- Taiwan

- /

- Electronic Equipment and Components

- /

- TWSE:6805

Exploring High Growth Tech Stocks In Asia December 2025

Reviewed by Simply Wall St

In December 2025, the Asian markets are navigating a complex landscape marked by global economic shifts and regional challenges, with technology stocks particularly under scrutiny due to concerns over valuations and the sustainability of elevated spending in AI infrastructure. Amidst these dynamics, identifying high-growth tech stocks requires a keen understanding of market trends and an ability to assess how companies are adapting to both local economic conditions and broader technological advancements.

Top 10 High Growth Tech Companies In Asia

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Shengyi TechnologyLtd | 21.50% | 32.87% | ★★★★★★ |

| Giant Network Group | 34.73% | 40.54% | ★★★★★★ |

| Zhongji Innolight | 34.93% | 35.60% | ★★★★★★ |

| Fositek | 37.83% | 51.54% | ★★★★★★ |

| Gold Circuit Electronics | 29.41% | 37.22% | ★★★★★★ |

| Knowmerce | 42.51% | 33.23% | ★★★★★★ |

| Shengyi Electronics | 24.67% | 33.32% | ★★★★★★ |

| eWeLLLtd | 21.55% | 22.80% | ★★★★★★ |

| Co-Tech Development | 35.68% | 75.80% | ★★★★★★ |

| CARsgen Therapeutics Holdings | 100.40% | 118.16% | ★★★★★★ |

Let's uncover some gems from our specialized screener.

Medy-Tox (KOSDAQ:A086900)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Medy-Tox Inc. is a South Korean biopharmaceutical company with a market cap of approximately ₩865.53 billion, focusing on the development and commercialization of medical treatments.

Operations: The company generates revenue primarily from its biotechnology segment, amounting to approximately ₩241.80 billion.

Medy-Tox, a player in the high-growth biotech sector in Asia, has demonstrated robust financial performance with a notable 103.6% earnings growth over the past year, significantly outpacing the industry average of 44.3%. This surge is supported by an aggressive R&D investment strategy, crucial for maintaining its competitive edge and fostering innovation. Despite facing challenges from a one-off loss of ₩8.2B, Medy-Tox's revenue growth remains strong at 16.1% annually, expected to continue outperforming the Korean market's average of 10.6%. Furthermore, recent strategic moves include a share repurchase program where Medy-Tox bought back shares worth KRW 2,999.84 million to boost shareholder value—a testament to their confidence in sustained long-term growth and stability within the volatile biotech landscape.

- Unlock comprehensive insights into our analysis of Medy-Tox stock in this health report.

Understand Medy-Tox's track record by examining our Past report.

Unimicron Technology (TWSE:3037)

Simply Wall St Growth Rating: ★★★★☆☆

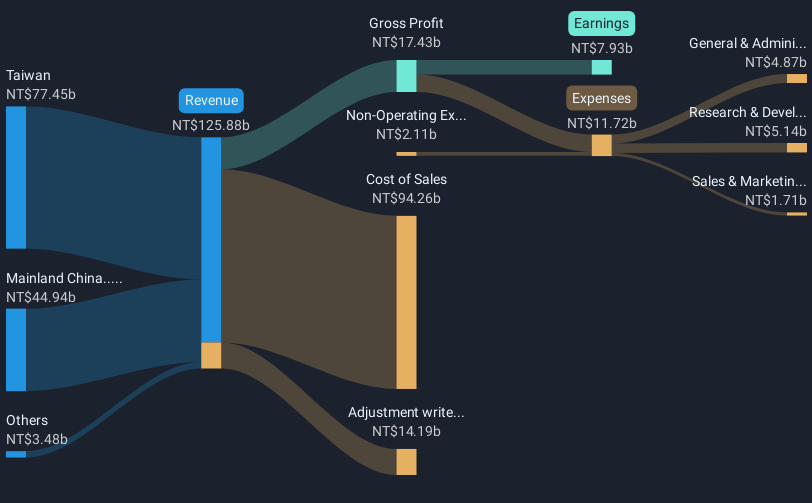

Overview: Unimicron Technology Corp. is involved in the development, manufacturing, processing, and sale of printed circuit boards and electronic products globally, with a market cap of NT$343.95 billion.

Operations: Unimicron Technology Corp. focuses on producing printed circuit boards, electrical equipment, electronic products, and testing systems for integrated circuits across global markets. The company generates significant revenue from Taiwan (NT$88.64 billion) and Mainland China (NT$52.63 billion).

Unimicron Technology has recently shown a remarkable financial upturn, with third-quarter sales rising to TWD 33.99 billion, a significant leap from TWD 31.71 billion the previous year. This growth is underpinned by a robust net income increase to TWD 2.19 billion from TWD 997 million, reflecting an earnings surge of over 100%. Despite this progress and an aggressive annual earnings forecast growth of 73.3%, challenges persist due to a substantial one-off loss of NT$1.5B affecting its recent financial results and a profit margin decrease to 2.5% from last year’s 7.1%. Unimicron's commitment to innovation is evident in its R&D investments, crucial for sustaining competitiveness in the fast-evolving tech landscape of Asia, although it struggles with high volatility in its share price and lower than expected revenue growth projections at just above the market average.

Fositek (TWSE:6805)

Simply Wall St Growth Rating: ★★★★★★

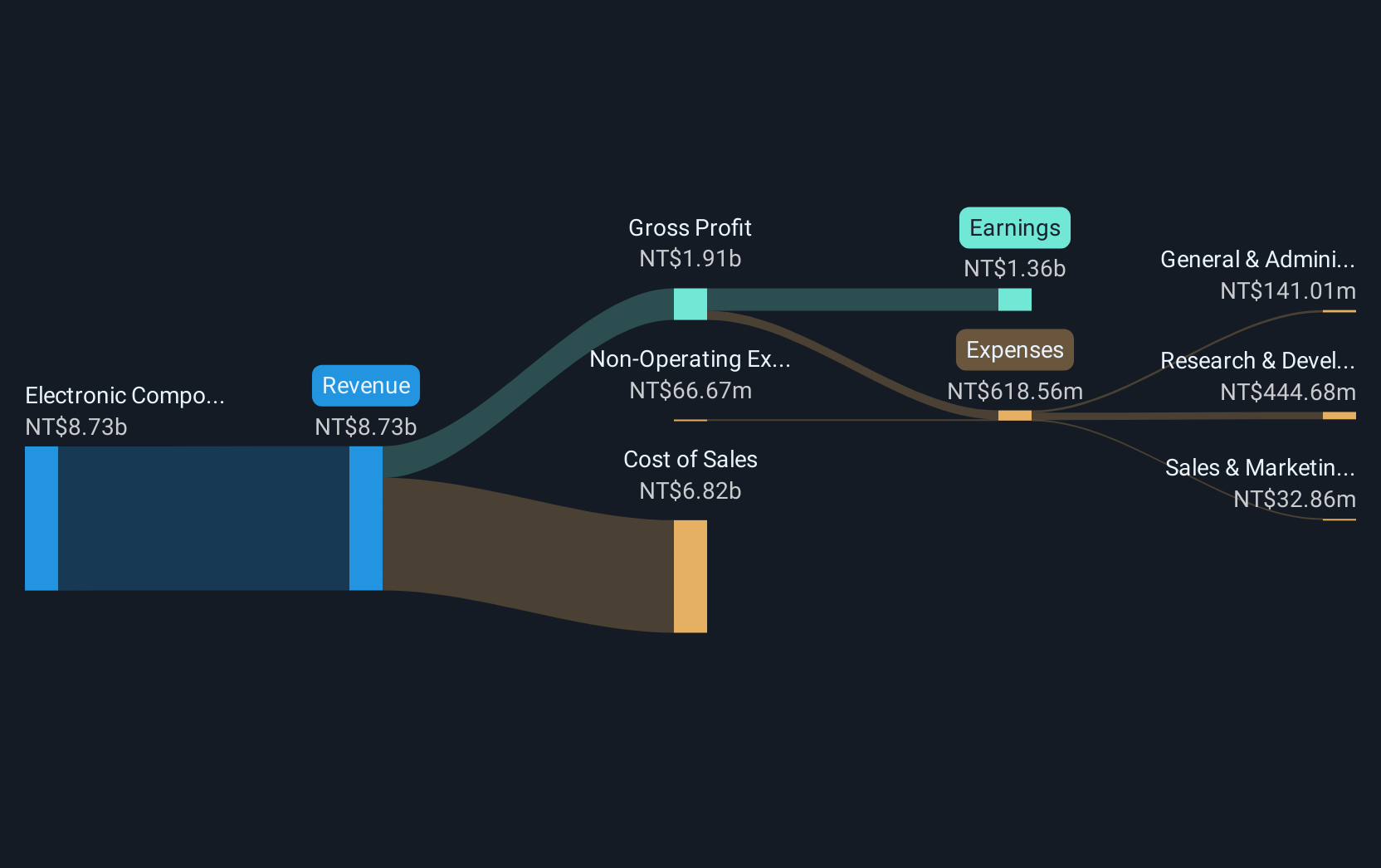

Overview: Fositek Corp. specializes in the design and manufacturing of metal stamping products across Asia, the United States, and Europe, with a market capitalization of NT$110.03 billion.

Operations: Fositek Corp. generates revenue primarily from its Electronic Components & Parts segment, which accounts for NT$11.21 billion.

Fositek has demonstrated robust growth, with a 37.8% annual revenue increase and a notable 51.5% surge in earnings per year, outpacing both the industry and broader market trends. This performance is bolstered by significant R&D investments, which have risen to TWD 500 million this year, accounting for approximately 6% of their total revenue. These strategic expenditures are crucial for Fositek as they navigate the competitive tech landscape in Asia, particularly in developing cutting-edge software solutions that meet evolving consumer and business needs. The company's recent earnings report underscores its upward trajectory with third-quarter sales more than doubling year-over-year to TWD 3.57 billion and net income also showing a strong increase from TWD 334 million to TWD 687 million.

- Dive into the specifics of Fositek here with our thorough health report.

Evaluate Fositek's historical performance by accessing our past performance report.

Where To Now?

- Take a closer look at our Asian High Growth Tech and AI Stocks list of 188 companies by clicking here.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TWSE:6805

Fositek

Engages in the design and manufacturing of various metal stamping products in Asia, the United States, and Europe.

Exceptional growth potential with outstanding track record.

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Stride Stock: Online Education Finds Its Second Act

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)