volatility and shareholder dilution over the past year, Posiflex's strategic initiatives and financial results indicate potential for sustained growth amidst industry challenges.

Summing It All Up

- Unlock more gems! Our High Growth Tech and AI Stocks screener has unearthed 1212 more companies for you to explore.Click here to unveil our expertly curated list of 1215 High Growth Tech and AI Stocks.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About KOSE:A248070

Solum

Manufactures and markets power modules, digital tuners, and electronic shelf labels to customers in South Korea and internationally.

Adequate balance sheet and fair value.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

A case for USD $14.81 per share based on book value. Be warned, this is a micro-cap dependent on a single mine.

Occidental Petroleum to Become Fairly Priced at $68.29 According to Future Projections

Agfa-Gevaert is a digital and materials turnaround opportunity, with growth potential in ZIRFON, but carrying legacy risks.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)