Global Value Stocks That May Be Priced Below Intrinsic Estimates In March 2025

Reviewed by Simply Wall St

As global markets navigate a landscape marked by declining consumer confidence and inflationary pressures, investors are keenly observing the impact of policy risks and growth concerns on stock valuations. Amidst these challenges, identifying undervalued stocks that may be priced below their intrinsic value can offer potential opportunities for those seeking to capitalize on market inefficiencies.

Top 10 Undervalued Stocks Based On Cash Flows

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Zhejiang Meorient Commerce Exhibition (SZSE:300795) | CN¥23.57 | CN¥46.81 | 49.7% |

| Zhejiang Cfmoto PowerLtd (SHSE:603129) | CN¥178.08 | CN¥352.75 | 49.5% |

| Laboratorios Farmaceuticos Rovi (BME:ROVI) | €53.65 | €107.22 | 50% |

| Hyosung Heavy Industries (KOSE:A298040) | ₩431000.00 | ₩851575.48 | 49.4% |

| Bide Pharmatech (SHSE:688073) | CN¥53.95 | CN¥106.91 | 49.5% |

| Gushengtang Holdings (SEHK:2273) | HK$41.00 | HK$81.81 | 49.9% |

| Storytel (OM:STORY B) | SEK89.55 | SEK177.35 | 49.5% |

| Fnac Darty (ENXTPA:FNAC) | €28.00 | €55.38 | 49.4% |

| Star7 (BIT:STAR7) | €6.20 | €12.29 | 49.5% |

| Doosan Fuel Cell (KOSE:A336260) | ₩16010.00 | ₩31670.96 | 49.4% |

We'll examine a selection from our screener results.

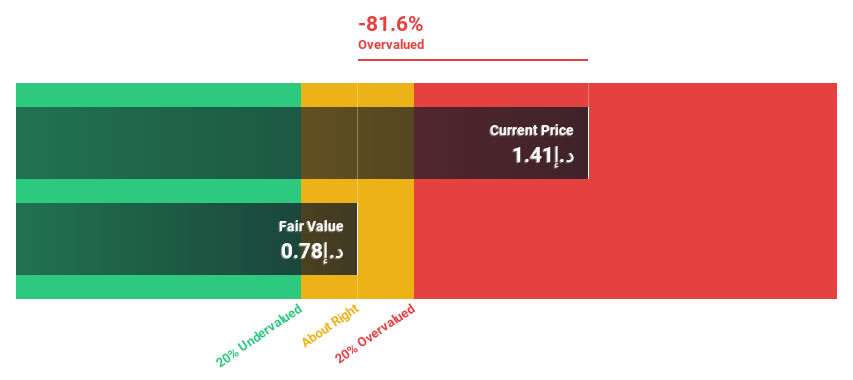

Burjeel Holdings (ADX:BURJEEL)

Overview: Burjeel Holdings PLC, along with its subsidiaries, operates multi-specialty hospitals and medical centers in the United Arab Emirates, the Sultanate of Oman, and the Kingdom of Saudi Arabia, with a market cap of AED8.12 billion.

Operations: The company's revenue segments include AED3.29 billion from hospitals and AED0.68 billion from medical centers across the United Arab Emirates, the Sultanate of Oman, and the Kingdom of Saudi Arabia.

Estimated Discount To Fair Value: 12.8%

Burjeel Holdings is trading at AED1.56, below its estimated fair value of AED1.79, suggesting it may be undervalued based on cash flows. Despite this, interest payments are not well covered by earnings, which could be a concern. Revenue growth is expected at 12% annually, faster than the AE market's 6.7%. Earnings are forecast to grow significantly at over 40% per year, indicating robust potential for future profitability improvement despite recent margin declines.

- Upon reviewing our latest growth report, Burjeel Holdings' projected financial performance appears quite optimistic.

- Dive into the specifics of Burjeel Holdings here with our thorough financial health report.

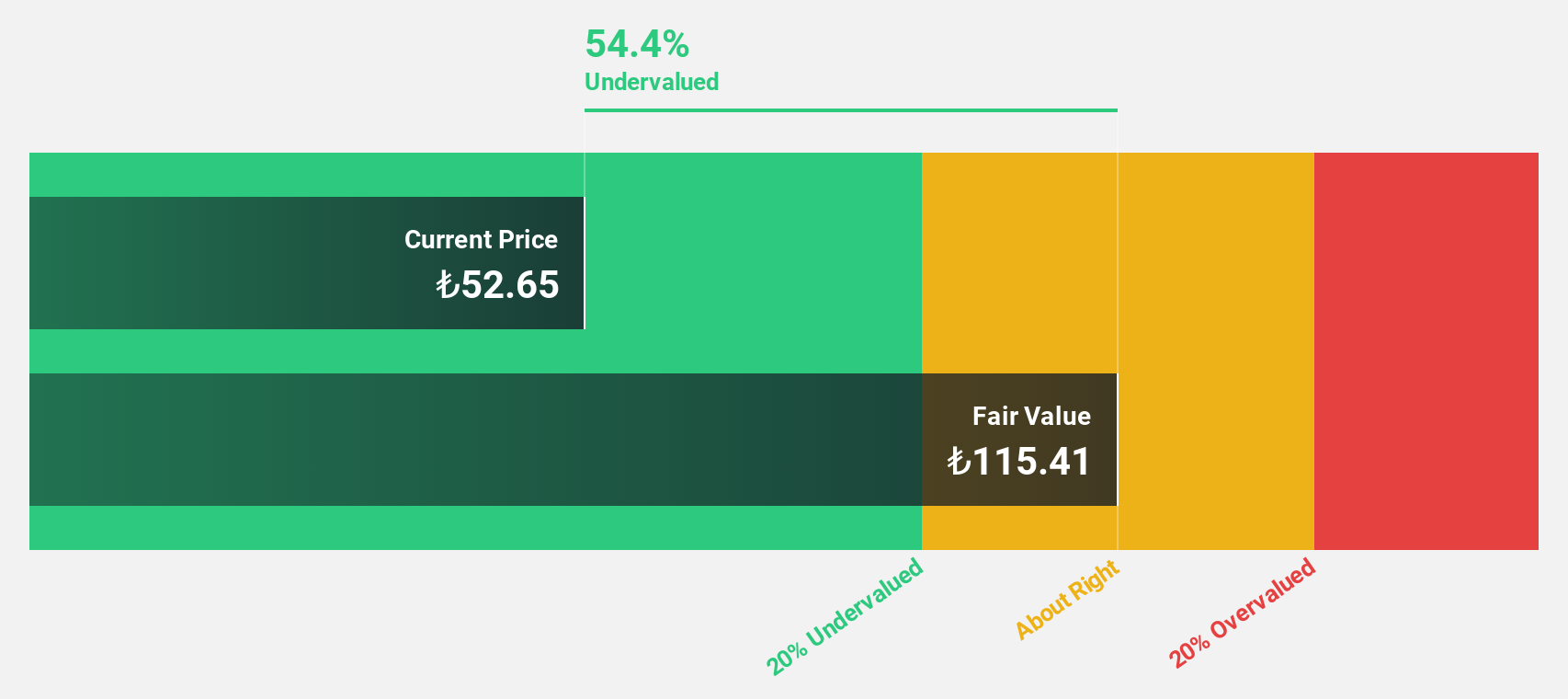

Coca-Cola Içecek Anonim Sirketi (IBSE:CCOLA)

Overview: Coca-Cola Içecek Anonim Sirketi, along with its subsidiaries, produces, sells, and distributes sparkling and still beverages across Turkey, Pakistan, Central Asia, and the Middle East with a market capitalization of TRY153.47 billion.

Operations: The company's revenue is primarily derived from its non-alcoholic beverages segment, amounting to TRY95.24 billion.

Estimated Discount To Fair Value: 23.4%

Coca-Cola Içecek Anonim Sirketi, with a trading price of TRY54.85, appears undervalued based on cash flow analysis as it trades 23.4% below its estimated fair value of TRY71.6. Despite a decline in net income from TRY 29,713 million to TRY 14,813 million for the year ending December 31, 2024, analysts predict a stock price increase of over 50%. Revenue is expected to grow at an annual rate of 23.6%, outpacing the Turkish market average growth rate.

- Insights from our recent growth report point to a promising forecast for Coca-Cola Içecek Anonim Sirketi's business outlook.

- Take a closer look at Coca-Cola Içecek Anonim Sirketi's balance sheet health here in our report.

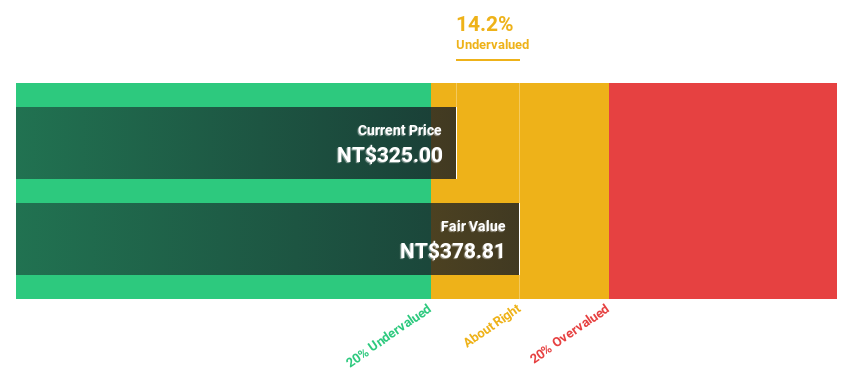

Posiflex Technology (TWSE:8114)

Overview: Posiflex Technology, Inc. manufactures and sells industrial computers and peripheral equipment in Taiwan, the United States, and internationally, with a market cap of NT$32.50 billion.

Operations: The company's revenue segments, in millions of NT$, are as follows: United States: 7002.15 and Domestic Business: 2513.04.

Estimated Discount To Fair Value: 14.0%

Posiflex Technology, trading at NT$322.5, is undervalued based on cash flow analysis, positioned 14% below its fair value of NT$374.89. Despite recent shareholder dilution and a volatile share price, earnings grew by 38.8% last year and are forecast to rise significantly at 28.22% annually—surpassing the TW market's average growth rate of 17.4%. Revenue growth is also expected to outpace the market's rate over the next few years.

- Our earnings growth report unveils the potential for significant increases in Posiflex Technology's future results.

- Unlock comprehensive insights into our analysis of Posiflex Technology stock in this financial health report.

Where To Now?

- Embark on your investment journey to our 506 Undervalued Global Stocks Based On Cash Flows selection here.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

If you're looking to trade Coca-Cola Içecek Anonim Sirketi, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About IBSE:CCOLA

Coca-Cola Içecek Anonim Sirketi

Engages in the production, sales, and distribution of sparkling and still beverages in Turkey, Pakistan, Central Asia, and the Middle East.

Undervalued with excellent balance sheet and pays a dividend.