- Taiwan

- /

- Communications

- /

- TPEX:6263

Soft-World International And 2 Other Reliable Dividend Stocks For Your Portfolio

Reviewed by Simply Wall St

As global markets continue to reach record highs, buoyed by strong consumer spending and geopolitical developments, investors are increasingly looking for stability amid uncertainties such as potential tariff hikes and fluctuating inflation rates. In this context, dividend stocks like Soft-World International offer a reliable income stream and can serve as a buffer against market volatility, making them an attractive option for those seeking steady returns in their portfolios.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Tsubakimoto Chain (TSE:6371) | 4.27% | ★★★★★★ |

| Wuliangye YibinLtd (SZSE:000858) | 3.22% | ★★★★★★ |

| CAC Holdings (TSE:4725) | 4.68% | ★★★★★★ |

| GakkyushaLtd (TSE:9769) | 4.63% | ★★★★★★ |

| Yamato Kogyo (TSE:5444) | 3.94% | ★★★★★★ |

| Guangxi LiuYao Group (SHSE:603368) | 3.25% | ★★★★★★ |

| Padma Oil (DSE:PADMAOIL) | 7.08% | ★★★★★★ |

| FALCO HOLDINGS (TSE:4671) | 6.85% | ★★★★★★ |

| HUAYU Automotive Systems (SHSE:600741) | 4.47% | ★★★★★★ |

| E J Holdings (TSE:2153) | 3.90% | ★★★★★★ |

Click here to see the full list of 1976 stocks from our Top Dividend Stocks screener.

Let's dive into some prime choices out of the screener.

Soft-World International (TPEX:5478)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Soft-World International Corporation develops, operates, and distributes games in Taiwan and China with a market cap of NT$19.78 billion.

Operations: Soft-World International Corporation generates revenue through its game development, operation, and distribution activities in Taiwan and China.

Dividend Yield: 6.7%

Soft-World International's recent earnings report shows improved financial performance, with third-quarter sales reaching TWD 1.82 billion and net income at TWD 275.53 million. However, its dividend sustainability is questionable due to a high payout ratio of 112.6%, indicating dividends are not fully covered by earnings despite being supported by cash flows at a 78.6% cash payout ratio. The dividend yield is attractive at 6.67%, but past volatility raises concerns about reliability for investors seeking stable returns.

- Click here and access our complete dividend analysis report to understand the dynamics of Soft-World International.

- The analysis detailed in our Soft-World International valuation report hints at an deflated share price compared to its estimated value.

Planet Technology (TPEX:6263)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Planet Technology Corporation offers IP-based networking products and solutions for small-to-medium-sized businesses, enterprises, and network infrastructures globally, with a market cap of NT$10.13 billion.

Operations: Planet Technology Corporation generates revenue of NT$1.85 billion from its Computer Network Equipment/Furniture & Telecommunication Products segment.

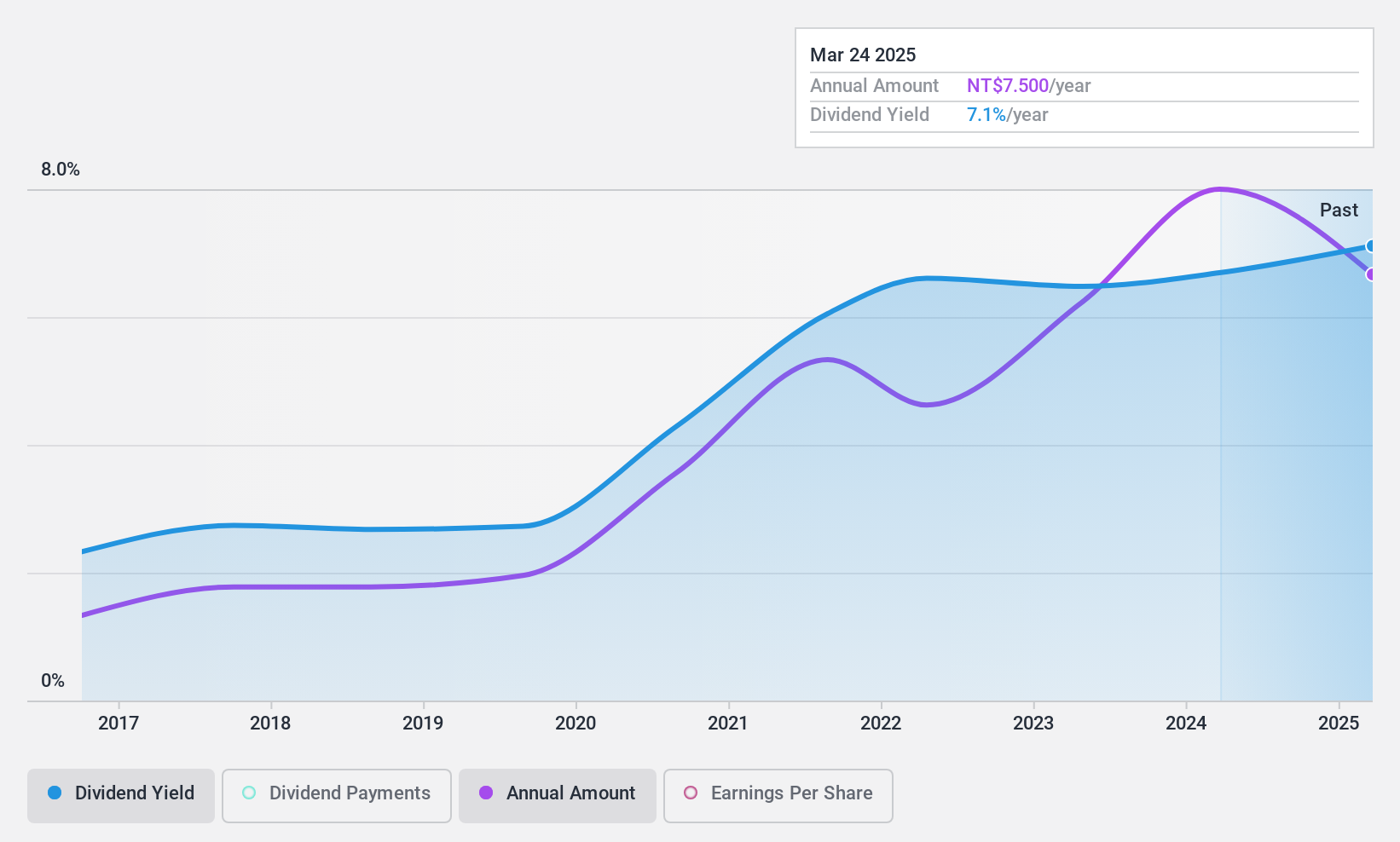

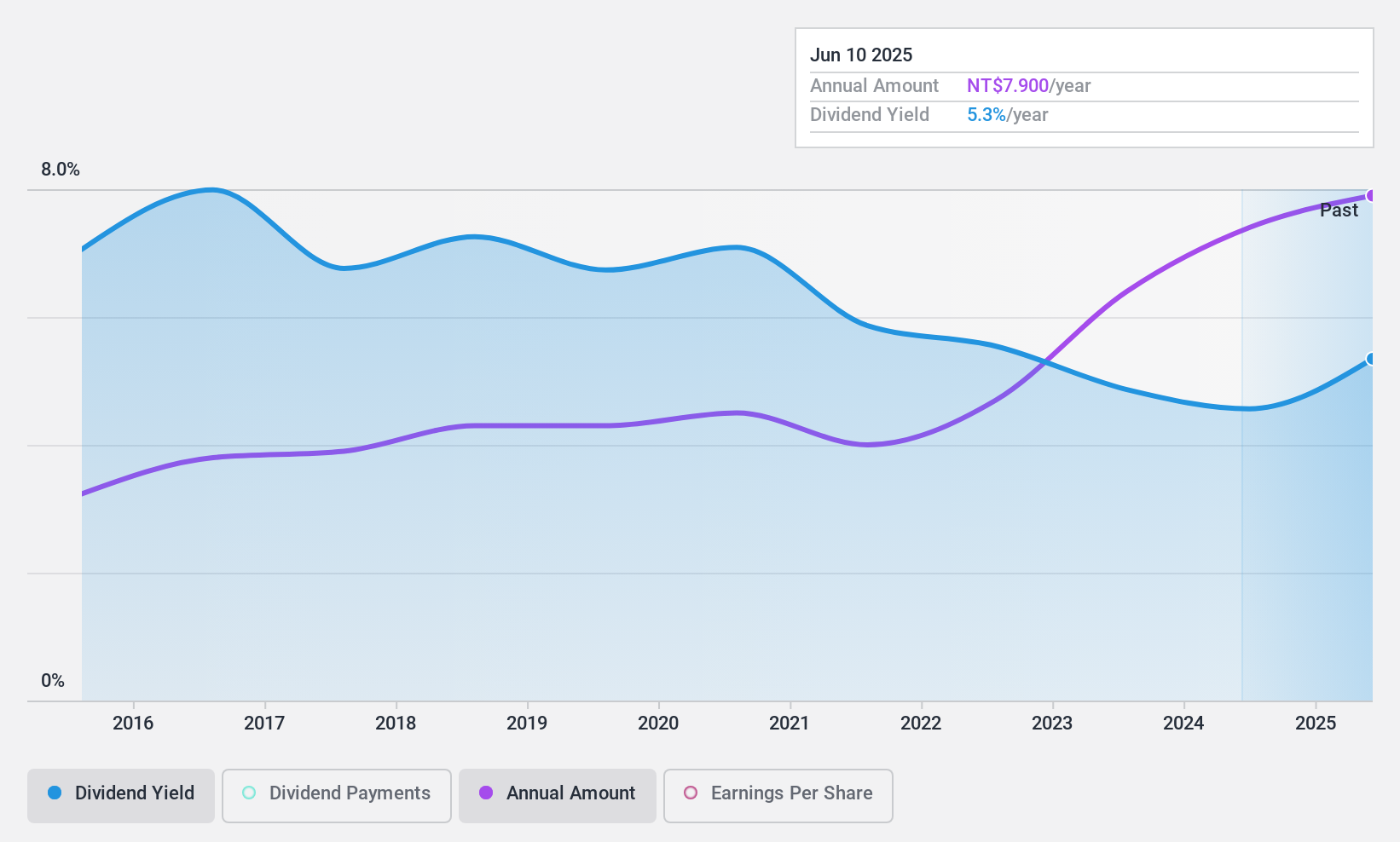

Dividend Yield: 4.5%

Planet Technology's recent earnings report indicates stable financial performance with third-quarter sales of TWD 459.67 million and net income of TWD 129.17 million. The company's dividend payments have been reliable and growing over the past decade, but a high cash payout ratio of 95.7% suggests limited coverage by cash flows, raising concerns about sustainability. Despite this, dividends remain covered by earnings with an 89.9% payout ratio, offering a competitive yield in the TW market at 4.47%.

- Click to explore a detailed breakdown of our findings in Planet Technology's dividend report.

- Insights from our recent valuation report point to the potential overvaluation of Planet Technology shares in the market.

Arcadyan Technology (TWSE:3596)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Arcadyan Technology Corporation, along with its subsidiaries, focuses on the research, development, manufacture, and sale of broadband access, multimedia, and wireless infrastructure solutions with a market cap of NT$38.45 billion.

Operations: Arcadyan Technology Corporation generates revenue primarily from its Communication Network segment, which accounted for NT$51.01 billion.

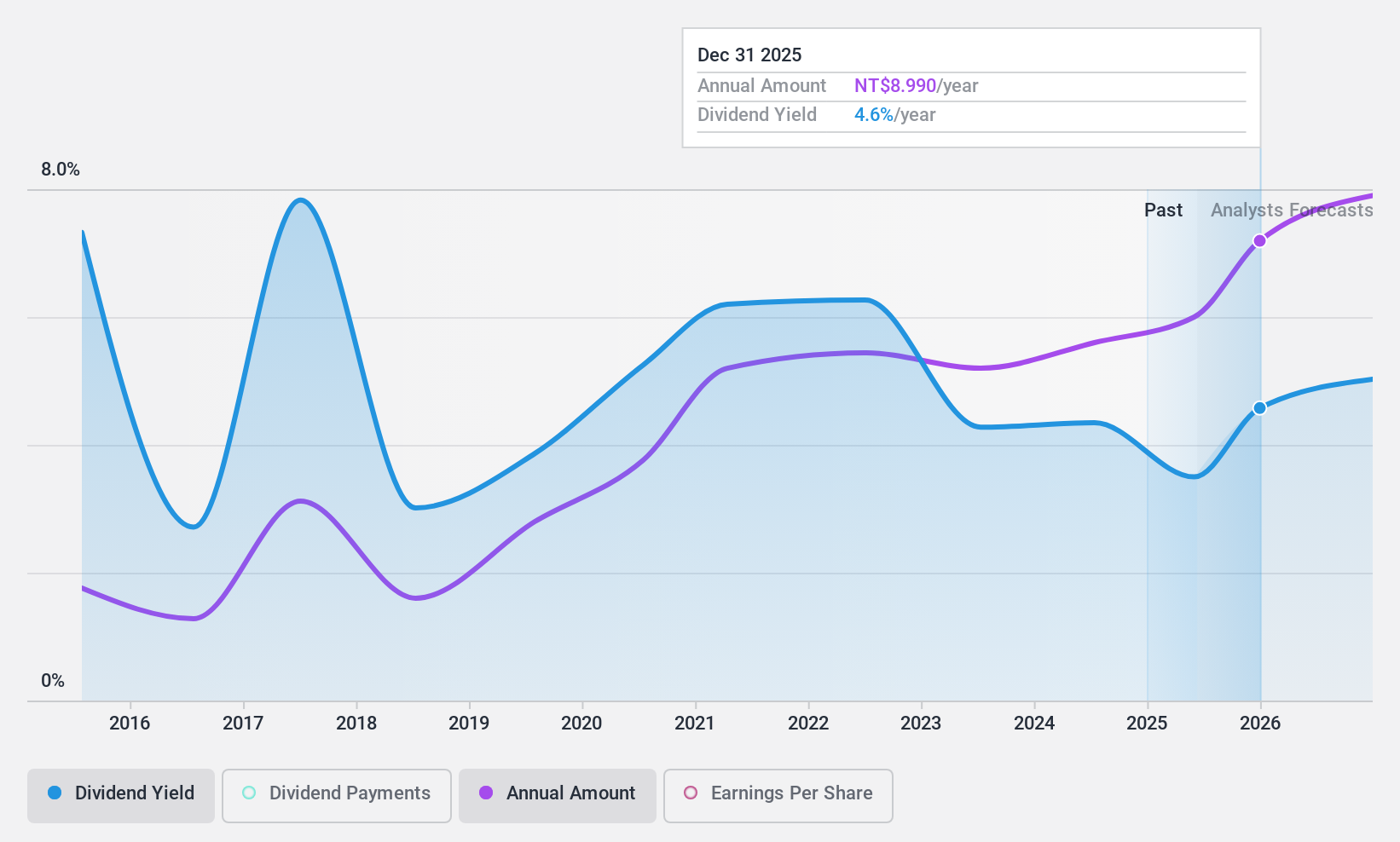

Dividend Yield: 4%

Arcadyan Technology's recent financial performance shows a decline in third-quarter sales and net income year-over-year, with TWD 12.17 billion in sales and TWD 657.68 million in net income. Despite this, the company's dividends are well-covered by earnings (61% payout ratio) and cash flows (27.5% cash payout ratio), although dividend payments have been volatile over the past decade. Trading at a favorable price-to-earnings ratio of 15.1x, Arcadyan offers a modest dividend yield of 4.03%.

- Get an in-depth perspective on Arcadyan Technology's performance by reading our dividend report here.

- According our valuation report, there's an indication that Arcadyan Technology's share price might be on the cheaper side.

Seize The Opportunity

- Take a closer look at our Top Dividend Stocks list of 1976 companies by clicking here.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TPEX:6263

Planet Technology

Provides IP-based networking products and solutions for small-to-medium-sized businesses, enterprises, and network infrastructures in Europe, the United States, Asia, and internationally.

Flawless balance sheet established dividend payer.