- Japan

- /

- Construction

- /

- TSE:1926

Allmind Holdings And 2 Other Top Dividend Stocks For Your Portfolio

Reviewed by Simply Wall St

As global markets navigate a mixed start to the new year, with U.S. stocks showing resilience despite recent profit-taking and economic indicators like the Chicago PMI signaling contraction, investors are increasingly looking for stability amidst uncertainty. In such an environment, dividend stocks can offer a reliable income stream and potential for capital appreciation, making them attractive options for those seeking to balance risk and reward in their portfolios.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Guaranty Trust Holding (NGSE:GTCO) | 6.58% | ★★★★★★ |

| Peoples Bancorp (NasdaqGS:PEBO) | 5.11% | ★★★★★★ |

| Tsubakimoto Chain (TSE:6371) | 4.25% | ★★★★★★ |

| CAC Holdings (TSE:4725) | 4.77% | ★★★★★★ |

| Southside Bancshares (NYSE:SBSI) | 4.63% | ★★★★★★ |

| Padma Oil (DSE:PADMAOIL) | 7.41% | ★★★★★★ |

| FALCO HOLDINGS (TSE:4671) | 6.42% | ★★★★★★ |

| Premier Financial (NasdaqGS:PFC) | 4.91% | ★★★★★★ |

| Citizens & Northern (NasdaqCM:CZNC) | 6.14% | ★★★★★★ |

| Banque Cantonale Vaudoise (SWX:BCVN) | 5.01% | ★★★★★★ |

Click here to see the full list of 1978 stocks from our Top Dividend Stocks screener.

Let's explore several standout options from the results in the screener.

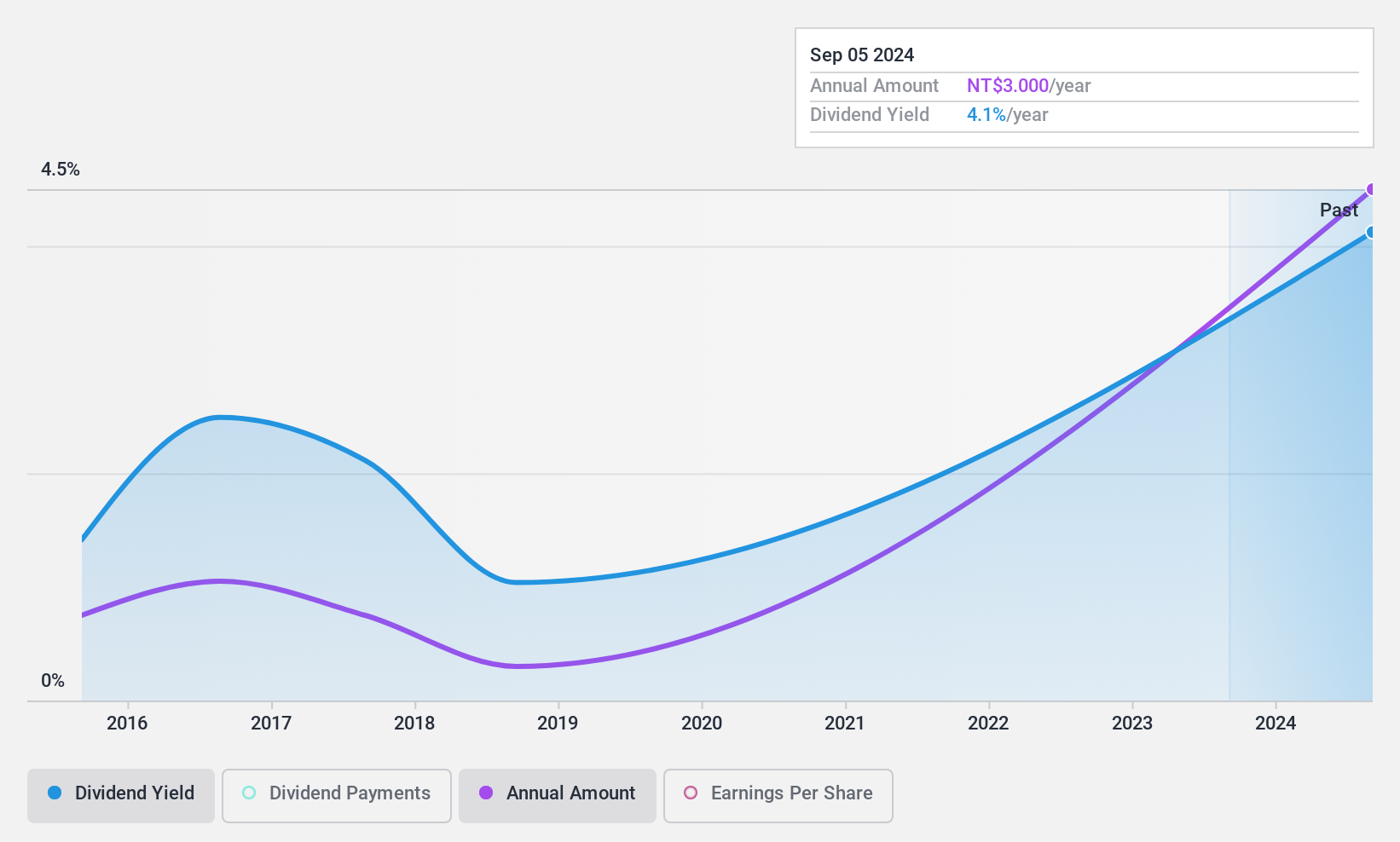

Allmind Holdings (TPEX:2718)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Allmind Holdings Corporation develops and rents houses and buildings in Taiwan, with a market cap of NT$6.65 billion.

Operations: Allmind Holdings Corporation generates revenue from its Operating Construction segment amounting to NT$4.67 billion.

Dividend Yield: 3.9%

Allmind Holdings has demonstrated significant earnings growth, with net income reaching TWD 2.91 billion in Q3 2024, up from TWD 91.2 million a year ago. Despite this robust performance and a low payout ratio of 8.6%, its dividend history is volatile and below the top tier in yield at 3.9%. Dividends are well-covered by both earnings and cash flows, suggesting sustainability despite past instability in payments over the last decade.

- Click here to discover the nuances of Allmind Holdings with our detailed analytical dividend report.

- Insights from our recent valuation report point to the potential undervaluation of Allmind Holdings shares in the market.

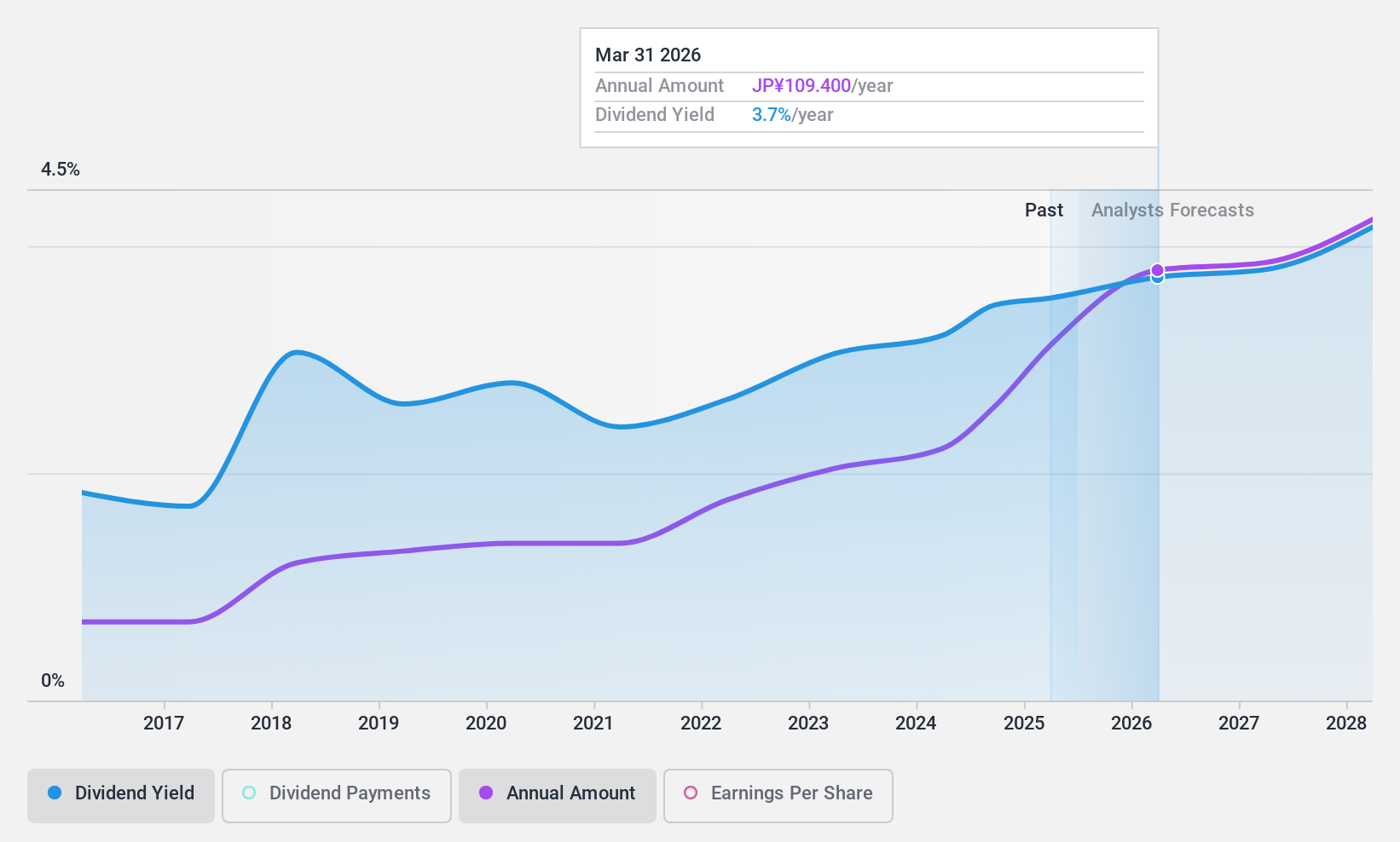

Raito Kogyo (TSE:1926)

Simply Wall St Dividend Rating: ★★★★★★

Overview: Raito Kogyo Co., Ltd. operates in the civil engineering sector across Japan, North America, and internationally with a market cap of ¥101.65 billion.

Operations: Raito Kogyo Co., Ltd. generates revenue primarily from its construction segment, amounting to ¥116.94 billion.

Dividend Yield: 4%

Raito Kogyo's dividends are well-supported by both earnings and cash flows, with payout ratios of 57.2% and 44.2%, respectively, ensuring sustainability. The company has maintained stable and growing dividends over the past decade, offering a yield of 3.98%, placing it among the top dividend payers in Japan. Moreover, recent share buybacks totaling ¥6.99 billion may further enhance shareholder value by reducing outstanding shares and potentially supporting future dividend growth.

- Click to explore a detailed breakdown of our findings in Raito Kogyo's dividend report.

- Upon reviewing our latest valuation report, Raito Kogyo's share price might be too optimistic.

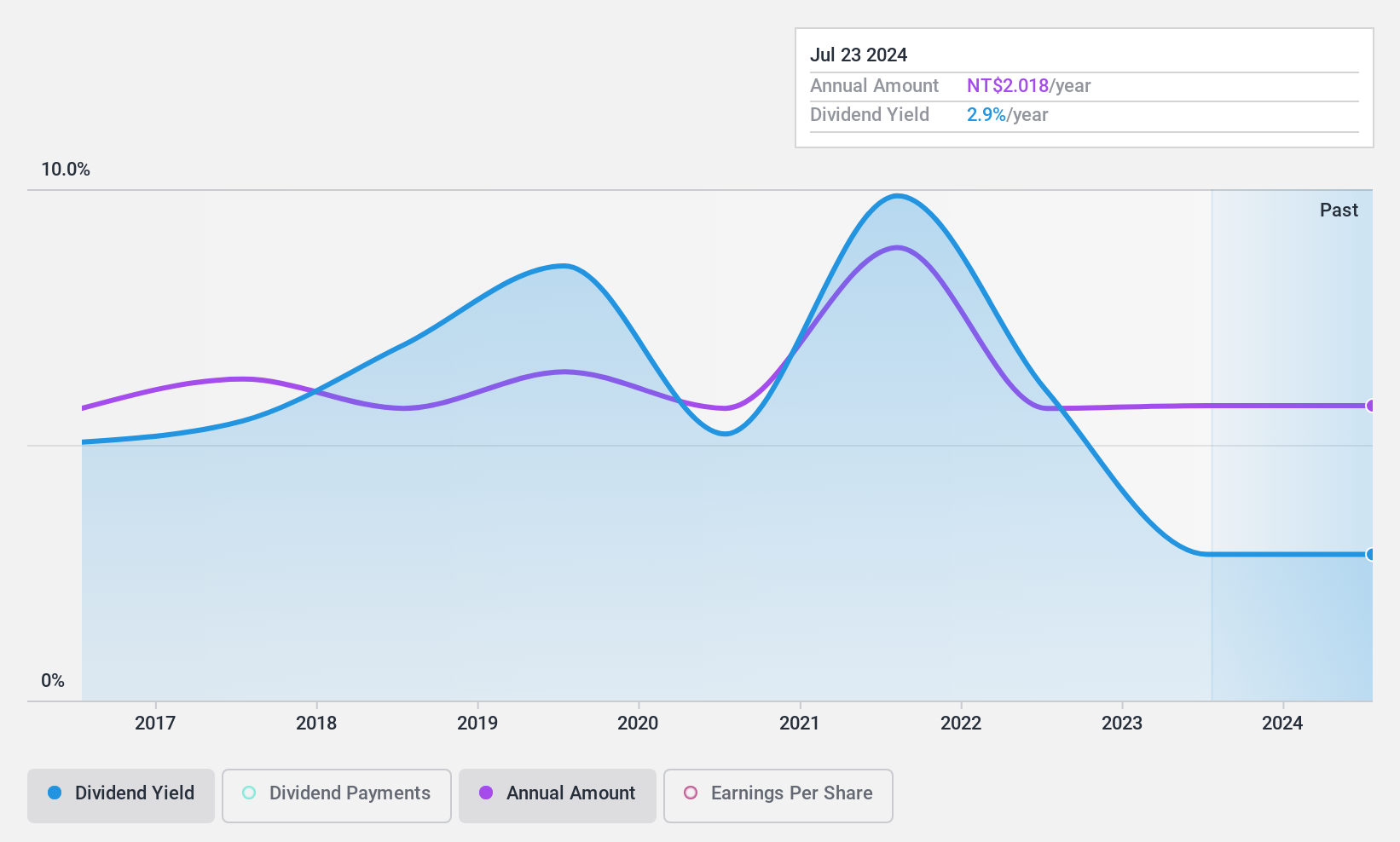

Compucase Enterprise (TWSE:3032)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Compucase Enterprise Co., Ltd. designs and manufactures PC cases, power supplies, rackmount chassis, and cabinets globally with a market cap of NT$9.97 billion.

Operations: Compucase Enterprise Co., Ltd. derives its revenue primarily from the Manufacturing segment with NT$4.22 billion, followed by the Server Casing Segment at NT$4.63 billion, Operation Headquarters contributing NT$5.88 billion, the Channel segment at NT$449.15 million, and the Medical Equipment Segment generating NT$479.87 million.

Dividend Yield: 3.9%

Compucase Enterprise's dividends are covered by earnings with a payout ratio of 68.2% and by cash flows with a cash payout ratio of 30.2%, indicating sustainability despite its volatile dividend history over the past decade. The company's recent financial performance shows declining sales and net income, which may impact future dividend stability. Trading at 44.4% below estimated fair value, it offers a dividend yield of 3.85%, lower than top-tier payers in Taiwan's market.

- Get an in-depth perspective on Compucase Enterprise's performance by reading our dividend report here.

- Our expertly prepared valuation report Compucase Enterprise implies its share price may be lower than expected.

Seize The Opportunity

- Take a closer look at our Top Dividend Stocks list of 1978 companies by clicking here.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:1926

Raito Kogyo

Engages in the civil engineering works business in Japan, North America, and internationally.

Excellent balance sheet with proven track record and pays a dividend.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Astor Enerji will surge with a fair value of $140.43 in the next 3 years

Proximus: The State-Backed Backup Plan with 7% Gross Yield and 15% Currency Upside.

A case for for IMPACT Silver Corp (TSXV:IPT) to reach USD $4.52 (CAD $6.16) in 2026 (23 bagger in 1 year) and USD $5.76 (CAD $7.89) by 2030

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.