- Hong Kong

- /

- Specialty Stores

- /

- SEHK:1929

Asian Market Stocks That May Be Trading Below Estimated Value

Reviewed by Simply Wall St

As global markets experience fluctuations, Asian markets have shown resilience with notable gains in key indices, driven by investor enthusiasm for technology and artificial intelligence sectors. In this environment, identifying stocks that may be trading below their estimated value can offer potential opportunities for investors seeking to capitalize on market inefficiencies.

Top 10 Undervalued Stocks Based On Cash Flows In Asia

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Xi'an NovaStar Tech (SZSE:301589) | CN¥153.00 | CN¥303.17 | 49.5% |

| Xiamen Amoytop Biotech (SHSE:688278) | CN¥81.78 | CN¥161.83 | 49.5% |

| Meitu (SEHK:1357) | HK$7.48 | HK$14.55 | 48.6% |

| LianChuang Electronic TechnologyLtd (SZSE:002036) | CN¥10.33 | CN¥20.20 | 48.9% |

| KoMiCo (KOSDAQ:A183300) | ₩85500.00 | ₩166235.75 | 48.6% |

| KIYO LearningLtd (TSE:7353) | ¥705.00 | ¥1381.47 | 49% |

| JUSUNG ENGINEERINGLtd (KOSDAQ:A036930) | ₩29500.00 | ₩57186.86 | 48.4% |

| Japan Eyewear Holdings (TSE:5889) | ¥1965.00 | ¥3848.28 | 48.9% |

| H.U. Group Holdings (TSE:4544) | ¥3410.00 | ¥6592.59 | 48.3% |

| Beijing Beimo High-tech Frictional MaterialLtd (SZSE:002985) | CN¥27.57 | CN¥53.26 | 48.2% |

Let's explore several standout options from the results in the screener.

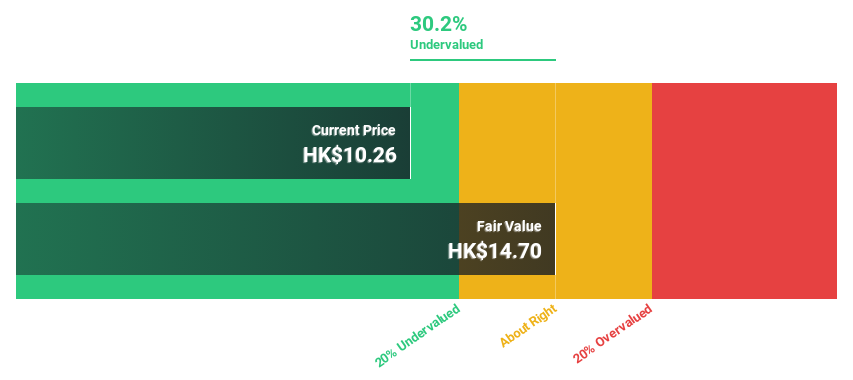

Chow Tai Fook Jewellery Group (SEHK:1929)

Overview: Chow Tai Fook Jewellery Group Limited is an investment holding company that manufactures and sells jewelry products in Mainland China, Hong Kong, Macau, and internationally, with a market cap of HK$137.02 billion.

Operations: The company's revenue is derived from Mainland China, contributing HK$73.75 billion, and Hong Kong & Macau of China and other markets, which account for HK$16.58 billion.

Estimated Discount To Fair Value: 37.1%

Chow Tai Fook Jewellery Group's current stock price is significantly below its estimated fair value of HK$22.09, indicating potential undervaluation based on discounted cash flow analysis. Despite a slight decrease in sales to HK$38.99 billion for the half-year ending September 2025, net income remained stable at HK$2.53 billion. However, the company's debt coverage by operating cash flow is weak, and its dividend yield of 3.74% isn't well covered by earnings or free cash flows.

- Our comprehensive growth report raises the possibility that Chow Tai Fook Jewellery Group is poised for substantial financial growth.

- Click here to discover the nuances of Chow Tai Fook Jewellery Group with our detailed financial health report.

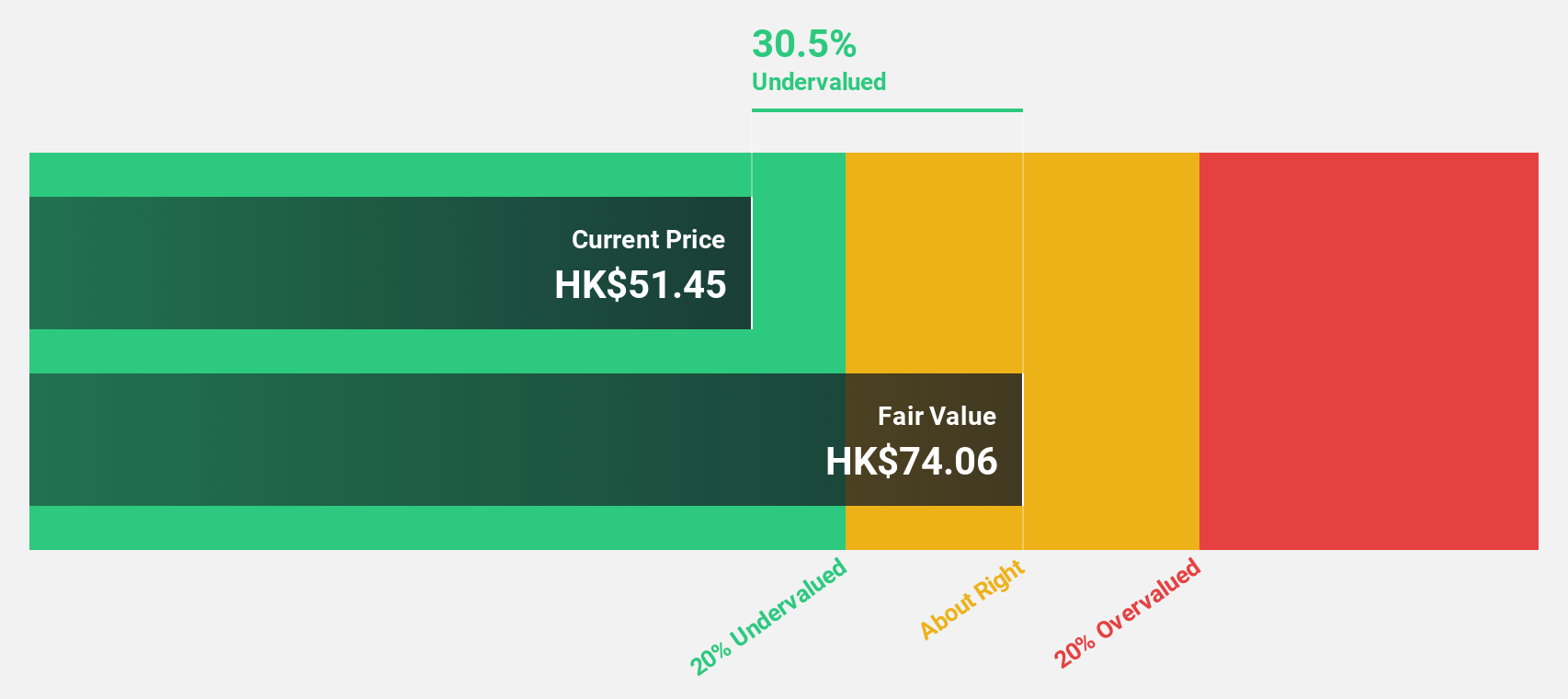

CaoCao (SEHK:2643)

Overview: CaoCao Inc. operates as a ride-hailing platform in China with a market cap of approximately HK$27.07 billion.

Operations: The company generates revenue from its transportation segment, specifically railroads, amounting to CN¥17.95 billion.

Estimated Discount To Fair Value: 36.1%

CaoCao's stock is trading at HK$49.7, well below its fair value of HK$77.77, highlighting potential undervaluation based on cash flow analysis. The company is expected to achieve profitability within three years and has a strong revenue growth forecast of 25.9% annually, outpacing the Hong Kong market rate. Recent strategic agreements for marketing services with YiYi Power could enhance revenue streams but also involve connected transaction complexities under listing rules.

- The analysis detailed in our CaoCao growth report hints at robust future financial performance.

- Click to explore a detailed breakdown of our findings in CaoCao's balance sheet health report.

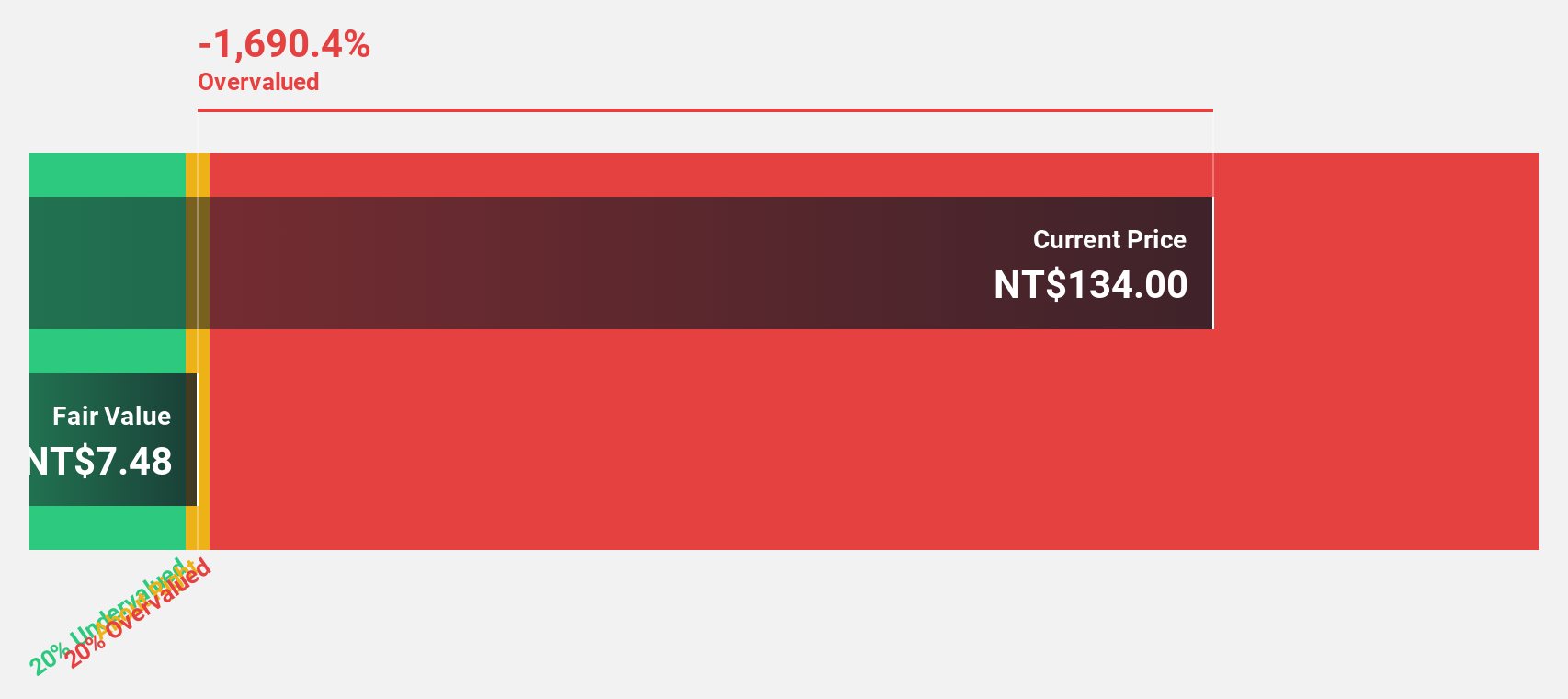

Chenming Electronic Tech (TWSE:3013)

Overview: Chenming Electronic Tech. Corp. is an OEM/ODM manufacturer involved in the R&D, manufacturing, and sale of computer and server cases, server chassis, mobile device components, and molds across Taiwan, China, the United States, and internationally with a market cap of NT$27.39 billion.

Operations: The company generates revenue primarily from the production and sales of computer and mobile device components, amounting to NT$10.18 billion.

Estimated Discount To Fair Value: 22.1%

Chenming Electronic Tech is trading at NT$133.5, below its estimated fair value of NT$171.34, suggesting undervaluation based on cash flow analysis. Despite a volatile share price recently, the company reported improved net income for Q3 2025 and forecasts robust revenue and earnings growth of 47.1% and 76.8% per year respectively, outpacing Taiwan's market averages. These factors indicate potential for future financial performance improvements despite current valuation gaps.

- Insights from our recent growth report point to a promising forecast for Chenming Electronic Tech's business outlook.

- Navigate through the intricacies of Chenming Electronic Tech with our comprehensive financial health report here.

Make It Happen

- Click here to access our complete index of 269 Undervalued Asian Stocks Based On Cash Flows.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:1929

Chow Tai Fook Jewellery Group

An investment holding company, manufactures and sells jewelry products in Mainland China, Hong Kong, Macau, and internationally.

Reasonable growth potential with proven track record.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

TXT will see revenue grow 26% with a profit margin boost of almost 40%

Significantly undervalued gold explorer in Timmins, finally getting traction

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026