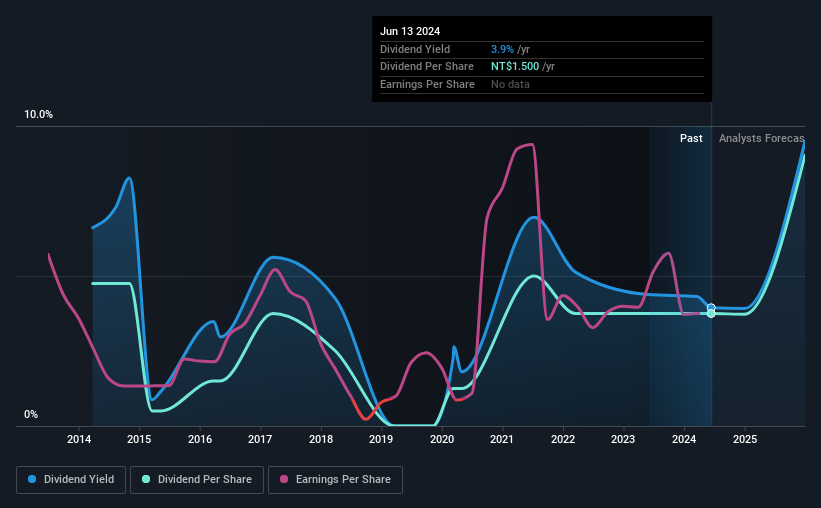

Gemtek Technology Co., Ltd.'s (TWSE:4906) investors are due to receive a payment of NT$1.50 per share on 19th of July. Based on this payment, the dividend yield on the company's stock will be 3.9%, which is an attractive boost to shareholder returns.

View our latest analysis for Gemtek Technology

Gemtek Technology's Dividend Is Well Covered By Earnings

If the payments aren't sustainable, a high yield for a few years won't matter that much. Before making this announcement, Gemtek Technology's dividend was higher than its profits, but the free cash flows quite comfortably covered it. Given that the dividend is a cash outflow, we think that cash is more important than accounting measures of profit when assessing the dividend, so this is a mitigating factor.

Over the next year, EPS could expand by 97.9% if recent trends continue. Assuming the dividend continues along the course it has been charting recently, our estimates show the payout ratio being 51% which brings it into quite a comfortable range.

Dividend Volatility

The company's dividend history has been marked by instability, with at least one cut in the last 10 years. The annual payment during the last 10 years was NT$1.90 in 2014, and the most recent fiscal year payment was NT$1.50. The dividend has shrunk at around 2.3% a year during that period. Declining dividends isn't generally what we look for as they can indicate that the company is running into some challenges.

Gemtek Technology Might Find It Hard To Grow Its Dividend

Growing earnings per share could be a mitigating factor when considering the past fluctuations in the dividend. Gemtek Technology has impressed us by growing EPS at 98% per year over the past five years. While EPS is growing rapidly, Gemtek Technology paid out a very high 96% of its income as dividends. If earnings continue to grow, this dividend may be sustainable, but we think a payout this high definitely bears watching.

Our Thoughts On Gemtek Technology's Dividend

Overall, it's nice to see a consistent dividend payment, but we think that longer term, the current level of payment might be unsustainable. The payments haven't been particularly stable and we don't see huge growth potential, but with the dividend well covered by cash flows it could prove to be reliable over the short term. This company is not in the top tier of income providing stocks.

Market movements attest to how highly valued a consistent dividend policy is compared to one which is more unpredictable. Meanwhile, despite the importance of dividend payments, they are not the only factors our readers should know when assessing a company. Taking the debate a bit further, we've identified 2 warning signs for Gemtek Technology that investors need to be conscious of moving forward. Is Gemtek Technology not quite the opportunity you were looking for? Why not check out our selection of top dividend stocks.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TWSE:4906

Gemtek Technology

Researches, develops, designs, produces, and sells wireless communications products in Taiwan and internationally.

Flawless balance sheet second-rate dividend payer.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Butler National (Buks) outperforms.

A tech powerhouse quietly powering the world’s AI infrastructure.

Keppel DC REIT (SGX: AJBU) is a resilient gem in the data center space.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)